Increasing Agricultural Productivity:

Encouraging Foreign Direct Investments in the COMCEC Region

57

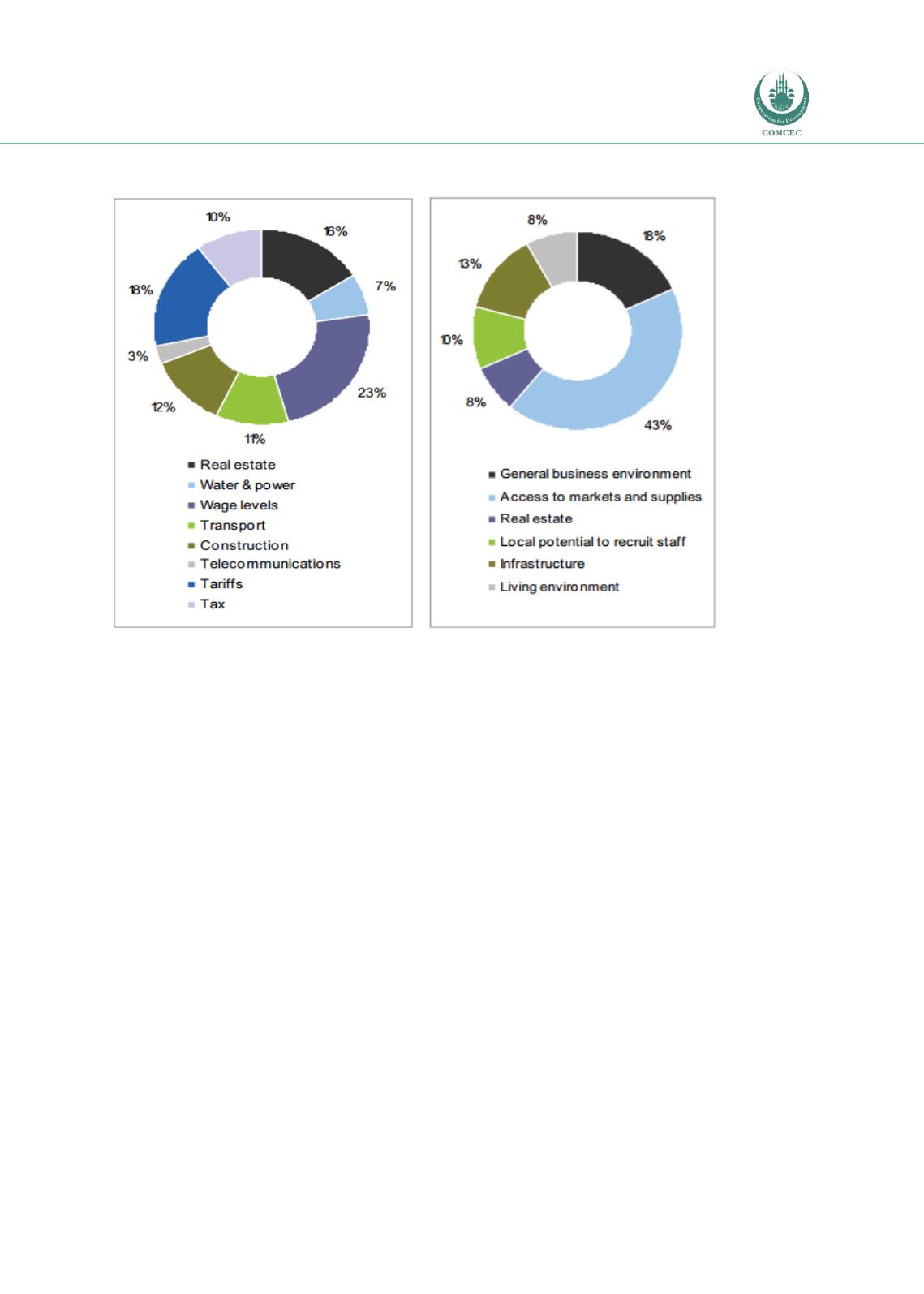

Figure 25: Breakdown of cost (left) and quality (right) motivations for food & beverage FDI

Source: MIGA 2007

Despite the diversity in terms of business activities between horticulture and food & beverage

(i.e. agro-processing), there appears to be consensus regarding the most important quality-

related site selection factors as illustrated in Figure 25. For both industries it seems that access

to markets and supplies (31 percent and 43percent, respectively) and the general business

environment (both 18 percent) are perceived by agricultural investors as most critical site

selection factors. The third most important site selection criteria, availability of real estate and

arable land for horticulture (14 percent) and local potential to recruit staff for food & beverage

(13 percent) do relate to differences in business activities. Horticulture investments are

dependent on vast quantities of (arable) land to grow crops whereas food & beverage

investments require labour to process products.

A similar picture is present with regards the cost-related site selection criteria. Wage levels (26

percent for horticulture, 23 percent for food & beverage) and the cost of real estate (20 percent

and 16 percent, respectively) have been identified as the most crucial site selection factors for

agricultural FDI projects. Again, the third most significant site selection factor differs between

horticulture and food & beverage investors: cost of transport and cost of construction,

respectively. As mentioned earlier, the horticulture industry is relies heavily on trustworthy

transportation to secure its just-in-time principles whilst food & beverage investments require

significant investments in commercial real estate.

The conclusion that can be drawn from the horticulture and food & beverage case studies, firstly

relates to the site selection criteria that have been perceived as significant by investors.

Secondly, this allows evaluating the competitiveness of agricultural FDI for various potential