Improving Agricultural Market Performance:

Creation and Development of Market Institutions

89

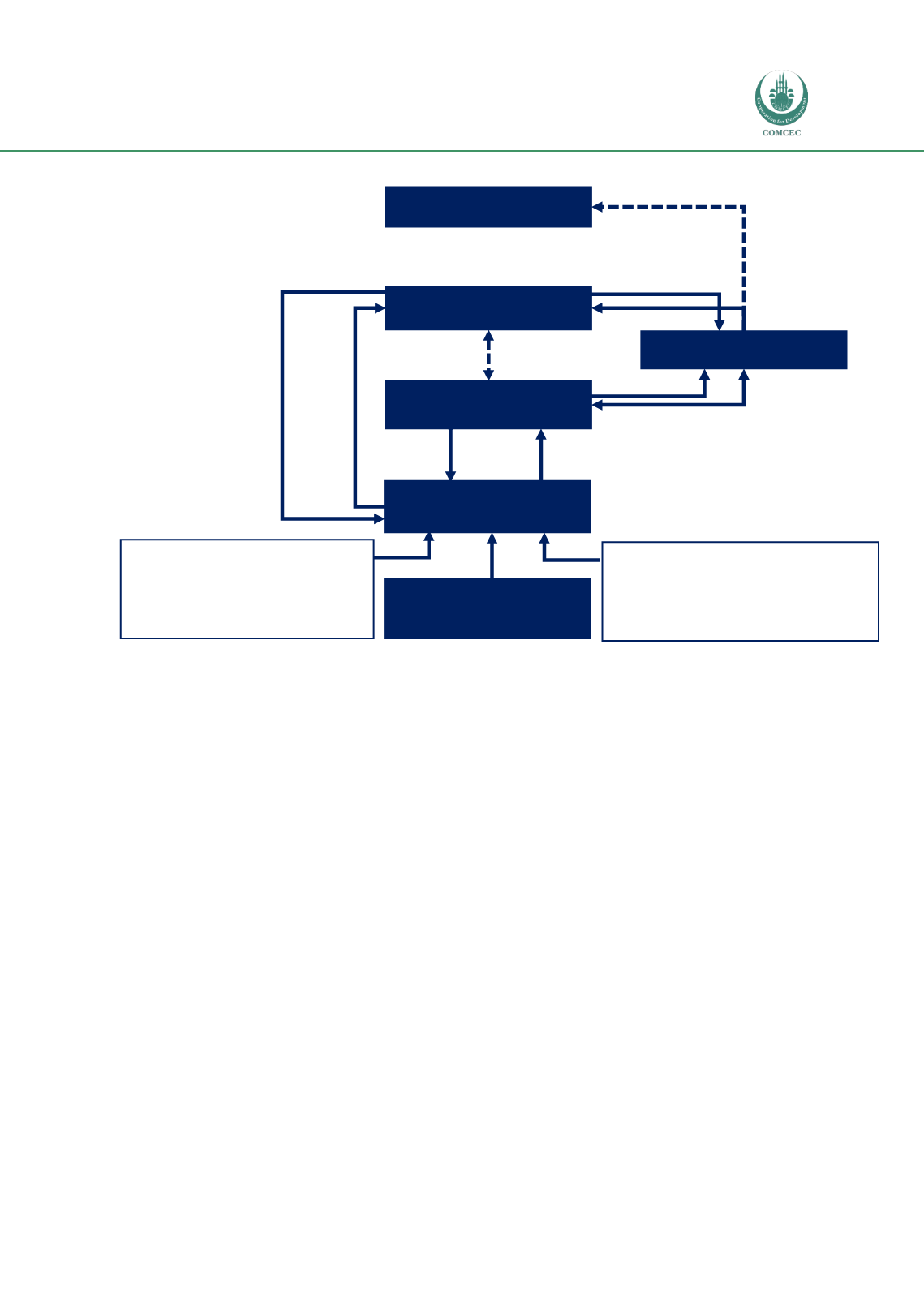

Figure 6 – Operators involved in warehouse system

Source: Investment Consulting Associates – ICA (2017), based on Onumah, G. (2013)

Highly perishable commodities are unsuitable for warehousing, while the existence of a system

of quality grading and certification helps ensure common valuation for warehoused goods.

Commodities subject to significant price swings are more suitable, since there is an incentive

to use warehouse receipts to smooth price fluctuations.

Examples of successful WRS systems in OIC countries include Kazakhstan, Tanzania, and

Uganda.

Kazakhstan

Kazakhstan, one of the largest wheat producers and exporters in the world, is a country in

which the warehouse receipt system has proven successful: it is estimated that international

banks lend more than US$1 billion a year against warehouse receipts, and local banks even

more. Local banks in Kazakhstan started financing grain traders against warehouse receipts in

the early 1990s, but there were few standards and controls, and significant fraud. Banks,

however, responded by setting up their own warehousing operations. In 2001 and 2002 a

more formal system of warehouse receipts was developed with donor support, backed by

enabling legislation governing both primary and secondary markets.

The legislation allowed banks to take possession of warehoused goods in cases of borrower

default, without the need for a court order. The new legislation, by providing greater certainty

140

Ibid

Depositors

Commodity Exchange

Buyers

Financial Institutions

Certified warehouse

operators

WR

Credit

WR

Payment

WR

Commodity

Warehouse regulatory

agency

WR

Commodity

Market supporting systems:

Market Information System

Warehouse legislation

Commodity standards

Enabling policy

Licensing requirements:

•

Operator capital

adequacy

•

Insurance cover

•

Performance bond