Preferential Trade Agreements and Trade Liberalization Efforts in the OIC Member States

With Special Emphasis on the TPS-OIC

173

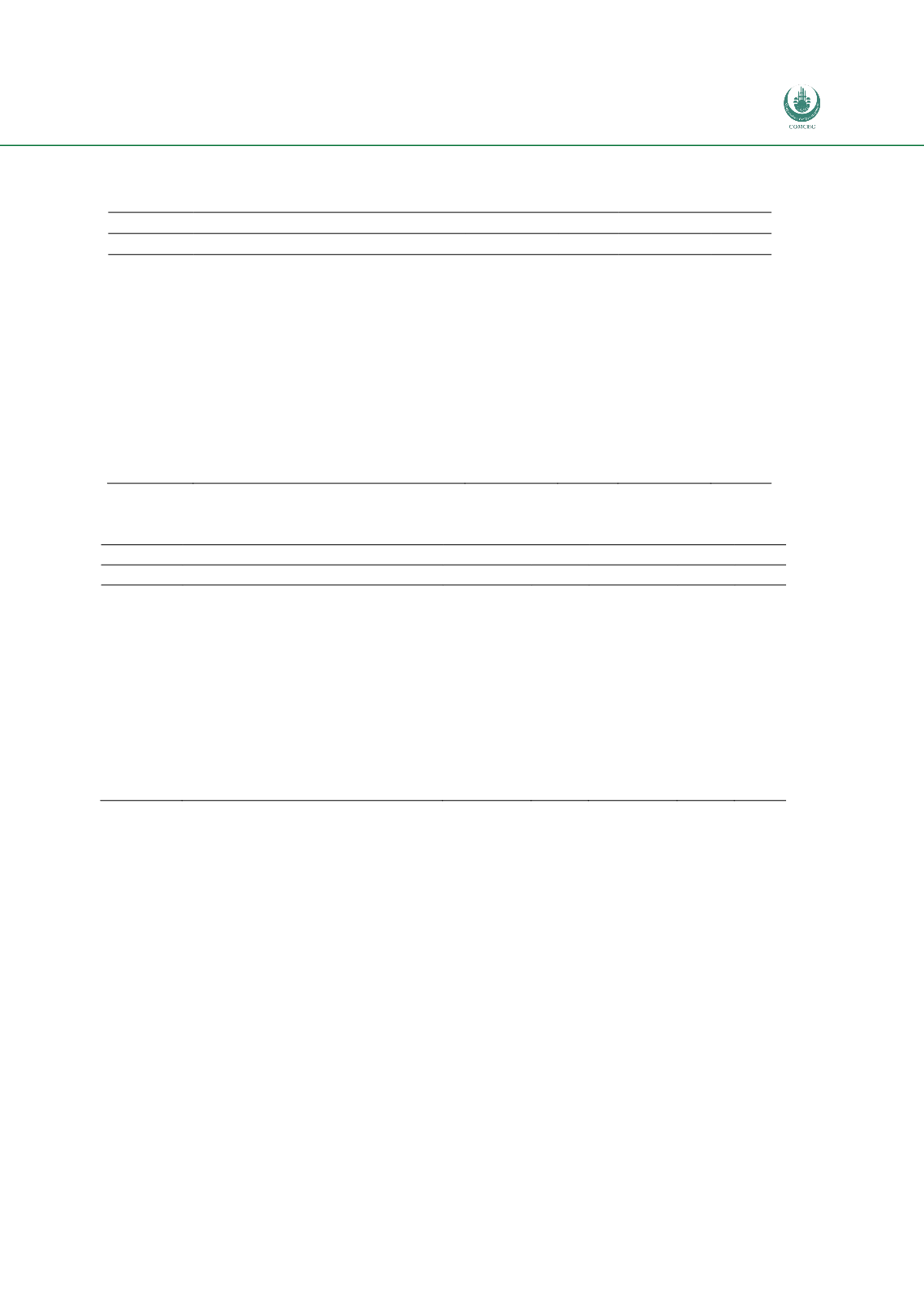

Table 43: Top 10 Malaysian exported products to TPS-OIC Countries 2012 & 13 (1000s of USD

Product

Product Name

2012

2013

Exports

Share

Exports

Share

711319

Articles of jewellery

1,369,984 13.88% 1,606,447 16.67%

151190

Palm oil,

1,465,560 14.84% 1,479,036 15.34%

852812

Reception app. for television

1,044,219 10.58%

902,320

9.36%

271019

Petroleum oils

640,840

6.49%

804,363

8.34%

151110

Palm oil, crude

396,253

4.01%

164,401

1.71%

841510

Window/wall type air-conditioning

146,798

1.49%

134,474

1.40%

401519

Gloves (excl. surgical), mittens

121,943

1.24%

108,013

1.12%

847330

Parts&accessories

94,738

0.96%

84,874

0.88%

151620

Vegetable fats & oils

90,524

0.92%

72,334

0.75%

440799

Wood

79,187

0.80%

80,336

0.83%

Grand Total

5,450,046 55.20% 5,436,597 56.40%

Table 44:

Top 10 Malaysian imported products from TPS-OIC 2012 & 13 (1000s of USD)

Product

Product Name

2012

2013

MFN

Imports

Share

Imports

Share

271011

Light petroleum oils

1,235,080 14.25% 1,571,083 18.07%

0.36

710813

Gold (incl. gold plated)

1,015,913 11.72%

680,563

7.83%

0

710812

Gold (incl. gold plated) unwrought

143,940

1.66%

814,168

9.37%

0

271019

Petroleum oils

251,936

2.91%

559,742

6.44%

0.42

711291

Waste & scrap of gold

242,185

2.79%

131,653

1.51%

0

760110

Aluminium, not alloyed

221,136

2.55%

151,793

1.75%

0

390110

Polyethylene

156,226

1.80%

188,485

2.17%

30

290511

Methanol

116,832

1.35%

115,128 1.32%

0

760120

Aluminium alloys, unwrought

128,023

1.48%

99,458

1.14%

0

390120

Polyethylene

83,056

0.96%

113,238

1.30%

30

Grand Total

3,594,328 41.48% 4,425,312 50.91%

Source: Comtrade using WITS, tariff data from TRAINS database

Oman

Excluding oil, the top 10 Oman exported products to the Contracting Countries of TPS- OIC accounted

for around 50% of the exports. Any reduction on the tariffs applied on these products by any of the

Parties of TPS-OIC System could have an effect on Oman’s exports. In terms of imports, as the GCC

Common external tariff only applies duties higher than 10% on alcoholic products, in none of the top

10 imports would there be any liberalisation and therefore any effect on trade flows. This can be seen

from the table below where all the MFN tariffs are set at 5%. Of course should OMAN choose to

voluntarily liberalise further with partner TPOS-OIC states then there would be some scope for trade

effects, though once again possibly somewhat minimal due to the low base level of the tariffs.