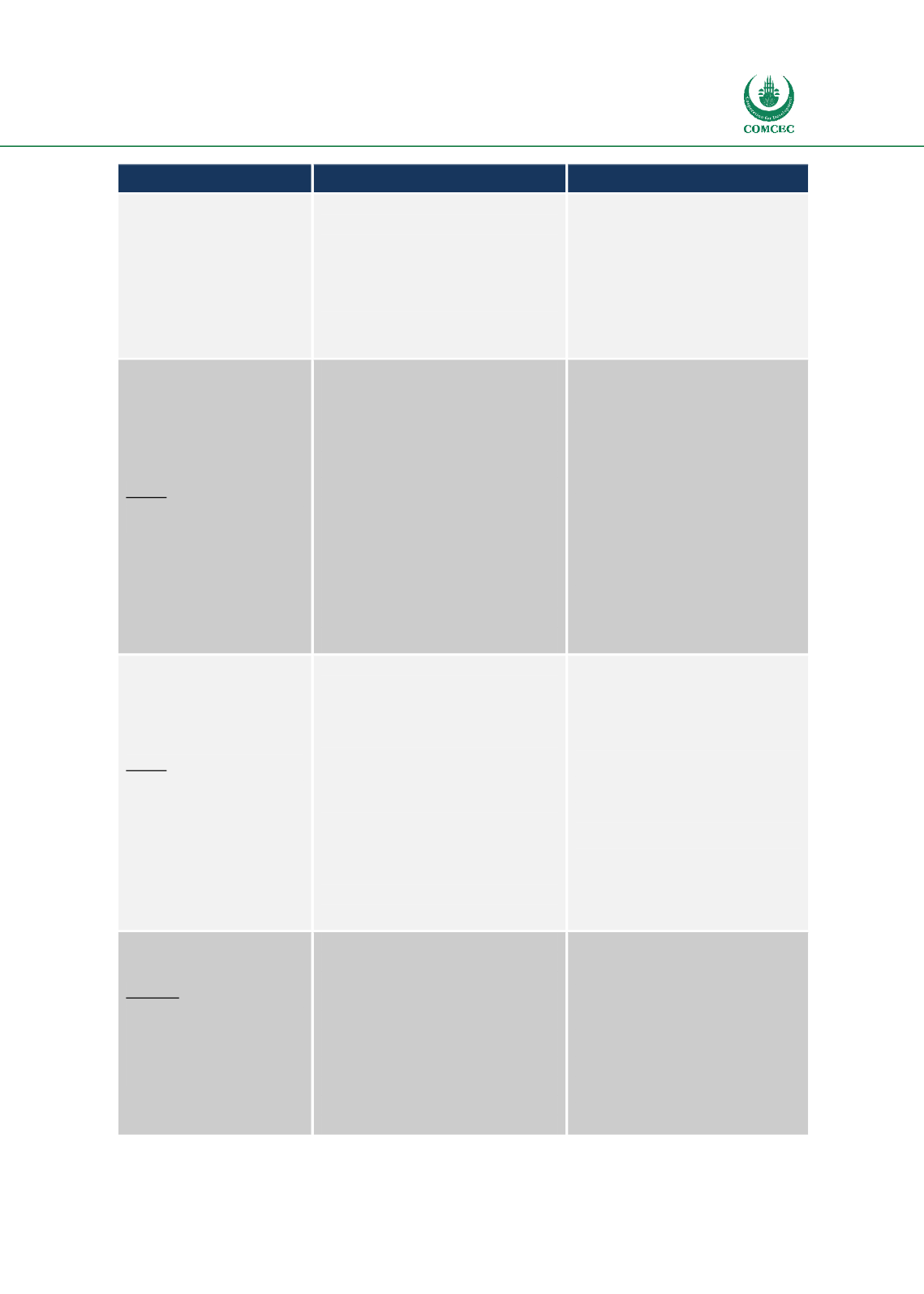

Special Economic Zones in the OIC Region:

Learning from Experience

51

Zones

Fiscal Incentives

Non-fiscal Incentives

Exemptions for import of raw direct

materials and supporting materials for

production purposes

No import income tax

No tax agency incentives

Reduction in property tax in compliance of

law and regulation

Jordan

Aqaba Free Zone

5% income tax on income generated from

activities within ASEZ in certain sectors

Exemption from social service tax

Exemption from sales tax on majority of

goods and services

Exemption from annual land and building

taxes on utilised property

Exemption from taxes on distribution of

dividends and profits on activities in ASEZ

and outside Jordan

No tariffs or import taxes on imported

goods for individual consumption and

registered enterprises

No foreign equity restrictions on

investment in tourism, industry, retail

and other commercial services

100% foreign ownership available

No foreign currency restrictions

Full repatriation of profits and capital

Streamlined labour and immigration

procedures - project may employ up to

70% foreign labour as an automatic right

Jordan

King Hussein Business Park

Ma’an Development Area

5% income tax on activities within the

economic zone

Exemption from taxable income from

export

Exemption from sales tax on goods sold

into (or within) the economic zone

Exemption from import duties on all

materials, instruments and machines

within economic zone

Exemption from social services tax

Exemption from dividends tax on income

accrued within the economic zone

No restrictions on foreign ownership

Streamlined

business

procedures,

licensing for expatriates and property

registration/transfer procedures

Flexible labour regulations

Improved enforcement of intellectual

property rights

Streamlined customs regulations

Clear land ownership policy

Malaysia

Bayan Lepas FIZ

Port Klang Free Zone

Iskandar

Pioneer firms receive exemption from

corporate income tax and development tax

of 5% for tax holiday period of 5 to 10

years. Unabsorbed capital allowances

incurred during the pioneer period can be

carried forwards

Investment Tax Allowances are also

available for companies which cannot

obtain pioneer status and allows an

allowance of 60% on capital expenditure

100% foreign ownership allowed for

companies exporting >80%

No equity restrictions

Foreign

exchange

administration

flexibilities and expatriate positions

Unrestricted employment of local and

foreign workers for some sectors

Protection of intellectual property