Improving Public Debt Management

In the OIC Member Countries

177

market, and the relative costs of borrowing at home and abroad. Likewise, a longer maturity

structure reduces the refinancing risk, but entails higher costs on average.

Islamic sovereign bonds (

sukuk

) are likely to gain greater popularity in OIC as well as nonOIC

countries. An important factor is the growing preference for

sharia

compliant finance products

by important international investors such as state funds. Moreover, the issuance of

sukuk

bonds can serve market development purposes by diversifying domestic capital markets and

attracting new (international) investors that wants to invest in sharia compliant financial

instruments from all over the world. Investors can also benefit from new sovereign

sukuk

issuances due to additional opportunities to diversify their portfolios. Hence, several OIC

member countries are planning to issue new sovereign

sukuk

or expand their already existing

portfolio. Infrastructure projects are especially suitable as underlying structures for sovereign

sukuk

given the assetbacked design of these bonds. In several Islamic markets, funding gaps

for infrastructure projects exist. Pairing the expected rise in infrastructure investments in

developing and emerging countries with the important role Islamic banking is playing in many

of these markets,

sukuk

issuances related to infrastructure are expected to further increase.

However, it should be noted that Islamic finance instruments do not necessarily minimize

financing costs as they often involve additional administrative expenses and greater legal and

accounting challenges. The limited tradability, the comparatively high issuance costs and the

rather small volume of existing

sukuk

may constrain market liquidity and hence a

government’s flexibility in conducting and financing fiscal policy measures. Hence, the issuance

of such bonds comes with both, risks and benefits. Overall, OIC member countries are

encouraged to assess their country's potential for issuing such bonds and (further) integrate

Islamic finance instruments into their public debt management practices, if possible.

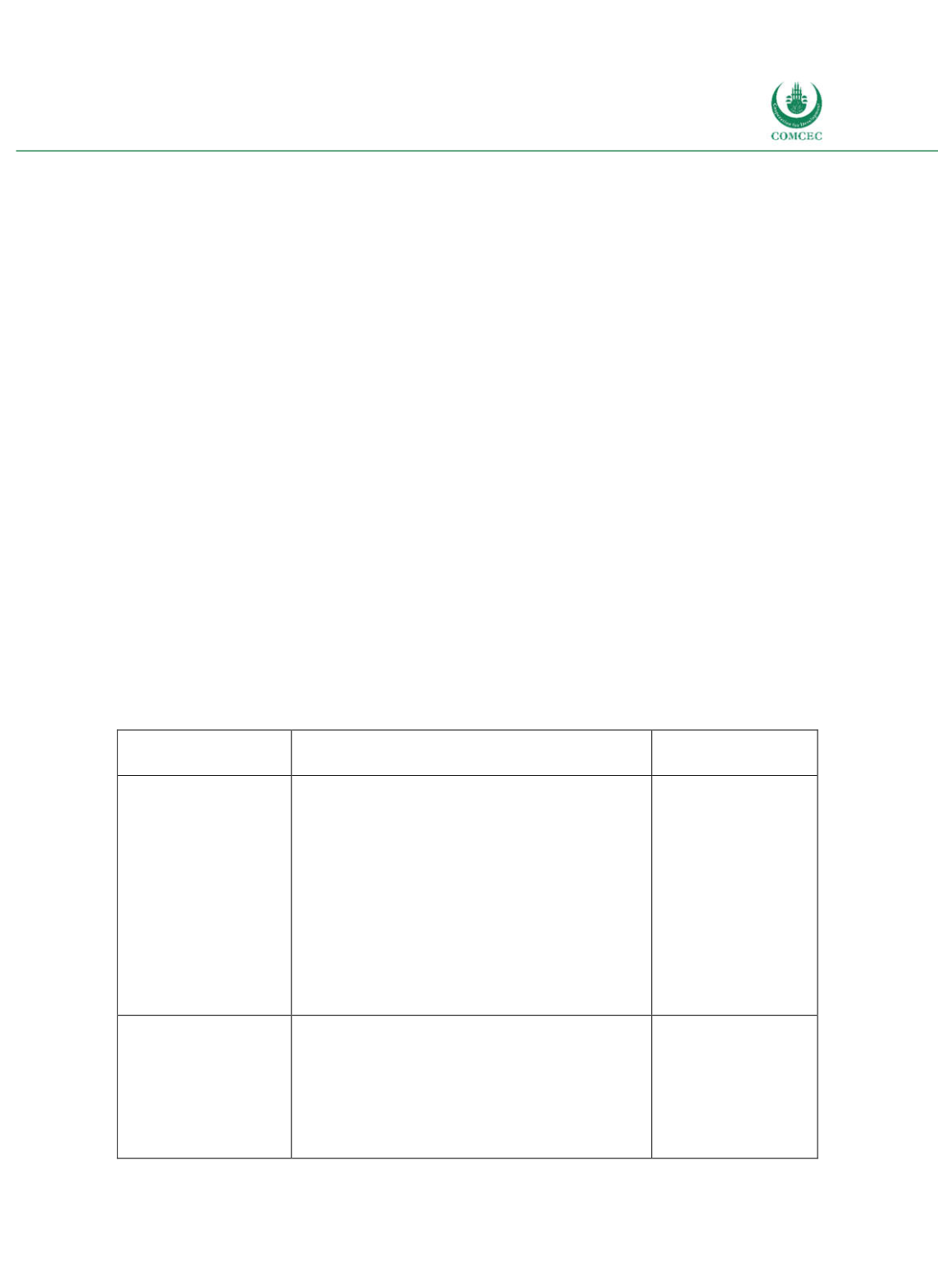

Table 51 summarizes the main challenges and obstacles of public debt management in OIC

member countries.

Table 5-1: Challenges and Obstacles to Public Debt Management

Area vulnerable to

obstacles

Challenges

Examples of

countries facing risks

(1) Outside incidents

Macroeconomic shocks might affect the structure of

public debt.

Risks:

Exchange rate risk due to debt denoted in foreign

currency with rising interest rate

Higher refinancing risk for countries with short

maturity of debt and high annual debt rollover rate

Interest rate risk increases for debt held by the

private sector if adverse economic shocks occur

Risk enhanced by strong economic dependency on

exogenous variables, e.g. prices for natural

resources

Gambia, Mozambique,

Togo, Uganda, Sudan,

Saudi Arabia, Nigeria

(2) Institutional

framework

Coordination and responsibility issues concerning

public debt management

Risks:

Unclear institutional responsibilities for public debt

management

-

Information flow between the institutions may

not be ideal

Azerbaijan, Bahrain,

Chad, Kazakhstan,

Malaysia, Oman, Saudi

Arabia, Sudan, United

Arab Emirates