Improving Public Debt Management

In the OIC Member Countries

73

Debt management strategy (incl. risk management)

The objectives of the debt management strategy of Gambia, which are highlighted in the Public

Finance Law, are primarily to ensure that the government meets its financing needs and

payment obligations at the lowest possible costs over the mediumto longterm with a

prudent degree of risk. The debt management strategy also promotes the development of the

domestic debt market. The MoFEA created the first MTDS for the years 20102012 (MoFEA

2012). The 20102012 strategy aimed at maximizing domestic borrowing and significantly

reducing external borrowing. External debt should mainly come from multilateral and bilateral

concessional sources with a grant element of at least 35%.

Domestic debt increased over the period 2010 to 2012 because of the issuance of (shortterm)

TBills. The domestic debt portfolio was thus prone to high interest and refinancing risks.

Consequently, the MTDS of 20112014 focused on addressing the challenges of the domestic

debt portfolio. The key aims of the MTDS 20112014 were to target NDB at 0.9% of GDP at the

end of 2014, to reduce domestic borrowing and to lengthen the maturity profile of the

domestic debt by introducing three year nominal bonds and – in the medium term five year

bonds (MoFEA 2014). The implementation of the MTDS 20112014 was difficult due to fiscal

dominance and an underdeveloped domestic debt market. Heavy domestic borrowing

requirements gave rise to increasing interest rates and higher refinancing risks because of

high costs of lengthening maturities (see also Table 41).

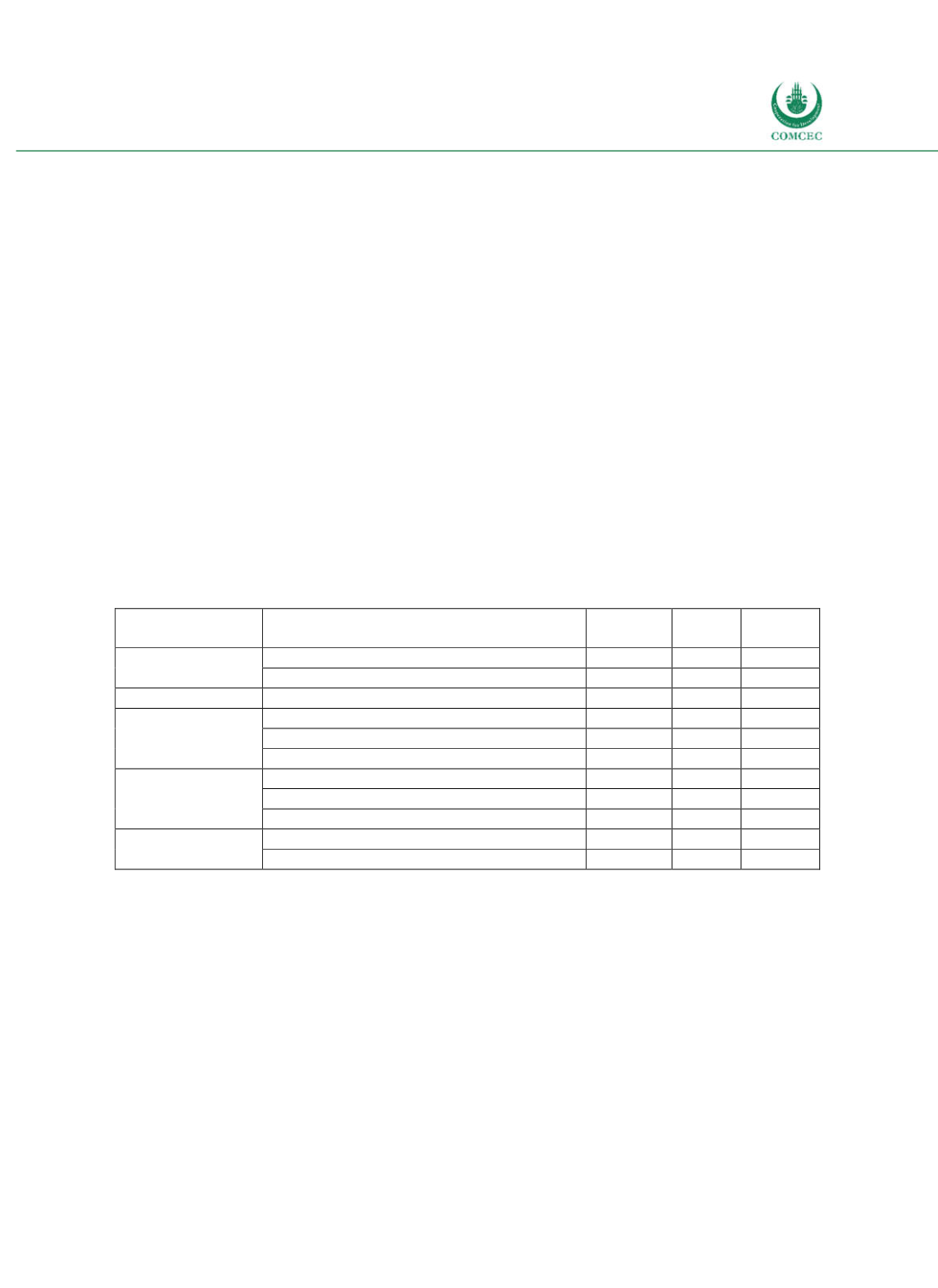

Table 4-1: Gambia – Cost and Risk Indicators for the Government's Debt Portfolio (2014)

Type of risk

Risk indicator

2010

Baseline

2014

Actual

2014

Targets

Solvency

Nominal debt as % of GDP

68.3 105.0 59.8

PV of debt as % of GDP

57.5

90.0 46.1

Cost of debt

Implied interest rate

5.3

6.0

5.2

Refinancing risk

ATM external portfolio (years)

13

11.1 15.4

ATM domestic portfolio (years)

3.8

2.6

4.6

ATM total portfolio (years)

9.1

7.5

12.6

Interest rate risk

ATR (years)

9.1

7.3

12.6

Debt refixing in 1 year (% of total)

34.2

40

15.4

Fixed rate debt (% of total)

100.0 97.1 100.0

Exchange rate

risk

FX debt (% of total)

57.0

57.9 72.7

ST FX debt (% of total)

8.9

15.7

8.4

Note: ATM = Average Time to Maturity; ATR = Average Time to Refixing; FX = Foreign exchange; ST = Short-term.

Source: MoFEA (2014).

The objectives of the MTDS 20152017 are to reduce public debt by decreasing NDB towards

1% of GDP and to increase external borrowings in particular from the concessional window

(MoFEA 2015). Based on three different shock scenarios, the risks of four different debt

management strategies are evaluated in the MTDS. The favored strategy envisions a

progressive reduction of the NDB to 2% of GDP in 2015, 1% of GDP in 2016 and zero

thereafter (MoFEA 2015). Domestic borrowing is financed at 100% by TBills and external

borrowing is a mixture of semiand concessional external borrowing. The MTDS 20152017

further discourages central bank financing as it creates inflationary pressure (MoFEA 2015).