55

levels indicate that attempts are being made to diversify the economy over time. Saudi Arabia shares

some of these problems, as well as the measures being adopted to wean the country out of oil dependency.

Internal Barriers

The general environment for a business environment that is conducive to the growth and sustainability of

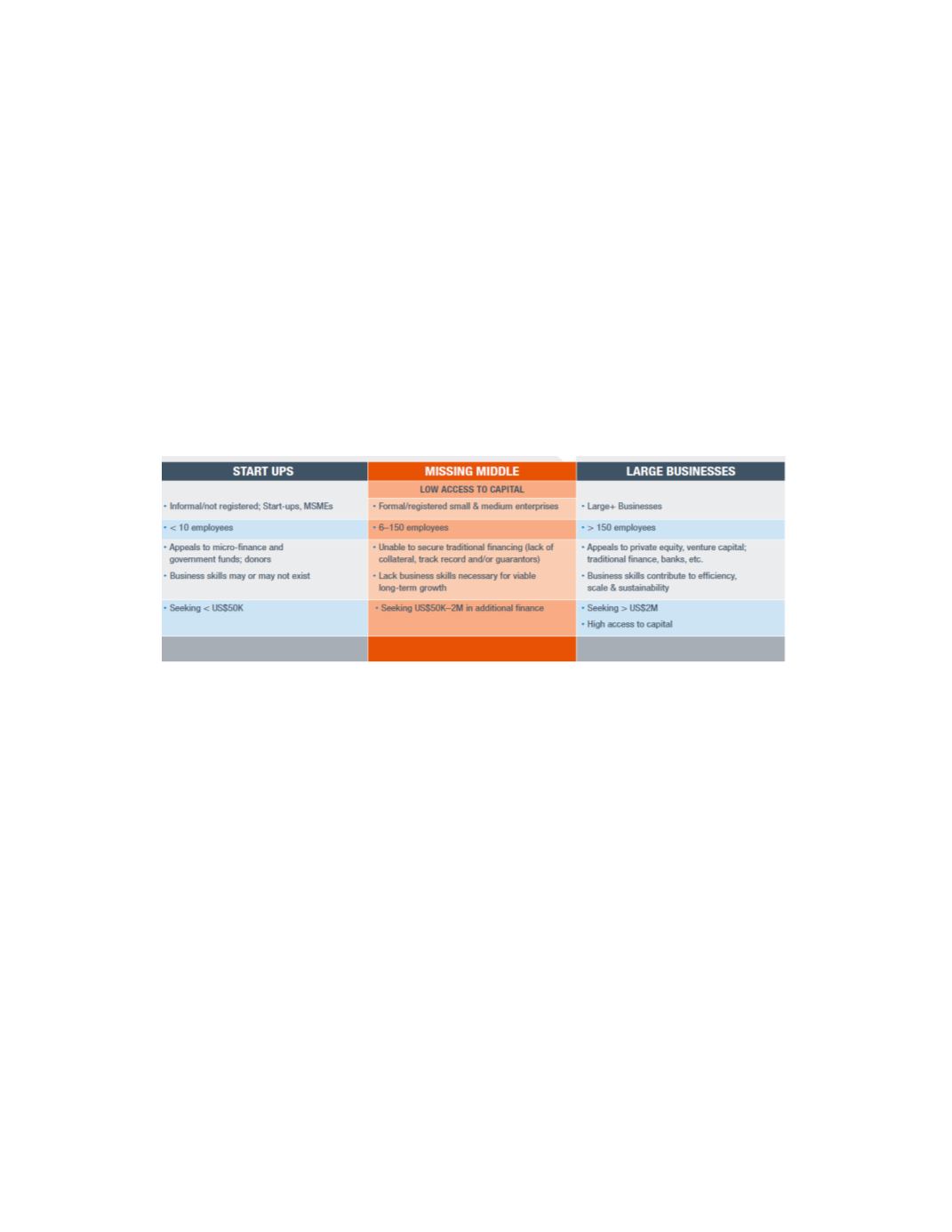

SMEs, especially the recently established ones, remains elusive in MENA countries. SMEs in the

“missing middle” struggle to obtain finance to expand their businesses and are largely ignored by

investors and government agencies which tend to prefer start-ups or large and well- established

businesses. Typically, “the missing middle” account for 40% to 70% of the MENA SME market. They

have modest revenues and employ no less than 6 and no more than 150 people. Compared to start-ups

they have more potential to create jobs and explore new markets. Contrasted with larger SMEs, they are

less exposed to risk, which in the current climate of and a growing population in many countries of the

MENA region. Risk aversion should make them more attractive to investment. Table 6 below shows the

variation in firm capacities between the start-ups, the missing middle and the larger firms.

Table 3.8 Different Types of SMEs in the MENA region

Source: Al-Yahya K and J. Airey (2013)

The level of financing of SMEs varies significantly from country to country with the oil exporting

countries providing limited access to SME loans as a proportion of all loans. A greater urgency for

diversification in the oil importing and poorer countries of the region has resulted in increased levels of

SME loans. Figure 3.6 shows that the proportion of SME loans in Yemen was 20.3% compared to 1.7%

in Saudi Arabia.