DRAFT

Improving the SMEs Access to Trade Finance

in the OIC Member States

25

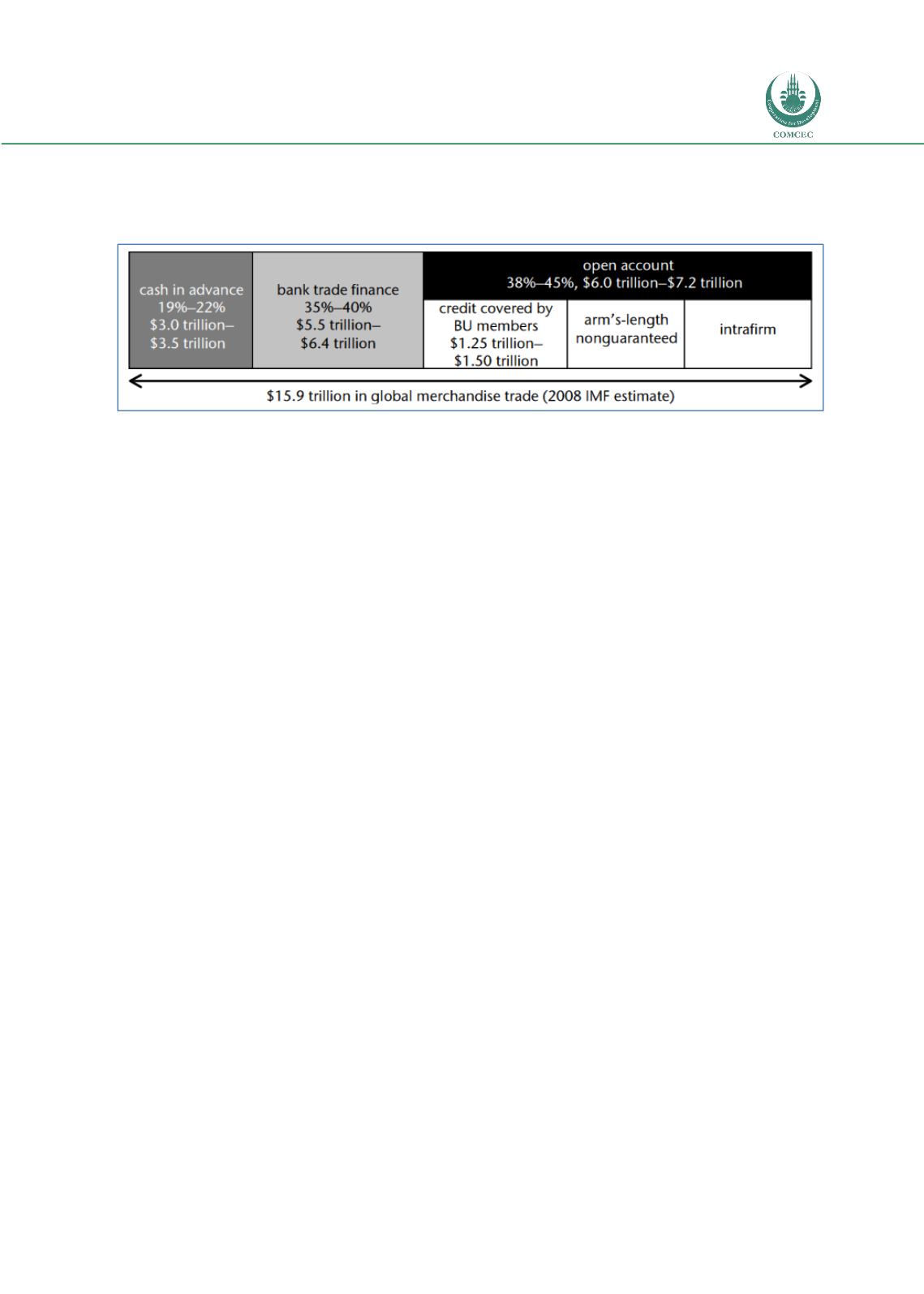

Figure 7: Trade Settlement and Finance: Market Sizing

Source: Trade Finance During the Great Trade Collapse, World Bank, 2012

Finance and risk mitigation solutions provided by export credit agencies supported

approximately 10% of global trade flows in 2012 according to industry estimates (Berne

Union, 2013).

The importance of financing to the conduct of international trade was compellingly

demonstrated over the course of the global crisis of 2007/2008 and beyond.

“While most firms have reported a tightening in trade financing since September 2008,

SMEs were the most affected. The most often cited constraints relate to the increase in

cost of trade financing instruments, banks’ more stringent selectivity and guarantee

requirements, and delays in payments from buyers. […] Even firms that have not been

relying extensively on the banking system for trade finance have also been affected.

These firms usually use open account with self-financing, cash in advance and accounts

payable. The scarcity of trade finance originated from the slower demand from their

export markets and the consequent drop in revenues, delays in payment terms by

buyers, and shortening payment terms by suppliers. This has in turn squeezed the

capital base of exporters and importers, their working capital and capacity to self-

finance their transactions.”

Source: Trade and Trade Finance Developments in 14 Developing Countries Post

September 2008, World Bank, 2009

In addition to illustrations of the importance of traditional trade finance and export credit

support, it is instructive to look at growth rates in cross-border factoring volumes, which by

definition involve foreign receivables and therefore relate to trade flows.