Preferential Trade Agreements and Trade Liberalization Efforts in the OIC Member States

With Special Emphasis on the TPS-OIC

167

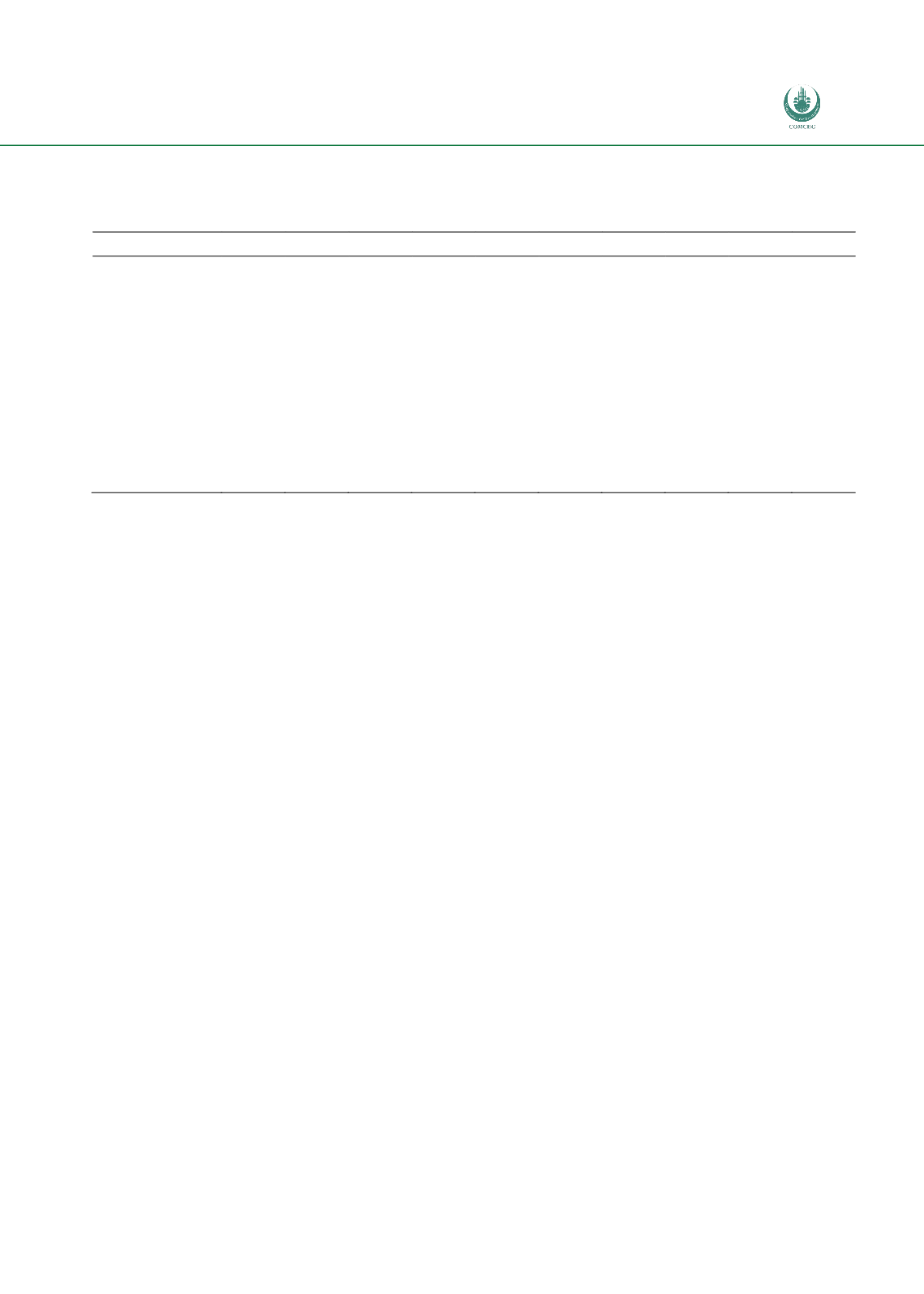

Table 36: FK Index of Import Similarity between the TPS Contracting States and the World (non-oil

imports)

Partner

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Bahrain

0.23

0.22

0.23

0.23

Bangladesh

0.29

0.26

0.28

0.31

0.30

0.34

0.33

0.38

0.38

0.35

Jordan

0.36

0.27

0.36

0.33

0.34

0.27

0.30

0.30

0.32

0.30

Malaysia

0.07

0.07

0.09

0.10

0.09

0.12

0.11

0.15

0.15

0.10

Oman

0.21

0.16

0.23

0.21

0.23

0.22

0.21

0.22

0.24

0.25

Pakistan

0.25

0.24

0.30

0.26

0.28

0.25

0.24

0.25

0.29

0.27

Qatar

0.27

0.18

0.30

0.28

0.30

0.31

0.29

0.28

0.30

0.31

Saudi Arabia

0.31

0.34

0.32

0.31

0.33

0.32

0.34

0.32

0.36

0.33

Turkey

0.12

0.14

0.15

0.15

0.16

0.14

0.14

0.15

0.15

0.15

UAE

0.35

0.32

0.33

0.37

0.38

0.36

0.39

0.36

0.38

0.39

Source: TradeSift calculations using HS 6-digit data from Comtrade via WITS

5.4.

COUNTRY PRODUCT ANALYSIS

As discussed above there is a reasonable prima facie case for suggesting that the general effect on

each of the individual Contracting Countries of TPS-OIC will be low. Ultimately this is driven by the

relatively low level of obligatory commitments embedded in the agreement (with a limited product

coverage and potentially small reductions) and by the fact that many of the members (particularly

the GCC members) would not be affected by the reductions and/or they already have deeper

agreements with some of the members. In addition for some members, the share of the trade with

the other Parties of TPS-OIC System tends to be small once oil is removed. All this indicates that the

effect from the obligatory part of the agreement is expected to be, overall, small.

Nevertheless, there might be for some members, products that are affected in the sense that they

might receive either some preferences or that the member might need to give preferences to the

other members. Therefore, it is important to identify the main products that each of the Parties of the

TPS-OIC System trade with the rest of the agreement since these would be, in principle, the products

that might be central to understanding the effects on exports and on imports. It is important to

remark, however, that it is very hard to identify the export effect as this will depend primarily on the

reductions that the other members make in these products and these will be different depending on

the importing party.

Bahrain

2011 is the year for which the latest trade data is reported by Bahrain. Although it would be possible

to use mirror data for 2012 and 2013, the fact that many other TPS countries also did not report their

trade for these years makes this alternative unreliable. Therefore, we focus on the 2011 data as

reported by Bahrain.