Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

22

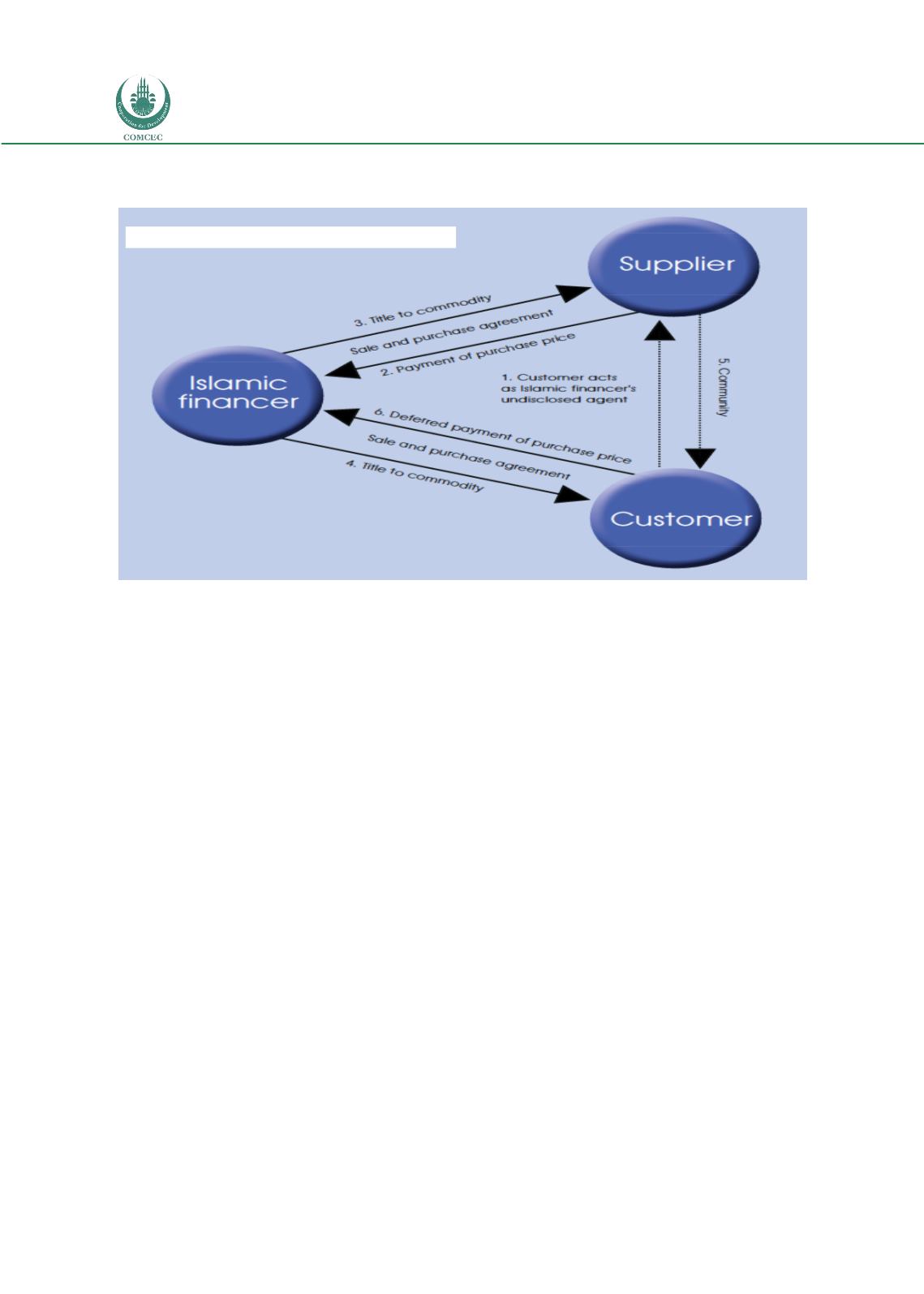

Figure 5: Islamic Trade Finance Murabaha Structure

Source: Trade & Forfaiting Review, 2013

The opportunities for mutual learning are brought sharply into focus when consideration is

given to certain fundamental tenets of Islamic Finance, contrasting those with the underlying

causes of the recent global financial crisis:

“Speculative transactions are deemed to involve a type of unjust increase prohibited by

the Quran. The underlying motivation is to ensure a fair correspondence between the

expected benefits and obtained benefits of both parties to a contract. All activities that

contain elements of uncertainty, such as commercial transactions in which there is

uncertainty about an asset or its price, are covered by the prohibition of gharar

(uncertainty) and maysir (gambling) stipulated in the Quran. Because an element of

uncertainty can be found in almost all commercial transactions, it is excessive gharar

that is prohibited. For example, excessive gharar can be identified in the case of

insurance contracts. Futures, forwards and other derivatives also fall under gharar, as

there is no certainty that the object of the sale will exist at the time the trade has to be

executed. These instruments are also subject to the prohibition on maysir, which

condemns the speculative exploitation of legal uncertainty in order to draw an

unjustified (because it is unfair) advantage. In addition, speculation (maysir) is seen as

diverting resources from productive activities.”

Source: Islamic Finance in Europe, ECB, 2013

1.4.

Transactional View of Trade Finance

As illustrated, trade finance involves several core elements to its value proposition, and the

numerous instruments of trade finance can combine features and solutions across one or more

Murabaha Structure