Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

46

countries and especially developed countries such as USA and EU members, may result in trade

diversion due to the higher tariffs to the OIC member countries from the Asia or Arab groups.

The Asian group’s average tariff applied to its top 5 imports is 7.8% for imports from the same

group, 1.3% for imports from the African group and 13.3% from the Arab group. This means a

more preferential rate is applied to the African group, and the highest rate applied to its top 5

imports by any group is the Asian one. Here again the tariff rate applied to non-OIC is lower

(11.9%) than the one applied to the Arab group and thus has a potential to divert trade from

Arab countries to outside of the OIC.

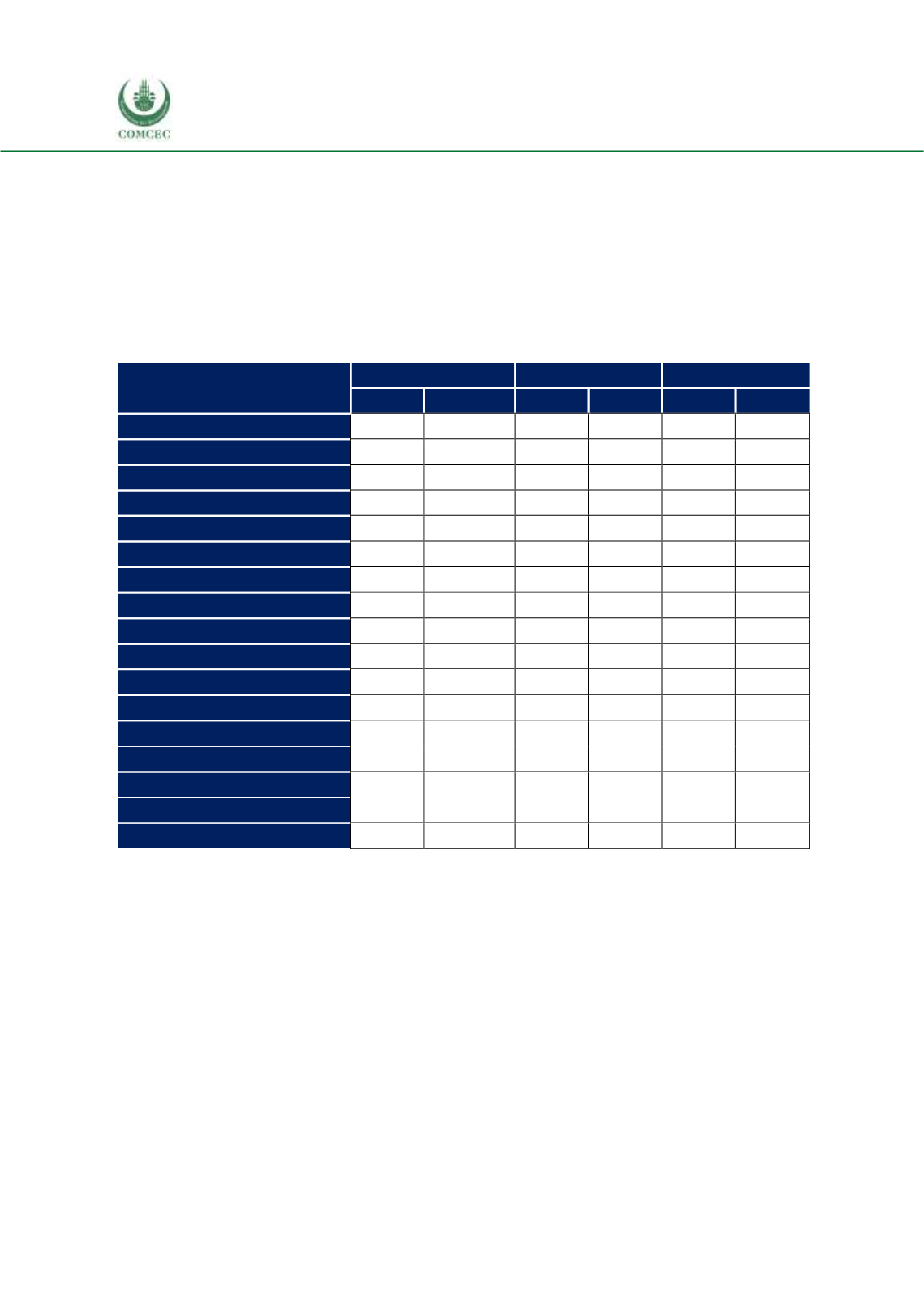

Table 3. 3 Percentage of Intra-OIC Exports Taking Place within RTAs, 2005 and 2016, %

Product

African Group

Arab Group

Asian Group

2005

2016

2005

2016

2005

2016

Live animals

99.6

99.95

99.94

98.94

8.02

78.2

Tobacco

83.39

71.56

91.69

50.32

50.9

49.41

Oil seeds

99.93

89.62

72.5

85.98

32.84

47.01

Crude rubber

87.93

98.95

93.75

95.44

51.37

25.62

Cork and wood

97.98

78.34

97.4

96.77

46.3

47.2

Rice

72.94

49.7

96.04

94.16

54.76

42.21

Vegetables

43.05

23.65

93.4

95.85

89.37

69.94

Fruit and nuts

9.38

76.61

97.66

97.84

69.77

63.6

Coffee

91.83

78.85

75.57

83.65

51.76

56.11

Other edible products

98.44

77.69

81.86

74.66

75.7

62.75

Cotton

50.24

59.65

57.93

99.53

90.81

88.97

Bread products

16.7

85.08

88.14

83.22

61.7

55.24

Palm oil

36.5

33.32

94.75

92.11

30.65

28.65

Fish and crustaceans

66.04

45.06

39.78

94.67

88.86

65.92

Cocoa and chocolate

99.19

21.05

87.04

77.91

73.06

72.79

Rest of 06

98.12

91.08

52.83

74.44

96.68

77.58

Rest of 04

99.98

86.1

45.31

99.14

60.46

68.07

Source: COMCEC (2018b).

Note: The product division 04 is for “Cereals and cereal preparations” and the rest of 06 includes those

other than wheat, rice, maize, barley, cereal flour, macaroni, and bread. The product division 06 is for

“Sugars, sugar preparations and honey” and the rest of 06 includes those other than beet and cane sugar,

natural honey, and sugar confectionery.

Finally, the Arab group’s average tariff applied to its top 5 imports is 0.8% for imports from the

same group, 8.6% for imports from the African group, and 16.3% from the Asian group. Again,

the 11.2% of average tariff applied to imports coming from the non-OIC countries is

considerably lower than the 16.3% applied to the Asian group, thereby implying a trade

diversion risk.