Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

73

agricultural products while improving its competitiveness and influential in agriculture both

regionally and globally.

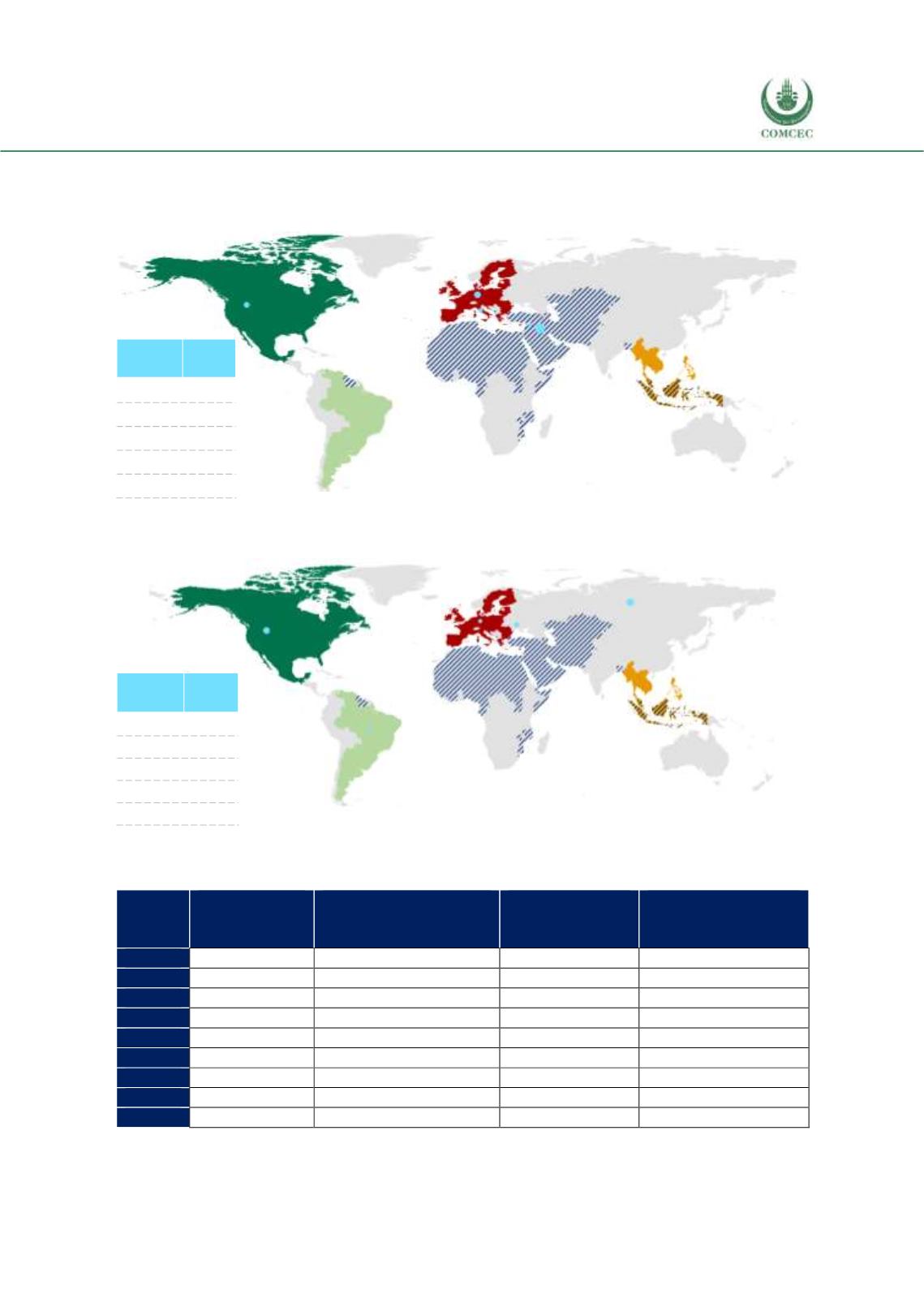

Figure 4. 3 Breakdown of Turkey’s Agricultural Export Destinations, 2016

Source: CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, authors’ visualizations

Figure 4. 4 Breakdown of Turkey’s Agricultural Import Origins 2016

Source: CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, authors’ visualizations

Table 4. 2 Value & Share of OIC in Turkey’s Agricultural Trade

Year

Value

(exports)

billion USD

Share in Turkey’s

total agricultural

exports, %

Value

(imports)

billion USD

Share in Turkey’s

total agricultural

imports, %

2008

3.3

29.7

1.8

16.9

2009

3.7

33.3

1.2

14.3

2010

4.3

34.2

1.8

15.8

2011

6.2

40.3

2.1

13.8

2012

6.6

42.1

1.9

13.3

2013

7.5

42.3

2.2

14.8

2014

7.6

41.2

2.2

14.2

2015

6.9

39.8

2.1

14.7

2016

7.3

42.5

2.1

15.9

Source: CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, and authors’ calculations

EU-28

%32

NAFTA

%7

MERCOSUR

%0

ASEAN

%2

OIC %42

Top 5

Partner

Share

Iraq

%17

Germany

%8

USA

%6

Italy

%4

Syria

%3

EU-28

%25

NAFTA

%15

MERCOSUR

%11

ASEAN

%7

OIC %16

Top 5

Partner

Share

Russia

13%

USA

11%

Ukraine

6%

Brazil

5%

Germany

4%