Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

67

For instance, poor management of SOEs is indicated as a major weakness by several participants

from different countries. Besides, the domestic orientation of SOEs is identified as a reason that

limit their trade facilitation function. Governments’ regulatory role is stressed as the main

complementarity mechanismwith the private sector that would ensure highest efficiency levels

in various stages of the supply chain.

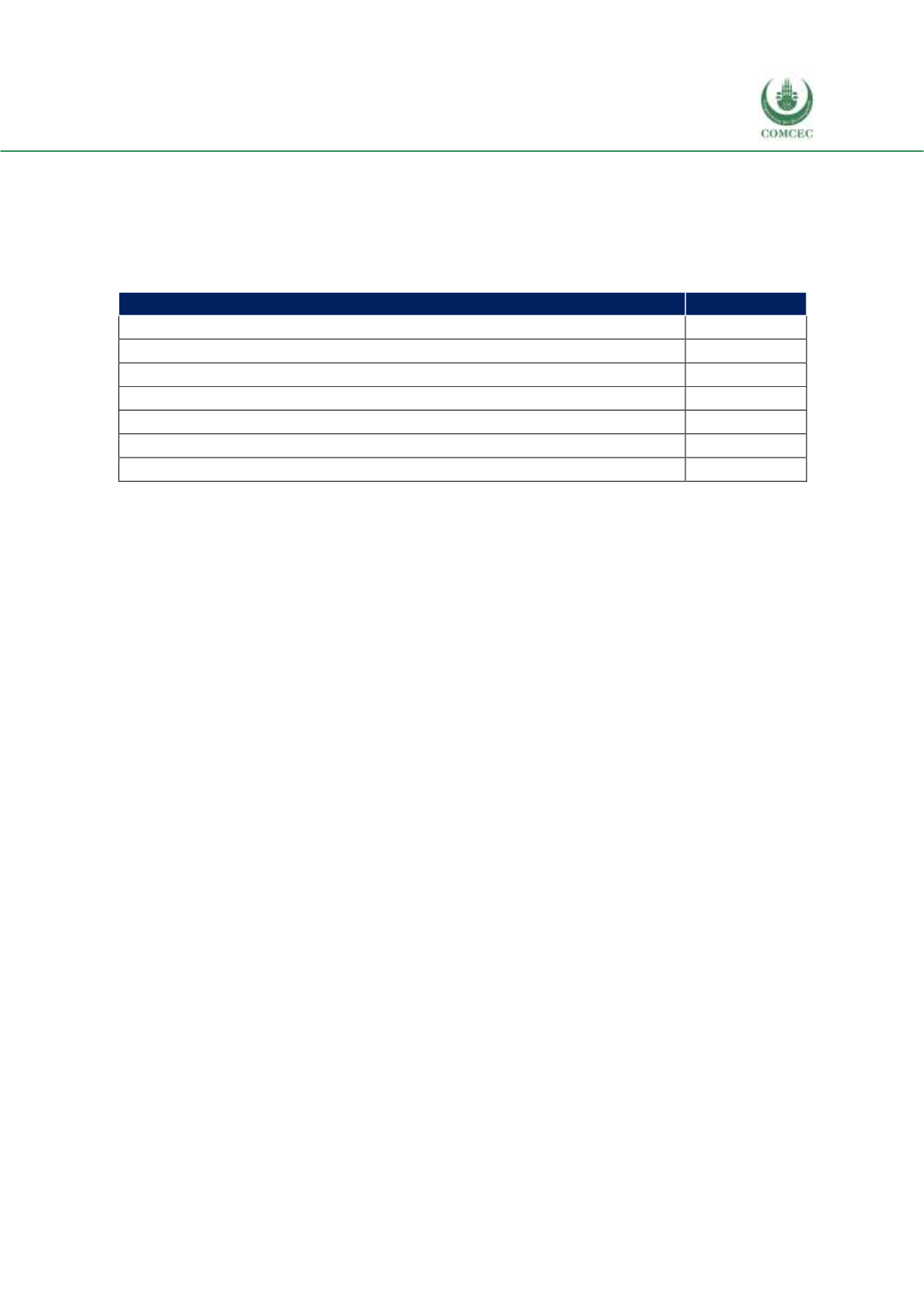

Table 3. 17 Regions with which Agricultural Trade is Expected to Increase

Region

Response Rate

Middle East

73.91%

Asia

47.83%

Africa

45.65%

Western Europe

41.30%

Central and Eastern Europe, the Baltic States and the CIS (transition economies)

34.78%

Latin America

8.70%

North America

4.35%

Source: Authors’ calculations

Over 80% of participants indicate that the agricultural cooperatives in their countries are and

will be key market institutions that contribute to trade facilitation. The cooperatives from the

participants’ countries are dispersed over a large spectrum of products including those

classified within fish products, animals, fruits and vegetables, and dairy products. Cooperatives

are seen as key institutions for a variety of reasons. A relatively large number of responses are

focused on different stages of supply chains, especially underlining that large cooperatives help

reduce information and credit barriers for smallholder farmers and prevent exploitative

practices exercised by middlemen.

Improvements in NTM arrangements such as standardization and accreditation schemes,

bilateral and multilateral trade agreements, infrastructure investments that would yield

improvements in logistic performance, increasing FDI flows, and product diversification are

seen as the foremost means through which further trade facilitation can be realized with current

trade partners.

The survey also includes questions that are designed to shed light on the trade networks within

OIC. Clearly, responses to these questions would be dependent on the list and groups of

countries which the survey participants are from. Among the regions with which agricultural

trade is expected to be strong in the next 5 years, the Middle East stands out as the top region,

receiving around 74% of responses. The Middle East is then followed by Asia (around 48%) and

Africa (around 46%). Neither the North America nor the South America exhibits a strong

potential in this regard.

The treemaps in Figure 3.16 indicate that there is an expectation of agricultural trade

relationships exhibiting some degree of persistence both with the OIC partners and with the

non-OIC partners. As stressed in other parts of this report, Saudi Arabia and Turkey are

agricultural import and export hubs within the OIC, respectively. These countries are

accompanied by non-OIC partners Russia, Germany and China both for the current and for the

future agricultural trade relationships.