52

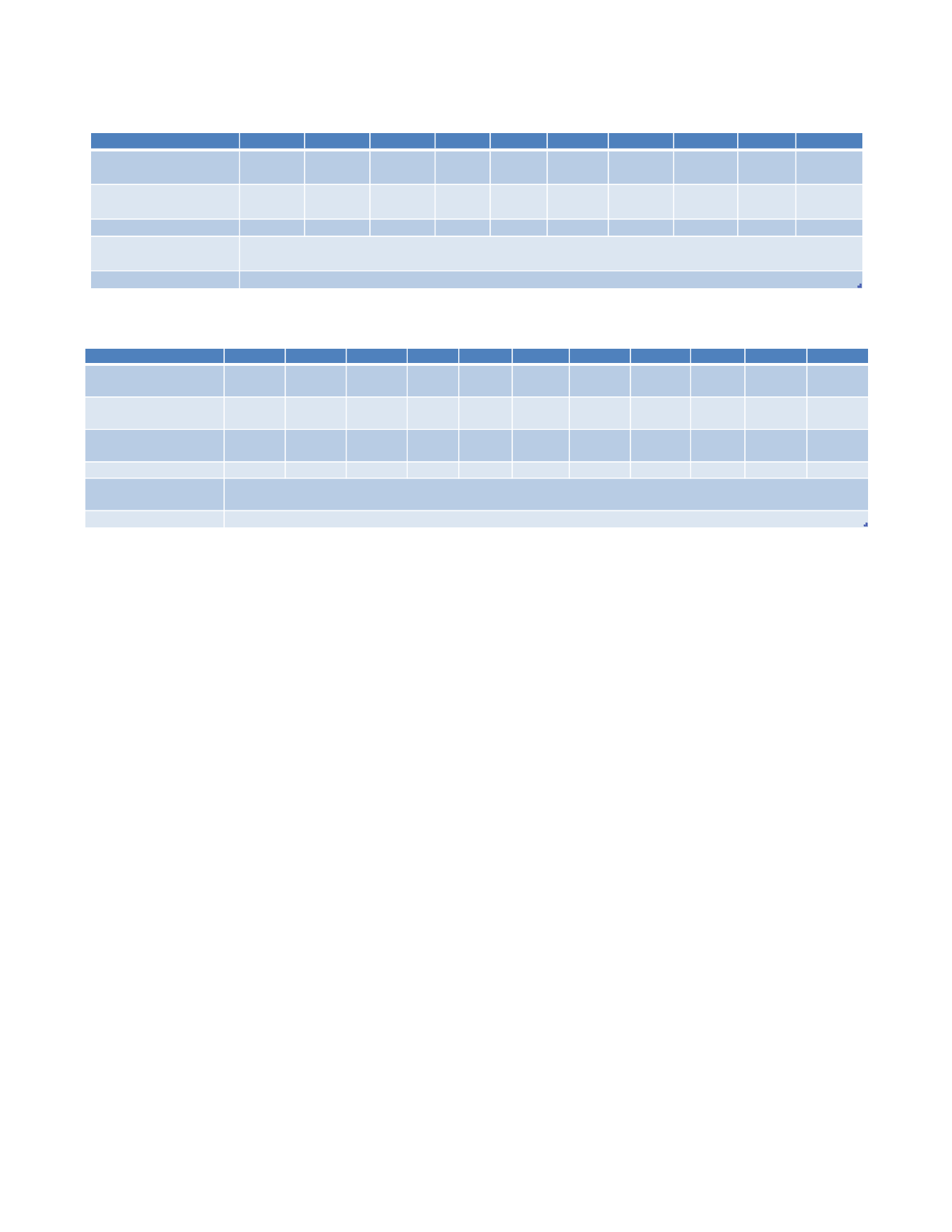

Table 3.6: Intra-OIC trade data (Egypt), 2000-2010

Source: ICDT

Table 3.7: Intra-OIC trade data (Saudi Arabia), 2000-2010

Source: ICDT

Sustaining and growing interdependency will be a function of improved economic conditions, better

framework conditions and increased industrial diversity. As part of a circular argument, gradual increases

in intra-OIC activity may enable these improvements to occur.

3.3.3.

SMEs in the MENA Region

In general terms SMEs are regarded as an effective enabler of economic growth. This is in part manifest

in the growth in the number of start-ups which has increased eight times in 2011 as compared to 2005,

with Egypt together with Lebanon, the UAE and Jordan attracting the most of early stage investments

(Dubai Internet City and Frost and Sullivan). Governments in the region are also seeking to drive

economic growth through business friendly policies. Some countries such as Egypt, Saudi Arabia, Jordan

and the UAE have started incubation programmes, ICT funding, and tie-ups with international

governments and private equity firms, thereby demonstrating a commitment to innovation.

The current definition for SMEs in the MENA region varies between countries. While Saudi Arabia and

the UAE tend to use markers close to the European definition, Jordan and Egypt restrict medium sized

firms to 100 employees SMEs have caught the attention of policy makers as they are seen as possible

solution providers to the problems of high unemployment and in some cases poverty, the declining levels

of employment in the public sector,

SMEs in Saudi Arabia

According to the World Bank, the SME sector currently forms 90% of all Saudi companies, yet the sector

only contributes a quarter of total employment and about a third of the country's gross domestic product.

The country’s SME sector remains inadequately financed. The share of bank loans that are received by

SMEs is below the levels of other countries. This inadequacy has a ripple effect on the capability of

SMEs to operate effectively in the exports market. To address this problem, the government has allocated

US$ 5bn to the Saudi Credit and Savings Bank in order to finance small businesses. It is anticipated that a

similar amount of money will be transferred to the Saudi Industrial Development Bank to support bank

Egypt

2000

2001

2002

2003 2004 2005 2006

2007

2008 2009

World exports

(in millions US $)

5633

4141 6971,1 8301 10500 10652,12 13756,31 16096,28 29317,4 24818,1

Intra OIC exports

share in %

13,81

18,65

14,69 15,76 27,76 23,82

35,76

39,93 27,08

29,88

Intra OIC trade share in % 12,02

16,29

13,37 14,56 20,88 22,99

32,21

33,42 21,25

22,91

Main intra-OIC exported

products (2008)

Petroleum/petroleumproducts, natural gas, Iron and steel, non–metal and mineral products, textiles and cereals

Main Customer (2009)

Saudi Arabia, Syria, Jordan, Turkey, U.A. Emirates, Sudan, Iraq, Morocco, Indonesia, Pakistan

Saudi Arabia

2000

2001

2002

2003 2004 2005 2006

2007

2008 2009

2010

World exports

(in millions US $)

74688

70453

66703 86219 112107 181054,54 190210 234950,76 279547 173232 227750

Intra OIC exports

(in millions US $)

10141

10298

9390 11643 18033 30446

31033 35035 42646

27702

35916

Intra OIC exports

share in %

13,58

14,62

14,08 13,5 16,09 16,82

16,32

14,91 15,26

15,99

15,77

Intra OIC trade share in % 12,86

11,54

10,94 11,05 14,92 14,85

14,77

14,06 14,66

14,3

15,11

Main intra-OIC exported

products (2008)

Petroleumand pretroleumproducts, natural gas, organic chemicals, dyes and coloring material, inorganic chemicals

Main Customer

Pakistan, Indonesia, Bahrain, U.A. Emirates, Jordan, Syria, Egypt, Turkey, Morocco and Kuwait