Improving Public Debt Management

In the OIC Member Countries

183

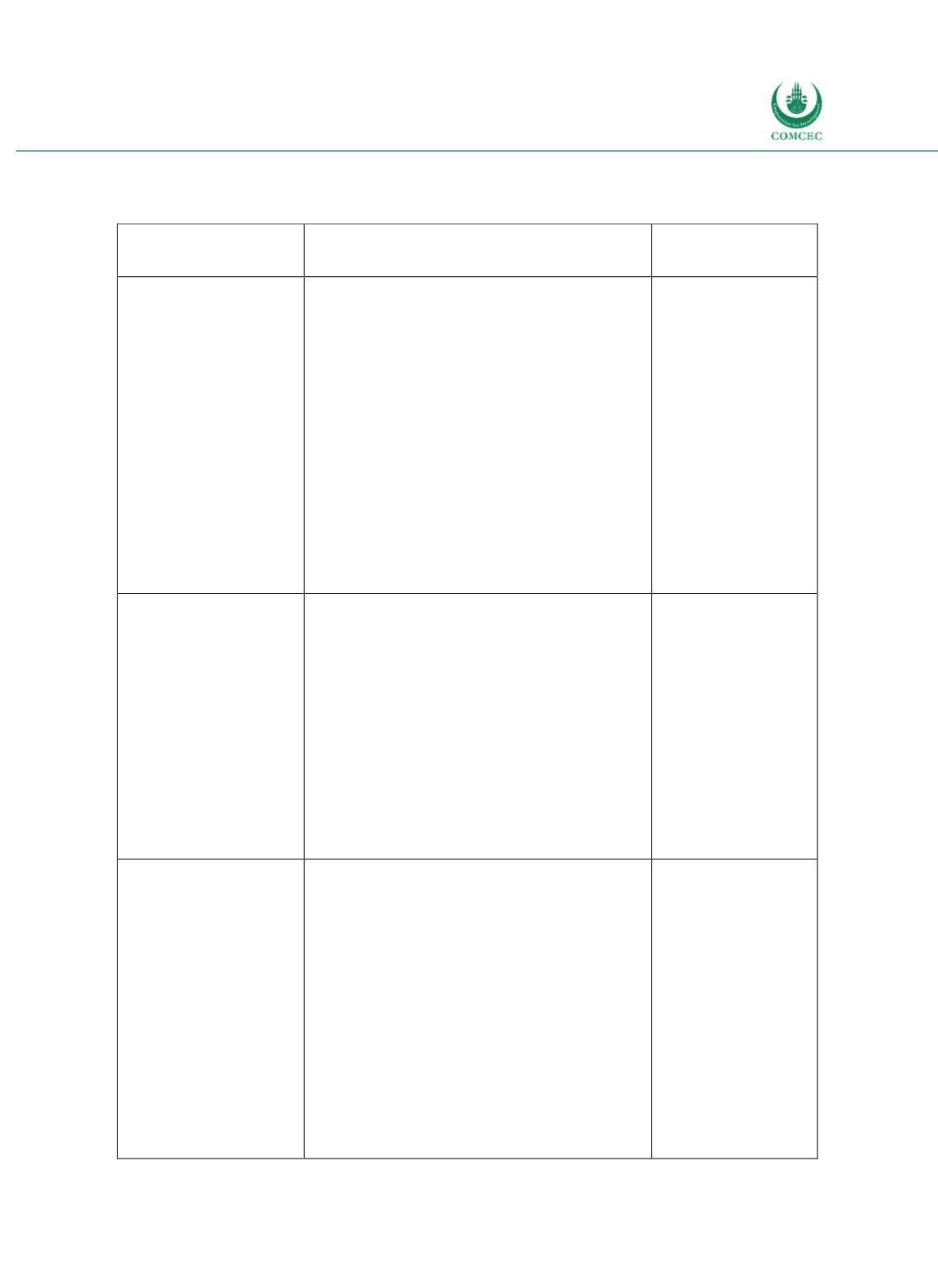

Table 52 summarizes the policy recommendations.

Table 5-2: Summary of Policy Recommendations

Area of improvement

of public debt

management

Policy recommendation

Examples of

countries concerned

(1) Institutional

framework

Indicators:

No centralized debt

management unit

No formal debt

management strategy

Low transparency

Strengthen the institutional framework of public

debt management.

Measures:

Creating centralized DMOs

Central bank independency

Developing MTDSs including (numerical)

strategic targets

Improving public disclosure on

Debt data and debt reports

Information on issuance procedures

Debt management strategy

Workshops within COMCEC might be useful to

bring OIC member countries together for

developing solutions of public debt management

problems according to their diverse experiences.

Azerbaijan, Bahrain,

Chad, Kazakhstan,

Malaysia, Oman, Qatar,

Saudi Arabia, United

Arab Emirates

(2) Strong reliance on

external borrowing/

underdeveloped domestic

debt markets

Indicator:

High share of external

debt in total debt

Develop the domestic debt market.

Measures:

Improving legal and regulatory frameworks

Establishing a reliable public debt management

strategy

Improving the dissemination of information on

debt operations

Adopting transparency in primary auctions and

developing secondary markets

Converting foreign grants into longterm

domestic currency bonds

Information exchange within COMCEC on

problems in the domestic debt market.

Afghanistan, Algeria,

Azerbaijan, Burkina

Faso, Comoros,

Djibouti, Gabon,

Guyana, Kyrgyz

Republic, Mali,

Mauretania,

Mozambique, Niger,

Senegal, Sierra Leone,

Sudan, Tajikistan,

Uzbekistan,

(3) Strong reliance on the

domestic banking sector/

risk of crowdingout of

private credit

Indicator:

High share of domestic

debt in total debt

Broaden and diversify the creditor base.

Measures:

Granting pension funds, insurance companies,

retail investors and foreign investors access to

the domestic debt market

Attracting foreign investors by issuing e.g.

Eurobonds and

sukuk

Balance between domestic and foreign borrowing

Fruther development of the sukuk bond market as

well as additio al consideration of the financial

debt structure

Information exchange within COMCEC on the

issuance of different types of bonds such as

Eurobonds and

sukuk

Bahrain, Egypt,

Gambia, Iran,

Kazakhstan, Lebanon,

Nigeria, Qatar, Saudi

Arabia, Syria, Yemen