Authorized Economic Operators

In the Islamic Countries:

Enhancing Customs-Traders Partnership

84

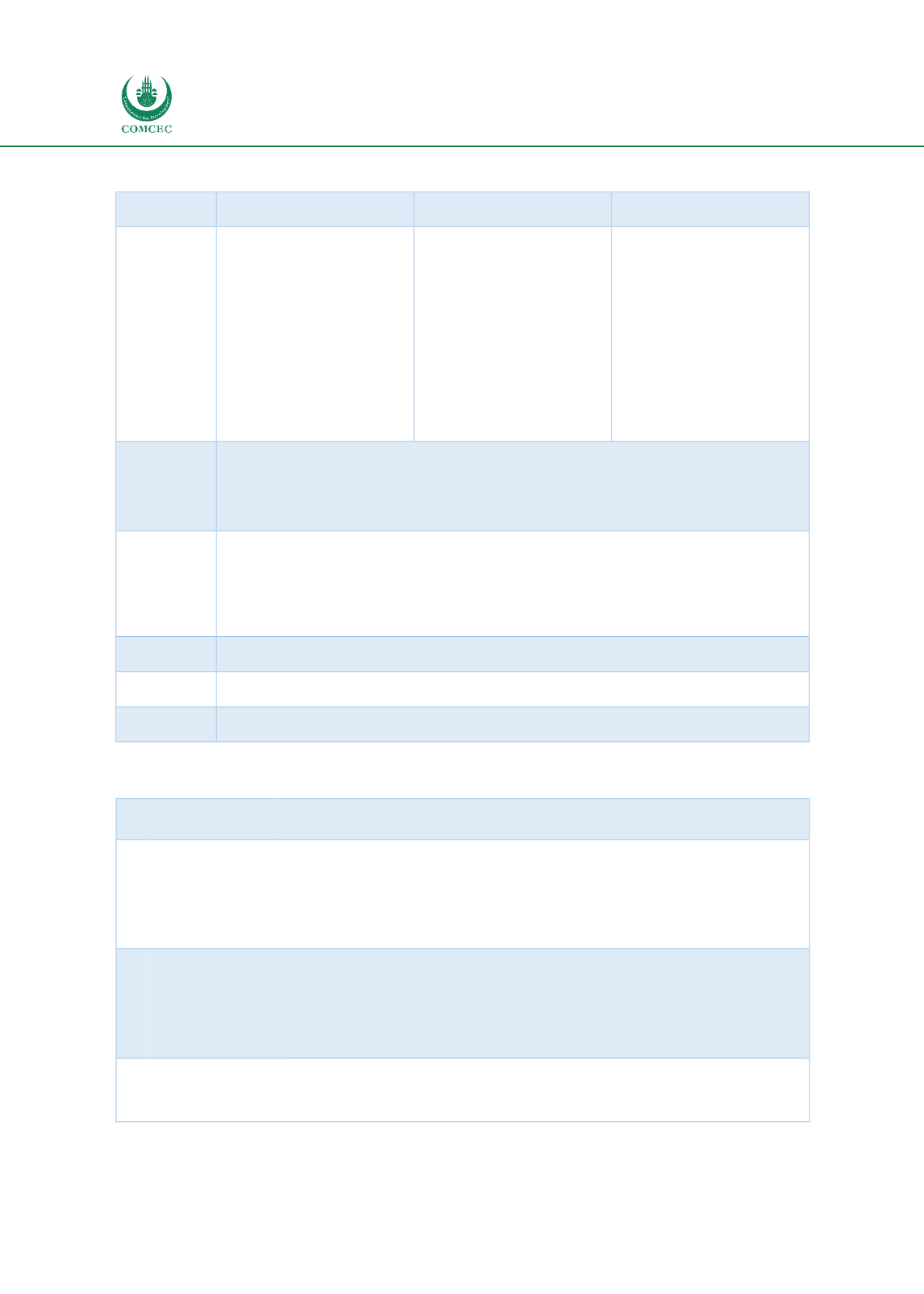

Table 4.3. Criteria List that Varies with the Type of the Operator

Source: Jordan Customs

Table 4.4. Requirements to Qualify for the Golden List Program

Requirements

Description

A

Fundamental

These requirements are imperative, and company must prove that it

has a documented procedure demonstrating strict adherence with

these requirements.

An improvement plan is not adequate and is not acceptable to

address these fundamental requirements.

B

Important

Company must provide a satisfactory improvement plan to ensure

compliance with these requirements within a reasonable period of

time agreed between Jordan Customs and the company.

Company must ultimately has a documented procedures

demonstrating a strict adhere with these requirements.

C

Desired

These requirements are not mandatory. However, Jordan Customs is

willing to negotiate additional benefits to be offered to the companies

that meet these requirements.

Source: Jordan Customs

Category

Qualified Industrial Zones

Exports

Imports

Criterion I

One of the following

conditions should be

satisfied:

Filed declarations are no

less than 100.

The overall declared value

of Customs declarations is

no less than JD 10 million.

One of the following

conditions should be

satisfied:

Filed declarations are no

less than 50

The overall declared value

of Customs declarations is

no less than JD 5 million.

One of the following

conditions should be

satisfied:

Filed declarations are no

less than 70

The overall declared value

of Customs declarations is

no less than JD 7 million.

The overall declared fees

and general sales tax are

no less than JD 700

thousand.

Criterion II

At least a 95% compliance rate calculated with

all

of the following equations:

Percentage difference between fees/ declared fees deducted from 100%.

Percentage difference between guarantees/ guarantees deducted from 100%.

Percentage difference between values/ declared values deducted from 100%.

Criterion III

No Customs lawsuits concerning declarations filed and for which the % of fines during

3 years before the application date were greater than 1% of the total declared value for

1 year prior to the application.

No Customs lawsuits against the company indicating its lack of an effective and

approved internal controls system.

Criterion IV

The company has been actively operating in its field for three years prior to the application

date.

Criterion V

Before a company qualifies for post-audit, a field inspection is carried out to verify its

existence.

Criterion VI

Proof of place and implementation of an internal control system and to ensure compliance

with Customs requirements including security requirements