Improving Agricultural Market Performance:

Creation and Development of Market Institutions

87

scale up new products, such as weather index insurance, new variants of pest and

disease insurance, etc.

3.

Technical Assistance Facility (US$60 million).

Provides of technical assistance to

equip banks to lend sustainably to agriculture. And to producers to help them borrow

and use loans more effectively, and to produce more and better-quality goods for the

market.

4.

Holistic Bank Rating Mechanism (US$10 million).

Rates banks based on the

effectiveness of their agricultural lending and its social impact.

5.

Bank Incentives Mechanism (US$100 million)

. Complements NIRSAL’s first three

pillars and offers banks additional incentives to build their long-term capabilities to

lend to agriculture.

135

A

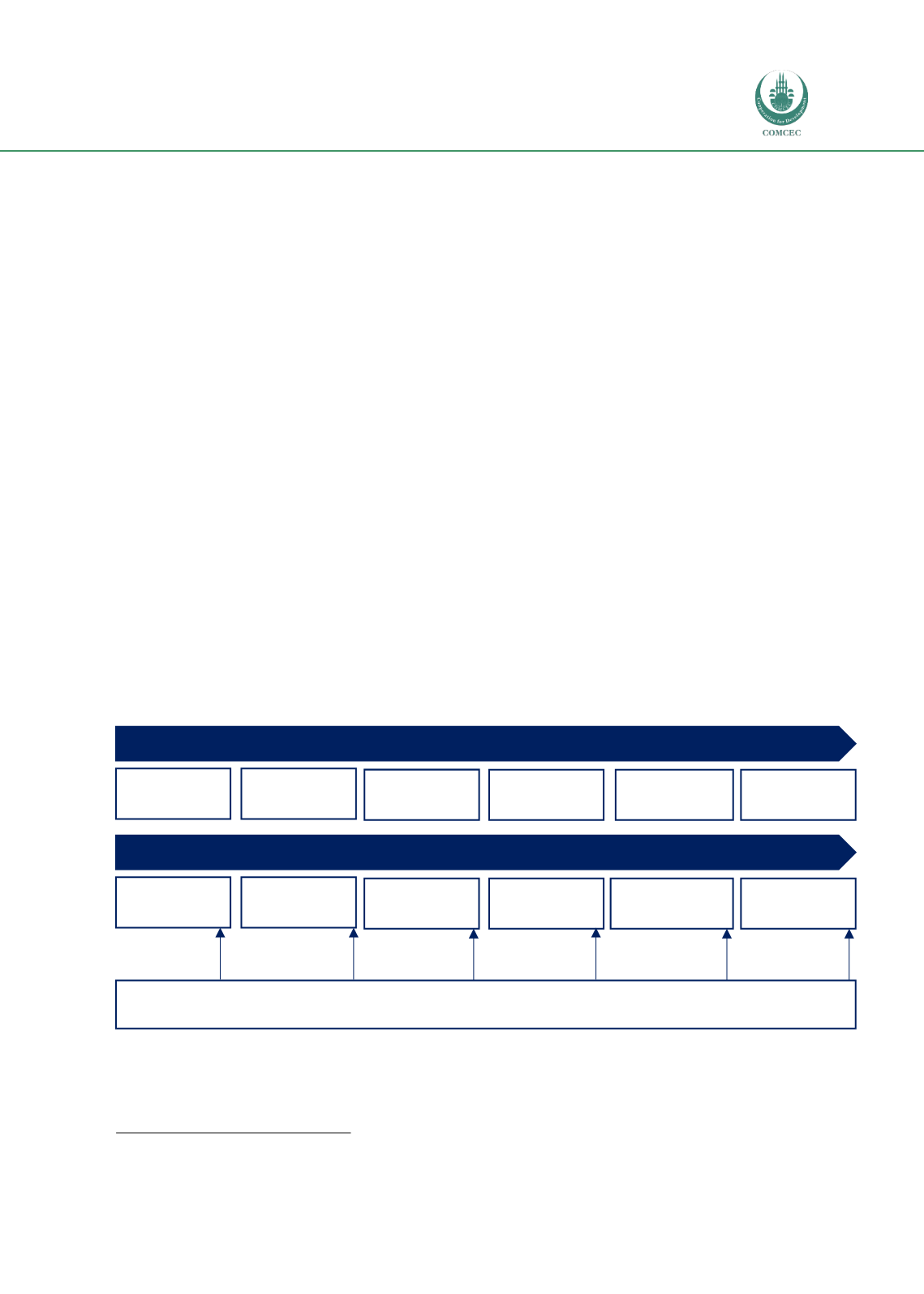

s Figure 4illustrates, NIRSAL works along the entire agro-food value chain in Nigeria, with

financial instruments adapted to the needs of each set of value chain participants and

delivered in coordination with other stakeholders.

NIRSAL has established partnerships with a wide range of public and private institutions,

within Nigeria and internationally. These include the major commercial banks in Nigeria, the

Nigerian Investment Promotion Commission, the Ministry of Agriculture and Rural

Development, the Bank of Industry and the Bank of Agriculture (state-owned development

finance institutions), the Nigeria Raw Materials Research and Development Council (a public

agency under the Ministry of Science and Technology), IFAD, the AfDB, USAID, UNIDO, GIZ, and

more than 30 private agribusiness groups.

Figure 5 – NIRSAL’s agro-food value chain interventions

Source: Investment Consulting Associates – ICA (2017), based on NIRSAL (2017)

Working with commercial banks, NIRSAL provides a credit risk guarantee (CRG) of between

30% and 75% of loan value, and an interest drawback program ranging from 20% to 40.

135

NIRSAL (2017), Our Core Focus, available at

www.nirsal.com[Accessed June 2017].

Input

Producers

Agriculture Value Chain

ENABLERS

Infrastructure

Credit Bureau

Policies

Extension Services

Price Stability Boards

Farmers

Agro

Dealers/Stor

age

Agro

Processors

Industrial

Manufacturer

s

Distribution

& Exports

Loan Product

Dev.

Agricultural Financing Value Chain

Credit

Distribution

Loan

Origination

Credit

Assessment

Managing &

Pricing for

Risk

Loan

Disbursemen

t