Improving Agricultural Market Performance

:

Creation and Development of Market Institutions

86

4.2 Agricultural Lending

Lack of access to finance is an important constraint to improvement of agricultural

productivity and production, which especially affects smallholders. Lacking adequate finance,

small producers cannot invest in better seed varieties, fertilizers and other inputs, or post-

harvest handling techniques that increase value. Without finance, they cannot increase the

amount of land they cultivate. Agricultural finance entails risks specific to each stage of the

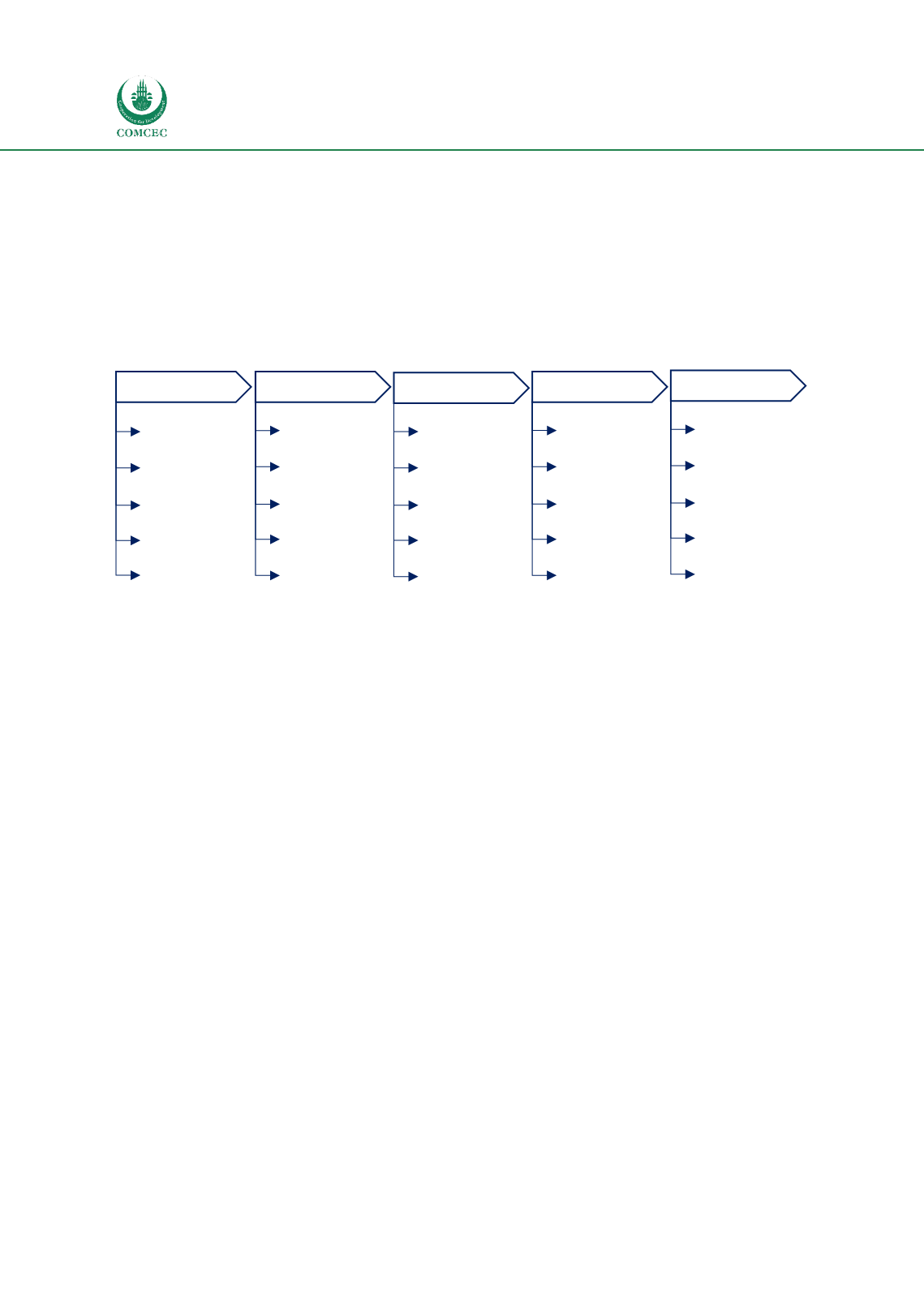

value chain, as illustrated i

n Figure 4 .Figure 4 – Risks along the agricultural value chain

Source: Investment Consulting Associates – ICA (2017), based on IFC (2015)

Financial institutions, agricultural lending programs, and other financial intermediation can

help reduce these constraints and improve market performance. One example of an

agricultural lending institution that has succeeded in doing this is the

Nigerian Incentive-

based Risk Sharing System for Agricultural Lending (NIRSAL).

In Nigeria, previous agricultural lending schemes encouraged banks to lend, but lacked a clear

strategy on how to use this activity to fix agricultural market systems and make lending more

effective. The Nigerian Incentive-based Risk Sharing System for Agricultural Lending (NIRSAL),

launched in 2013 as a public-private initiative sponsored by the Central Bank of Nigeria (CBN)

was intended to address agriculture market systems together with agricultural financing. The

US$500 million program is based on five pillars that aim to “de-risk” agricultural lending,

lower the cost of lending for banks, and – through both activities – enhance the functioning of

the market.

The funds are divided across the pillars as follows:

1.

Risk-sharing Facility (US$300 million).

Addresses banks’ perception that

agriculture is a high-risk sector, NIRSAL will share their losses on agricultural loans,

up to 50% on larger loans and up to 75% on smaller ones.

2.

Insurance Facility (US$30 million)

. Expands insurance for agricultural lending to

help reduce credit risks and increase lending across the entire market system. This is

intended to attract new private sector insurance providers into the market in

partnership with the National Insurance Commission, to expand existing coverage

offered by the Nigerian Agricultural Insurance Corporation (NAIC), and to pilot and

Producers

Input

Suppliers

Quality

Availability

Infrastructure

Knowledge

Financing

Price

Production

Organization

Financing

Institutional

Transporters

Quality control

Infrastructure

Technology

Logistics

Temporary over-

supply

Processors

Regulatory

environment

Technology

Finance & staffing

Product quality

Government

policies

Retailers

Storage

Infrastructure

Price

Lost production

Government

policies