Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

65

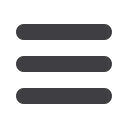

Exporter

Product

Share of the

product in

the

exporter’s

total agr.

exports, %

Share of the

country in

the total

world export

of the

product, %

Share of OIC

as destination

for the

country's

export of the

product, %

Weighted average

tariff rates

implemented by

OIC members to

the country's

export of the

product, %

Burkina

Faso

Sesame (Sesamum) seeds

4,2

1,4

23,0

1,4

Oil-seeds & oleaginous

fruits, n.e.s.

3,3

1,8

2,3

0,0

Source: ITC Macmap, CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, and authors’ calculations.

Note: This table collects information on the global and OIC market shares of countries’ top export products at the product level

and weighted average tariff rates these products face at the OIC markets. Each column is colored according to the thresholds

indicated at the first row. To take just one example, “Other beet/cane sugar in solid form, other than flavoured/coloured matter”

from Algeria has a large share within Algeria’s agricultural exports (larger than 10%) as indicated in the colored third column.

This product is important, and hence the fourth column is colored, also because 0.9% of Algerian share in “Other beet/cane sugar

in solid form, other than flavoured/coloured matter” is larger than the overall Algerian share in agricultural products.

Furthermore, the share 98.7% of OIC markets for Algerian “Other beet/cane sugar in solid form, other than flavoured/coloured

matter” is larger than the overall OIC share of agricultural products from Algeria, and the fifth column is also colored. Finally, the

last column is colored for in “Other beet/cane sugar in solid form, other than flavoured/coloured matter” because the weighted

average applied tariff rates faced by this product by Algerian exporters in OIC markets is larger than the corresponding rates

applied to overall agricultural exports from Algeria in OIC markets.

A vast majority of participants states that agricultural trade is either very important (67%) or

important (21%) to the country’s overall agricultural development. Similar figures are observed

with regards to the role of agricultural trade on food security (72% and 22%, respectively). This

is expected given the large share of the agricultural sector in employment and GDP in OIC

member countries generally. But it also indicates that the design and implementation of sound

agricultural trade policies would result in significant positive effects on the social and economic

welfare in the OIC member countries.

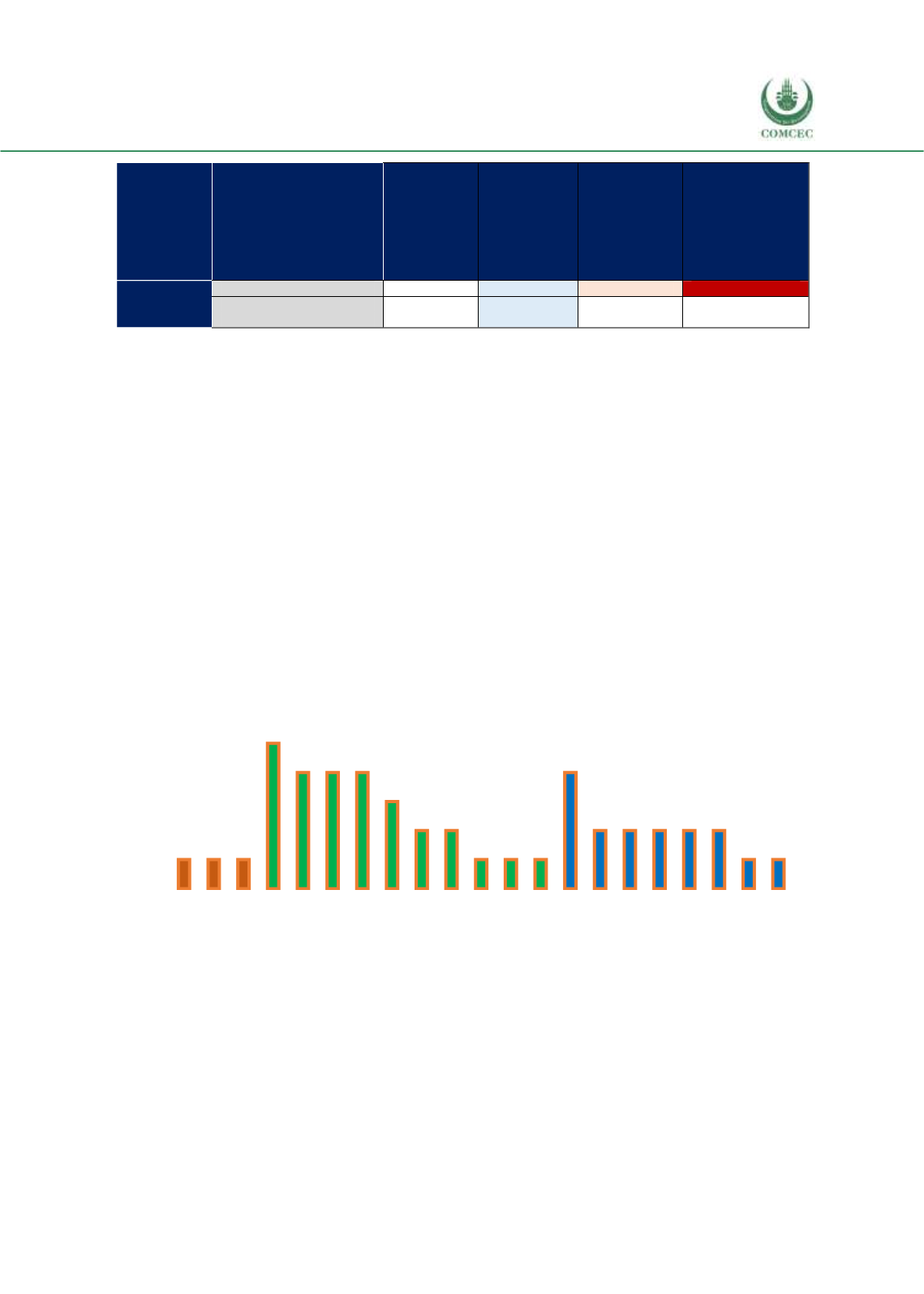

Figure 3. 15 Distribution of Survey Participants across Countries

Source: Authors.

0%

2%

4%

6%

8%

10%

12%

Cote d'Ivoire (1)

The Gambia (1)

Uganda (1)

Egypt (5)

Lebanon (4)

Palestine (4)

Tunisia (4)

Jordan (3)

Morocco (2)

Qatar (2)

Algeria (1)

Sudan (1)

United Arab Emirates…

Turkey (4)

Brunei-Darussalam (2)

Indonesia (2)

Iran (2)

Malaysia (2)

Pakistan (2)

Afghanistan (1)

Suriname (1)