Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

18

documents, or will the importer seek to manipulate the process through frivolous issues of

non-compliance (such as a typographical error in a key shipping document) as a means of

obtaining commercial advantage? Will either party commit outright fraud? Is there a

possibility that either party may face bankruptcy or insolvency, and thus cause commercial

loss or hardship to their trading partner?

Commercial risk is a reality of business, but one that is magnified significantly in the context of

international commerce, given the distances involved, the lack of transparency about the

health of a business, and challenges related to the conduct of appropriate due diligence. It is a

recognition of this reality that motivates importers and exporters developing new trading

relationships to include appropriate risk mitigation in their trade financing structures, until

such time as the relationship has been tested and proven over time, and focus can shift

(somewhat) away from risk considerations and allow emphasis on efficient payment and

appropriate financing solutions.

Importers and exporters also frequently contend with various types of transactional risk, such

as risk related to volatility in foreign currency markets. The majority of global trade is still

conducted in US Dollars, with the Euro generally in second position, and the Renminbi gaining

traction quickly as China’s influence grows on both the import and the export side of the

commercial equation.

d.

Foreign Exchange Risk

Importers or exporters doing business in foreign currency face the risk of unfavourable

movements in exchange rates, possibly raising the cost of purchasing for the importer, or

reducing the profitability of a transaction for the exporter, when assessed in terms of their

respective domestic currencies. There are also possibilities of exchange rate shifts that are

favourable to one or the other, reducing the cost of the imported goods, or making the export

sale more profitable, however, the key is to manage for the risk of adverse impact, and trade

financiers can assist in this regard by combining trade financing solutions with appropriate

currency hedging solutions.

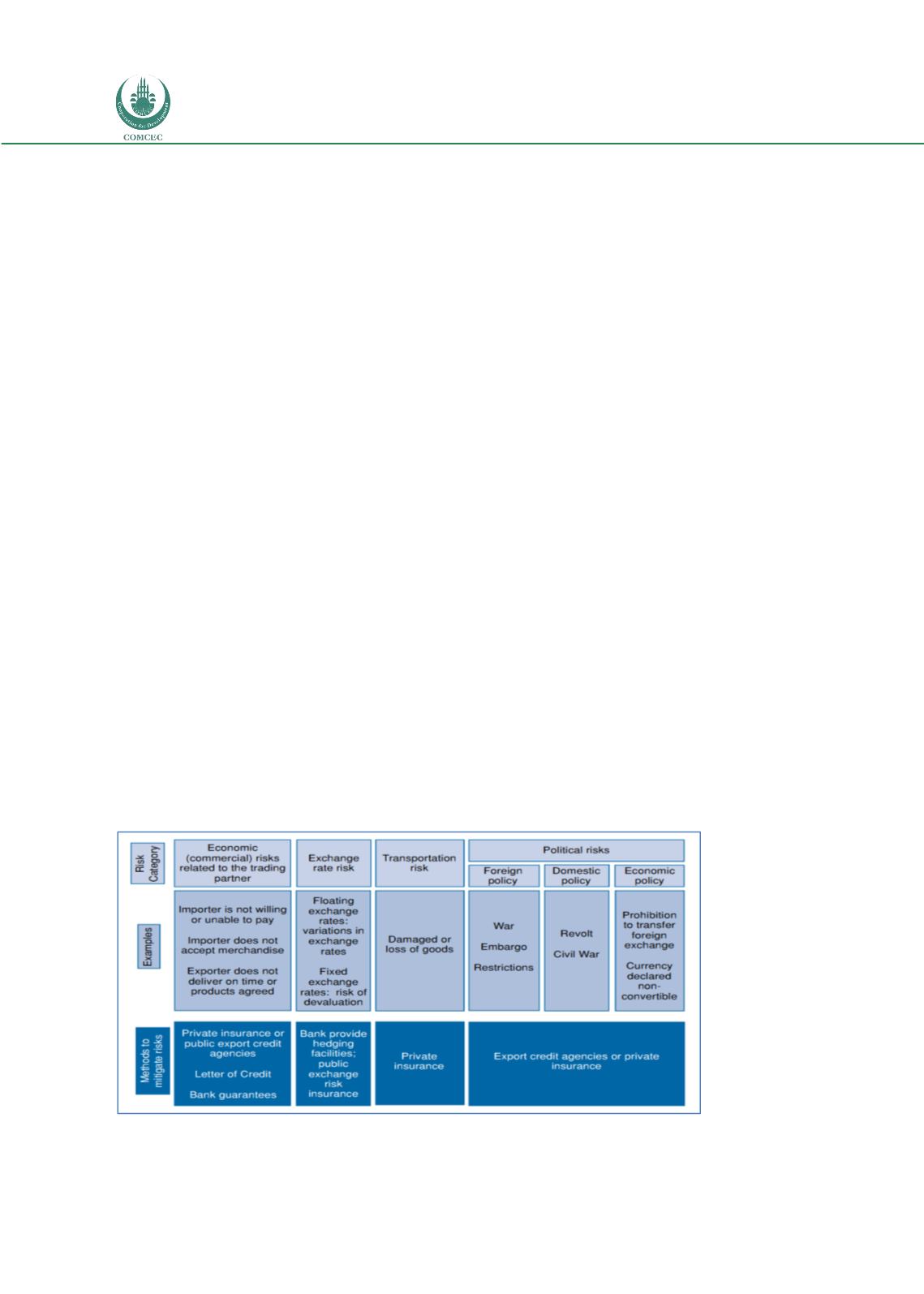

Figure 4: Risks in International Trade

Source: WTO