Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

56

reasons why these products are not widely traded within the OIC group thus demonstrating a

need for policy analysis on trade creation and trade diversion for intra-OIC trade.

Country pairs most likely to be successful to promote intra-regional trade at those product

divisions are identified through considering the performance of importer and exporter

countries for each specific product divisions separately. The shared criteria set is taken as the

prerequisite criterion for the importers and exporters. Importers and exporters which met the

criteria demonstrated in Tables 3.9 and 3.10 are shortlisted as potential importers and potential

exporters as demonstrated in Table 3.11.)

The second part of the analysis presented in Section 3.4.2 is at the product and country levels.

In order to explore the product level trade flows and analyze trade policies for each OIC country,

five major products with highest shares in the country’s agricultural product basket are selected.

The focus of the analysis is to compare the weighted average tariff rates imposed by the OIC

countries towards a country’s exports of the selected products with the weighted average tariff

rates imposed by the OIC countries for this country’s overall agricultural exports. In this way,

which countries are facing higher tariffs within the OIC and how these applied tariffs differ

across their top products versus their overall export basket are documented.

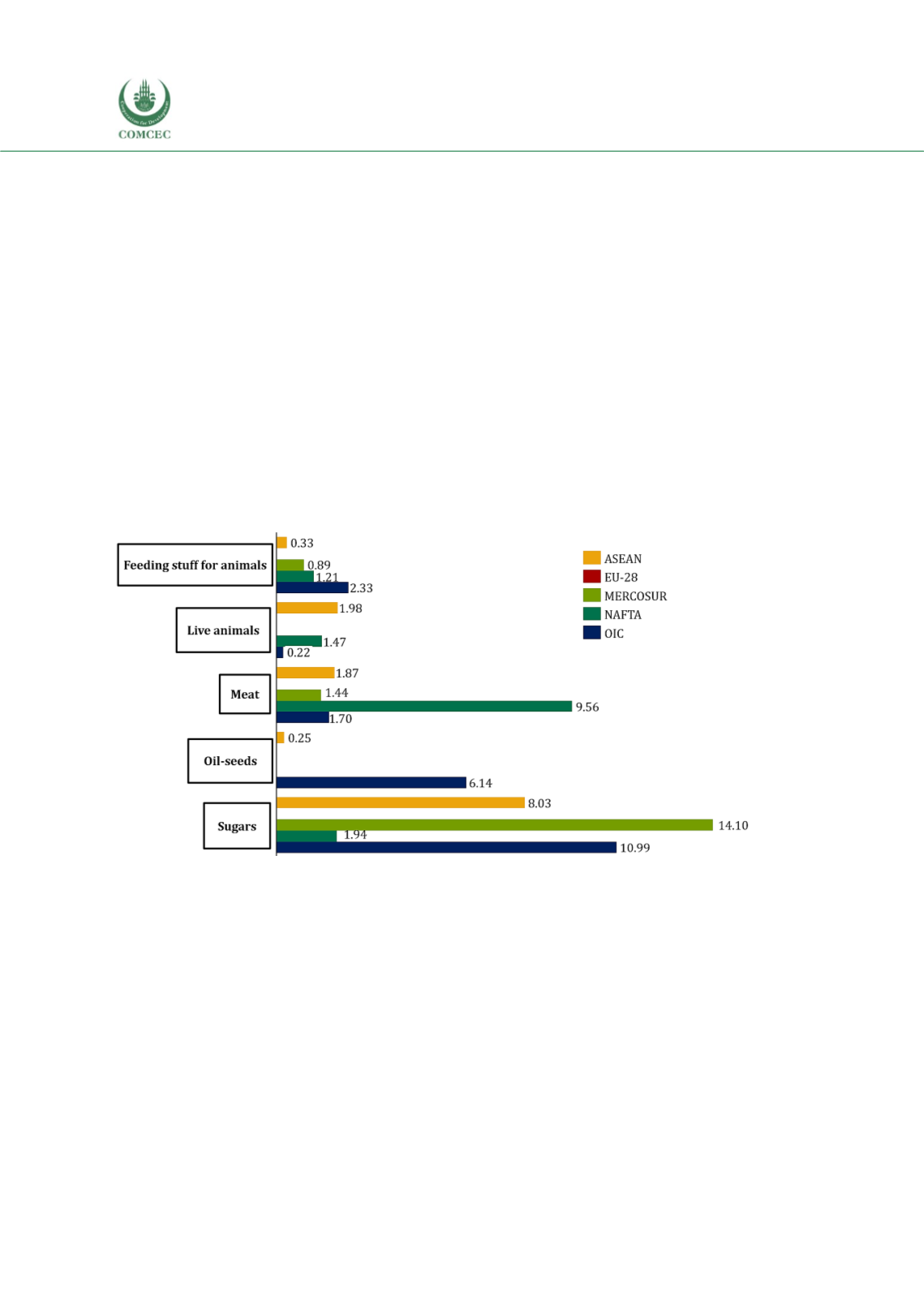

Figure 3. 14 Within Blocs’ Tariff Rates for Selected Divisions %, 2016

Source: ITC Macmap, CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, and authors’

calculations.

Note: The weighted average applied tariff rates, ad valorem equivalent.

3.4.1. Policy Analysis at the product division and regional level

The tariff rates of the selected key product divisions as applied by different trade blocks are

demonstrated in Figure 3.14. (See Table F.12 in Annex F). The tariff rates of the OIC group for

live animals and meat are generally lower than the overall average tariff rates of the five trade

blocks. For sugar, feeding stuff for animals, and oil seeds, the intra-OIC tariff rates are higher

than the average tariff rates imposed by the five trade blocks. Intra-OIC tariff rates are highest

for oil seeds and feeding stuff for animals among all trade blocks, representing large protection

for these product divisions in the OIC markets. The protection in oil seed imports in OIC group

is particularly higher than the other groups, representing nearly six times higher protection