Special Economic Zones in the OIC Region:

Learning from Experience

50

Box 14 - Dubai Free Zones Council – Coordinated Approach to Incentives and Policies

4.2.3

Incentives

There are a range of incentives offered by the different zones for firms choosing to locate within

the zones. A comparative matrix of fiscal and non-fiscal incentives is presented below i

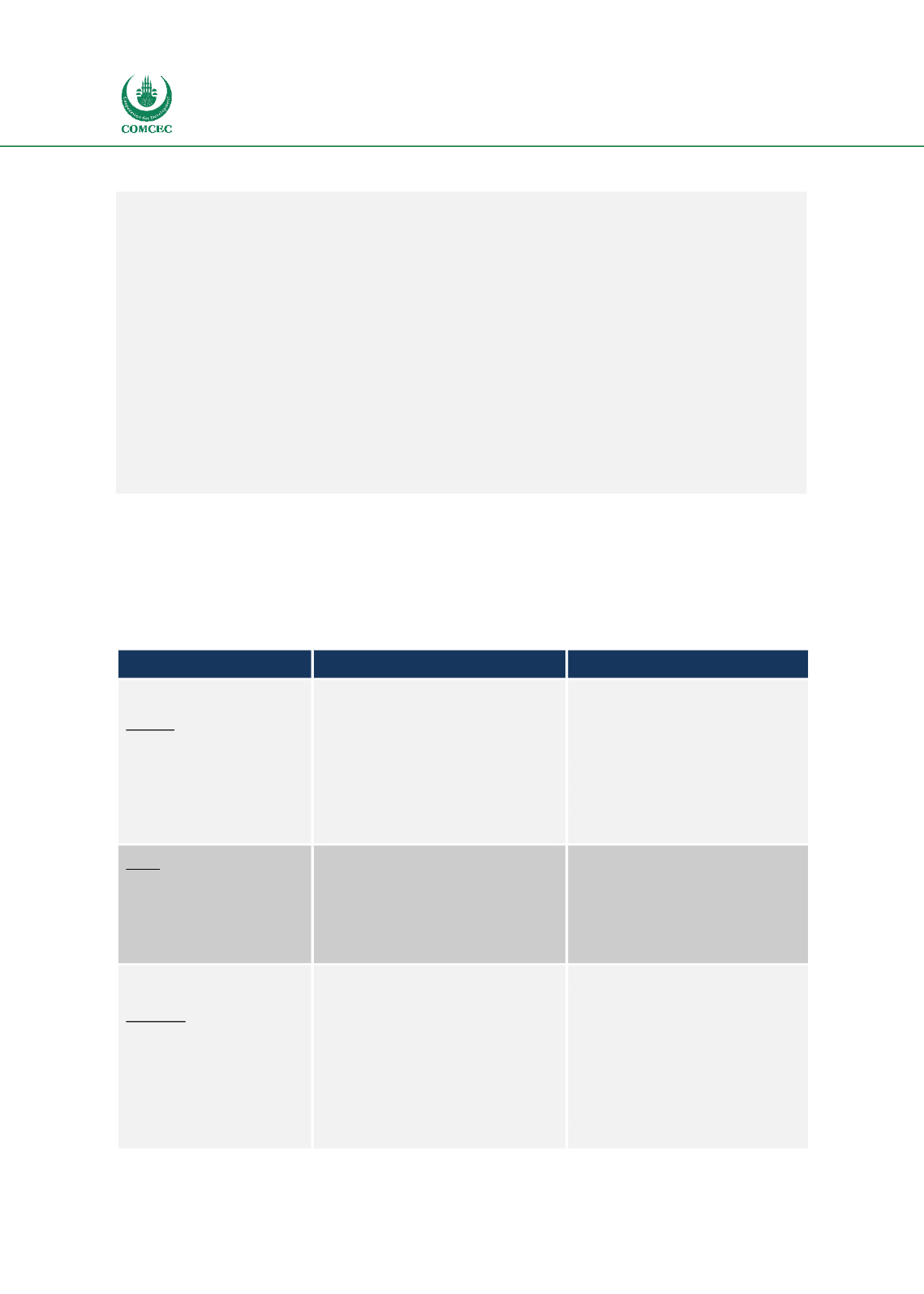

n Table 4-3.Table 4-3 - Comparative Matrix of Incentives within Selected OIC Member State SEZs

Zones

Fiscal Incentives

Non-fiscal Incentives

Bahrain

Bahrain

International

Investment Park

North Sitra Industrial Estate

0% corporation tax (with a 10 year

guarantee)

Duty free access to all GCC markets

Exemption from import duties on raw

materials and equipment

Duty free imports of raw materials and

equipment for manufacturing

100% foreign ownership

100% repatriation of capital

No recruitment restrictions

No minimum capital required

Egypt

Alexandria Public FTZ

Nasr City Public Free Zone

Suez Trade Free Zone

5% income tax vs 10-20% outside SEZ

10% unified income tax vs 20% outside

SEZ

Duty free import of capital equipment, raw

materials and intermediate goods

Accelerated customs service within SEZ

Access to sales within domestic market

Duty on sales to domestic market will be

assessed on the value of imported inputs

only

Indonesia

Tanjung Api-Api

MBTK

Bitung

Exemptions on corporation tax depending

on scale of investment - from 20%-100%

VAT and Luxury Sales Tax exempt for

certain taxable goods

Exemption from import duties for certain

goods to SEZs

Permission to hire foreign workers in

directorial or managerial roles

Ease in regulations with regards to land

ownership and land acquisition

Granted land rights for those who

already have land

Ease in regulations with regards to

immigration of foreign business people

Dubai Freezone Council

The vision of the Dubai Freezone Council is to support the free zones within Dubai to become the

leading destination for investment globally. The council acts as the primary forum for

coordination of free zone activities including review of legislation and policies that regulate the

zones.

The Freezone Council has developed a comprehensive strategy for the free zones in Dubai and

proposes and reviews policies and rules with regards to enterprise registration. In 2017 the

Council approved a new strategic plan to support the Dubai Plan 2021 and the individual free

zone strategies.

The success of Dubai’s free zone policies is evident in the economic performance of the zones

where it is recorded that approximately 225,000 employees works within approximately 19,000

enterprises within the free zone boundaries.