Improving Public Debt Management

In the OIC Member Countries

178

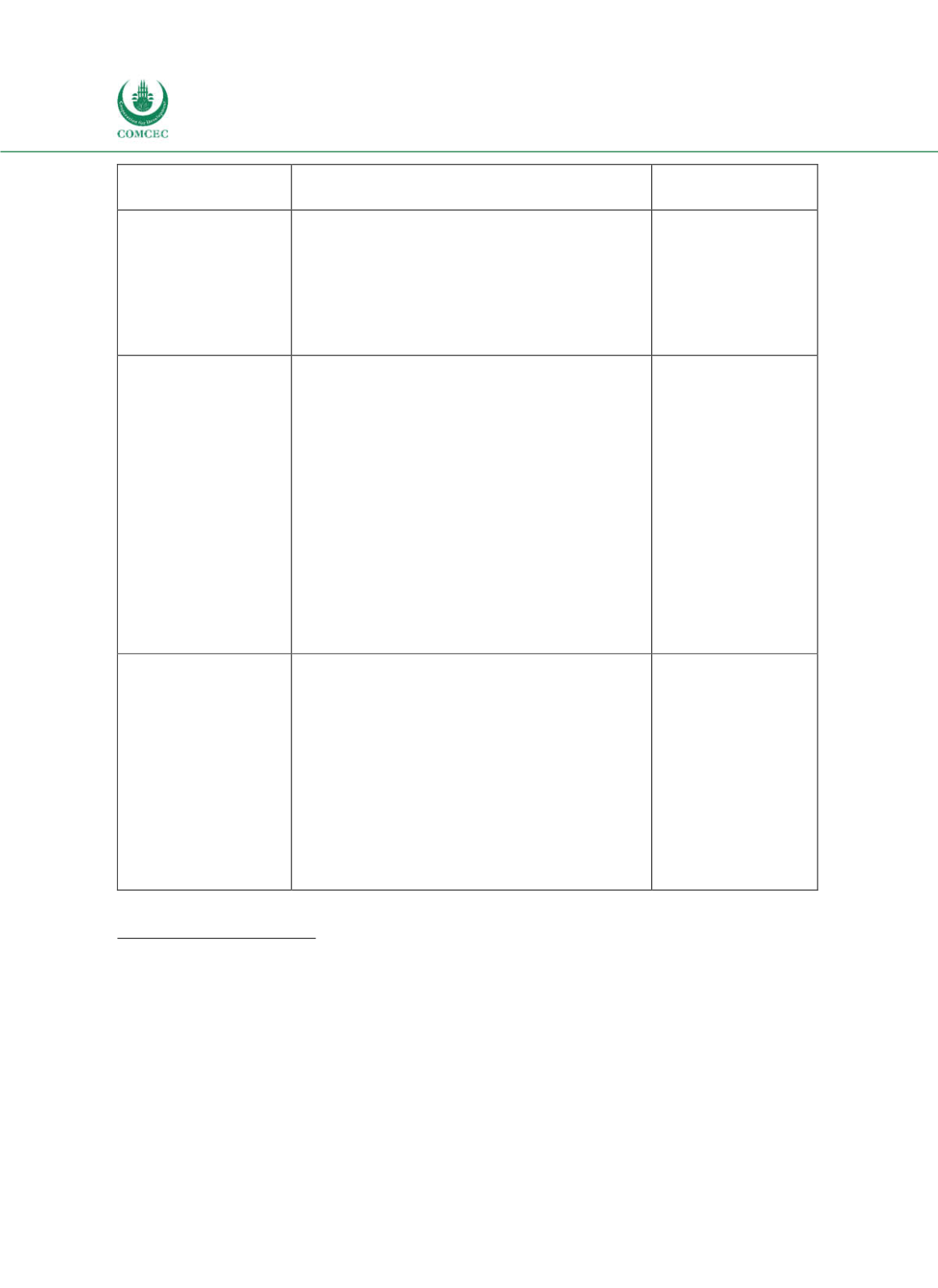

Area vulnerable to

obstacles

Challenges

Examples of

countries facing risks

-

Accountability may be ambiguous

DMOs may be dependent on political constraints

Lacking formal debt management strategy: MTDS and

numerical strategic targets are not yet implemented.

Risks: Difficulties in attracting foreign investors

(3) Domestic public

debt markets

Dependency on external borrowing caused by

underdeveloped domestic public debt market

Problems:

Insufficient market infrastructure, e.g. lack of

informational transparency

Immature secondary markets

Limited market size

Small investor base

Risks:

Limited diversification of investor base which

increases idiosyncratic risks

Increased dependency on global market conditions

affected by macroeconomic trends which are less

related to current countryspecific conditions

Afghanistan, Algeria,

Azerbaijan, Burkina

Faso, Comoros,

Djibouti, Gabon,

Guyana, Kyrgyz

Republic, Mali,

Mauretania,

Mozambique, Niger,

Senegal, Sierra Leone,

Sudan, Tajikistan,

Uzbekistan

(4) Debt structure

Short average maturity of public debt, especially

concerning debt held by the private sector

Risks:

Refinancing risk

Potentially harms further development of the

domestic debt market

Domestic banking sector holds great share of total

public debt

Risks:

Crowdingout of bank loans to the private sector

Albania, Bahrain,

Egypt, Gambia, Iran,

Lebanon, Kazakhstan,

Nigeria, Qatar, Saudi

Arabia, Syria, Togo,

Yemen

Specific Recommendations

The following main areas of improvement of public debt management in the OIC member

countries can be identified.

(1) Institutional framework of public debt management

In several OIC member countries the delineation of competences between different

institutions involved in public debt management remains vague. Especially the partial lack of

competence centralization at a DMO might prove to be challenging for further improving

public debt management functions. Moreover, 38% of OIC member countries have not yet

developed a specified MTDS according to international standards. Among the OIC member