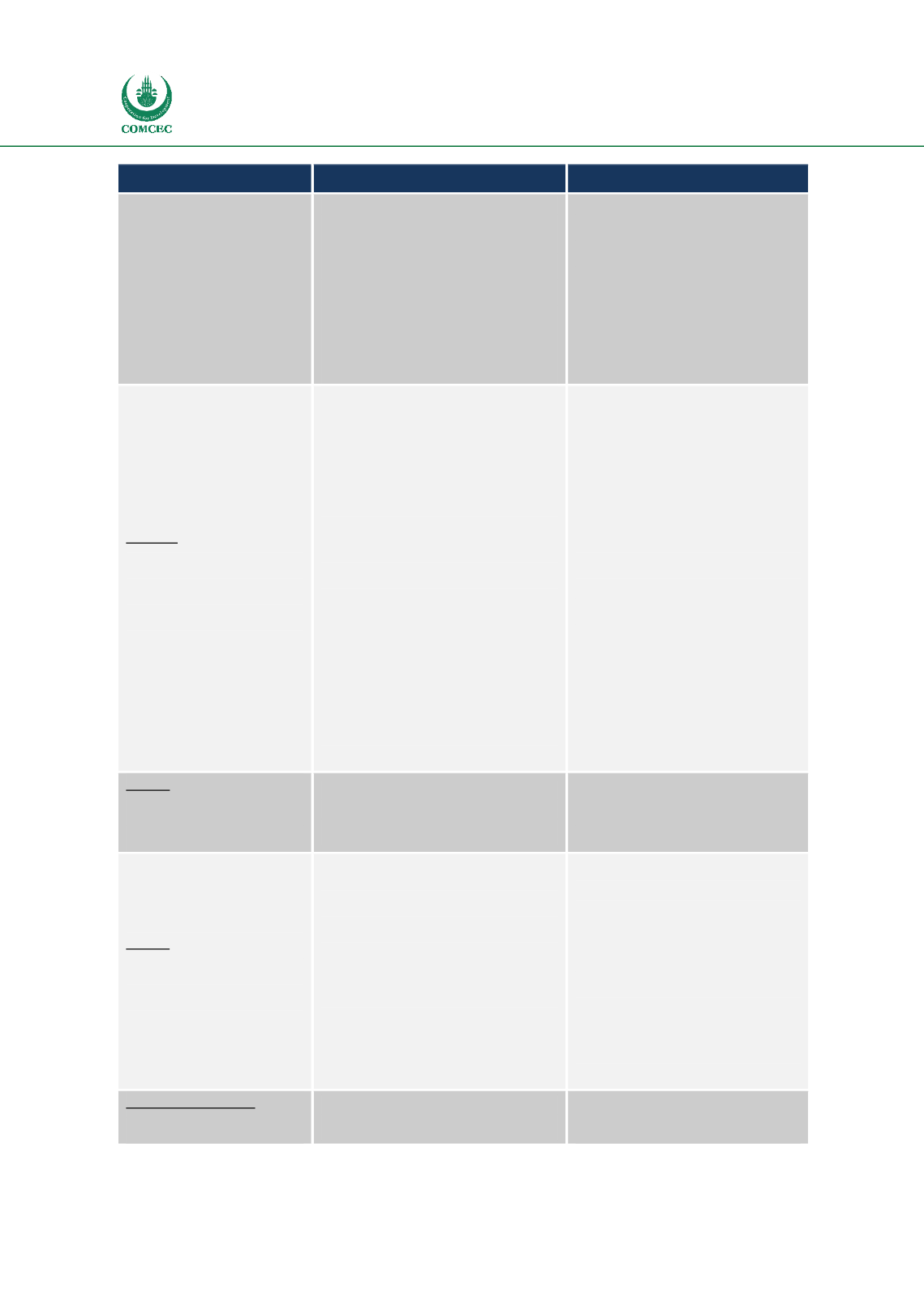

Special Economic Zones in the OIC Region:

Learning from Experience

52

Zones

Fiscal Incentives

Non-fiscal Incentives

within five years. This allowance can be

offset against 70% of its statutory income

for each year of assessment reducing

corporate income tax.

Exemption from payment of sales tax

Exemption from payment of excise duty

Exemption from payment of service tax

Reinvestment allowance

Expedited

timescale

for

license

applications

Human Resource Development Fund

Special industrial building allowance for

training

Deductions for approved training, pre-

employment training and non-employee

training

Morocco

Tanger Med FTZ

Kenitra Automotive Free Zone

Midparc

Full exemption from corporate tax for first

five years following by fixed rate of 8.75%

for 20 year period

Subsidies for some industries through

Hassan II fund

Contribution of up to 30% of cost of

buildings

Contributions of up to 10% of costs of

acquiring new capital goods

Total state participation up to 15% of total

investment

Contributions of up to 30% of total land

acquisition costs

Import duty exemptions

VAT exemptions for capital costs such as

equipment good, materials and tools

required to achieve investment projects

Support system for operators in training

efforts

Training plan tailored to needs of the

automotive sector

Nigeria

Ogun Guangdong FTZ

Lekki Free Zone

100% tax holidays for all federal, state and

local government taxes, rates, duties and

levies

Provision of offsite infrastructure

Turkey

Mersin Free Zone

Antalya Free Zone

Exemptions from corporate income tax

Free transfer of profits

Income tax exemptions over salaries

providing a minimum of 85% of goods are

exported

Exemption from custom related taxes on

imports to economic zones

100% foreign investment is allowed

No minimum requirement for capital

investment

Sales to domestic market is allowed

No restrictions on work permits for

expatriate employees

Stocks can be kept in FTZs for unlimited

periods of time

Incentives and advantages are available

to all firms regardless of their origin

United Arab Emirates

Jebel Ali Free Zone

0% corporation tax for 50 years

(renewable concession)

100% foreign ownership allowed

No restrictions on repatriation of capital