Improving Agricultural Market Performance:

Creation and Development of Market Institutions

99

Chetoui trees).

155

This is demonstrated by the high quantities of vegetables (3.34 million

tonnes), cereals (2.35 million tonnes), and fruits (1.31 million tonnes).

156

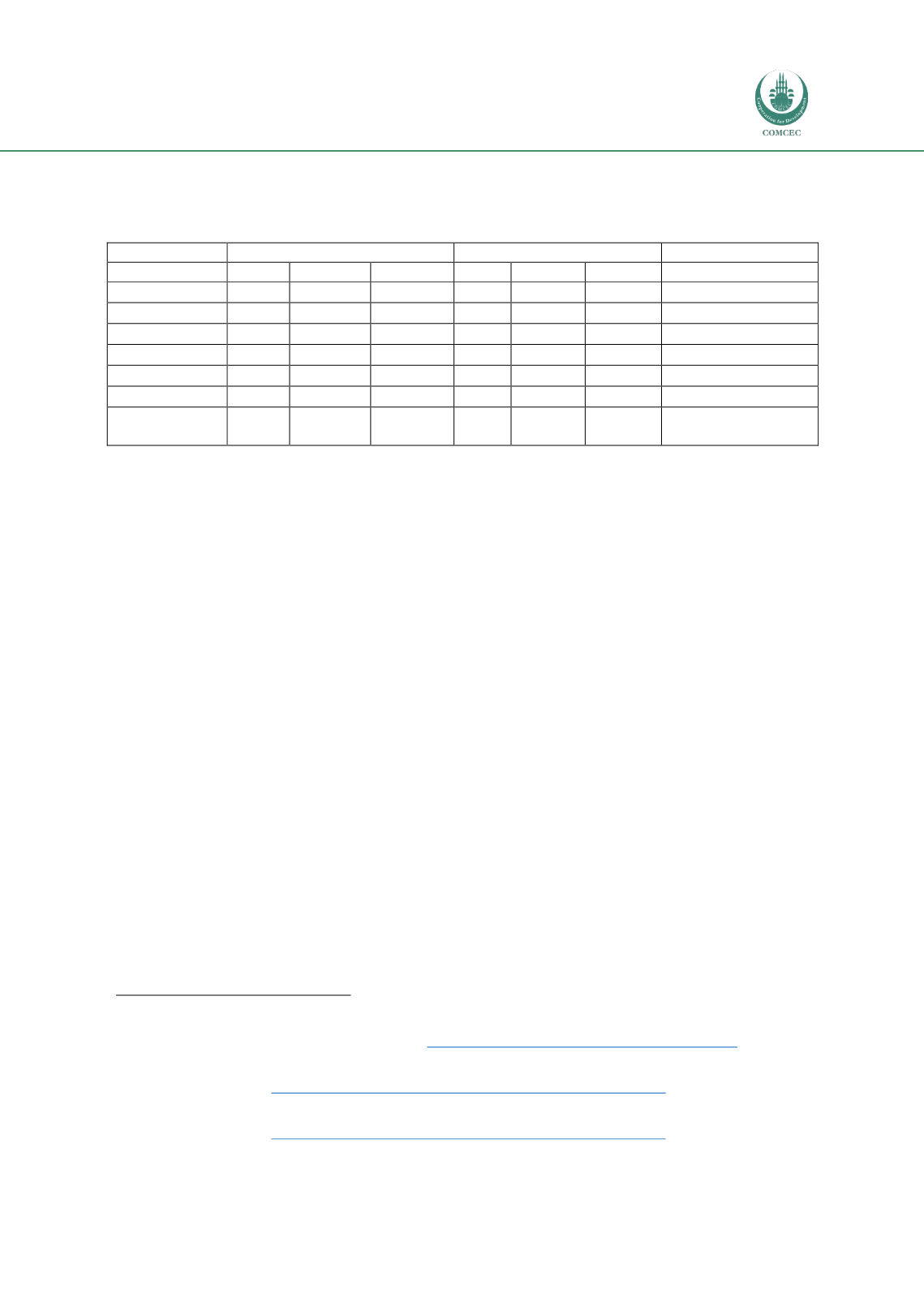

Table 2

–

Tunisian (TUN)/World agricultural production and exports, selected commodities

2016* Production (‘000 MT)

2016* Exports (‘000 MT)

Imports (‘000 MT)

TUN

World

TUN % TUN

World

TUN %

Olive Oil

200

3,120

6%

0.140

0.92

15%

Wheat

0.99

739,533

0%

/

178,550

0%

1.98

Tomatoes

1,250

170,750

1%

20.5

17,167

0%

39.9

Citrus fruit**

560

91,800

1%

26

9,650

0%

Dates***

199

7600

3%

104.9

8,498

1%

Almonds****

66.7

2,697

2%

0.27

3,223

0%

6.8

Wine

(000 hl)

253

269,900

0%

19

103,349

0%

* or last available year

** world data refers to oranges, tangerines, grapefruits and lemons

*** exports include figs, pineapples etc. (HS 0804 classification)

**** exports and imports refer to nuts according to HS 0802 classification

Source:

USDA Foreign Agricultural Service (2017); International Trade Center (2017); FAO (2017); The

International Organisation of Vine and Wine (2017)

Handling and Storage

With regards to handling and storage, Tunisia currently lacks sufficient post-harvest

management and storage capacity. This is particularly important for fresh products, which

require special supply chain activities to anticipate on the freshness, perishability, and quality

of fresh agricultural products. Such infrastructure is currently insufficient, requiring a better

management of supply chains, post-harvest infrastructure, and markets access. Storage

capacity can be increased for grains through grain silos

157

given the variety in grain harvests

and limited storage capacity. The same is true for cold storage capacity.

158

The Tunisian

Government, however, provides incentives to support companies up to 15% of their

investment in constructing storage facilities and equipment.

159

Processing and Packaging

As mentioned, the agri-processing and packaging stage has historically dominated by a small

number of very large agr-processing companies. However, Tunisia’s agri-processing sector has

opened up for foreign investment. The agri-processing industry received a total of US$25

million of FDI – especially from France, Italy, and The Netherlands - in 2014.

160

This is the only

part of the agricultural sector open for foreign investment as foreign investors can’t own or

rent agricultural land but need to co-manage this with a Tunisian national.

161

155

Interview conducted with Foreign Investment Promotion Agency in Tunis, May 15, 2017

156

COMCEC (2016), COMEC Agricultural Outlook 2016, pp. 55-90, Ankara: COMCEC.

157

Export.gov (2016), Tunisia - Agriculture, available a

t https://www.export.gov/article?id=Tunisia-agriculture [Accessed

May 2017].

158

European Commission DG Enterprise and Industry (2013), Business Opportunities in the Mediterranean – focus on agri-

food in Tunisia, available a

t http://www.taasti.org/business-opptunities-in-the-mediterranean.pdf [Accessed May 2017].

159

Interview conducted with Agence de Promotion des Investissements Agricoles in Tunis, May 16, 2017

160

European Commission DG Enterprise and Industry (2013), Business Opportunities in the Mediterranean – focus on agri-

food in Tunisia, available a

t http://www.taasti.org/business-opptunities-in-the-mediterranean.pdf [Accessed May 2017].

161

Ibid