DRAFT

Improving the SMEs Access to Trade Finance

in the OIC Member States

23

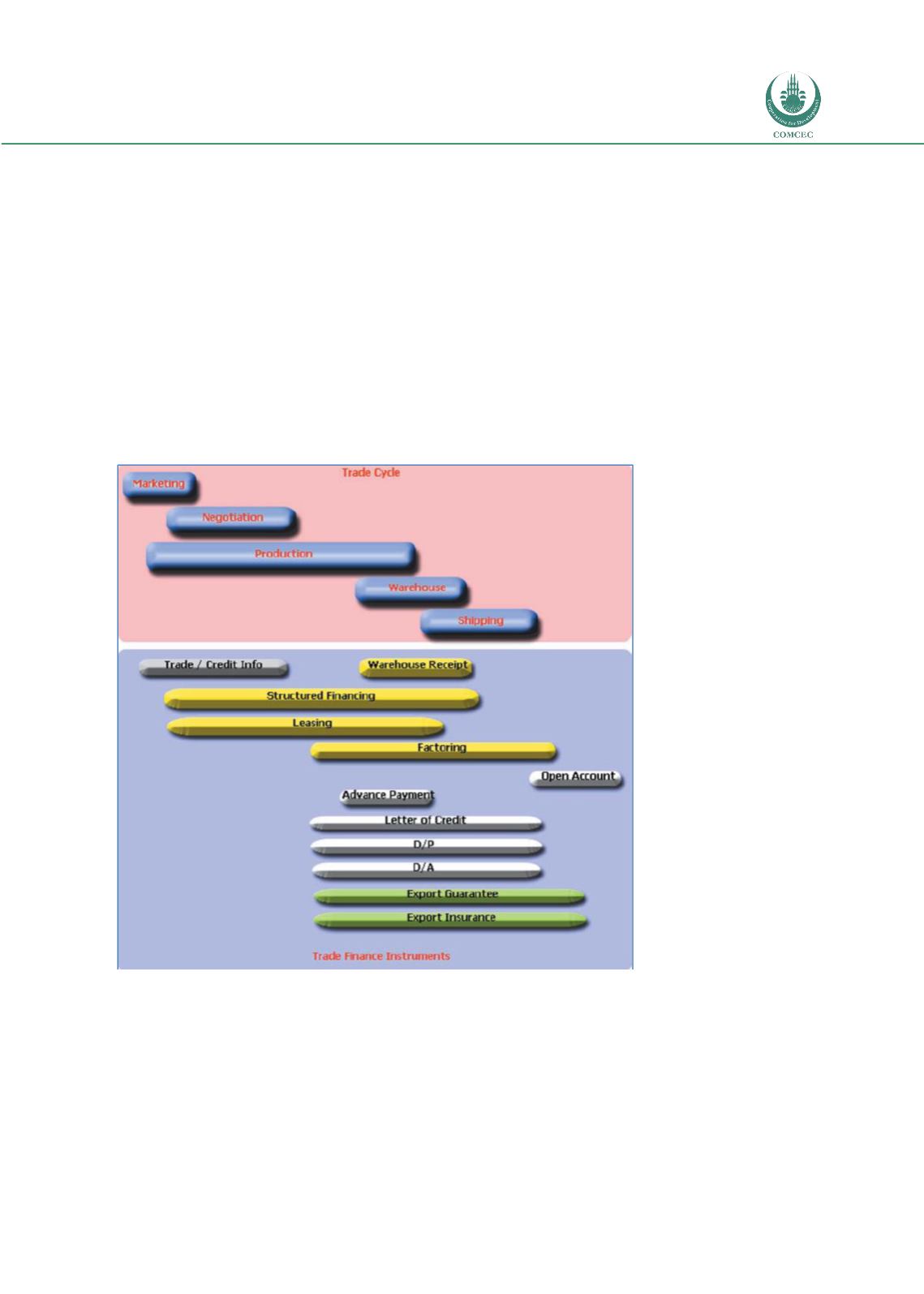

of the four core elements (payment, financing, and risk mitigation and information flow). In

addition to this proposed framework for understanding trade finance (including emerging

solutions in supply chain finance), it is instructive to consider trade finance in terms of the

transaction flow related to trade activity, as well as in terms of the various providers of trade

finance that combine to make up the global trade financing landscape.

The requirements and options related to financing across the lifecycle of a trade transaction

are illustrated by the following graphic from UNESCAP/ITC. The illustration provided by the

UN Economic and Social Commission for Asia Pacific (UNESCAP) together with the

International Trade Centre (ITC) in Geneva (Trade Finance Infrastructure Development

Handbook, 2005). The UNESCAP/ITC approach, devised before significant focus was put onto

supply chain finance, is instructive in its attempt to map financing options and solutions

against an illustrative trade transaction, or what is referred to as the trade cycle.

Figure 6: Transactional View of Trade Finance

Source: Trade Finance Infrastructure Development Handbook, UNESCAP/ITC, 2005

Irrespective of the specific instrument or financing structure under consideration, a view can

be taken based on one or more of the categories above, to determine the nature and suitability

of a particular trade finance mechanism to meet the needs of one or more parties to the

underlying trade transaction.