Improving Public Debt Management

In the OIC Member Countries

131

Evaluation of an additional Eurobond issuance, which might have positive spillovers on

domestic and external financing conditions thanks to the buildup of a positive reputation

Contribute to further develop the domestic securities market

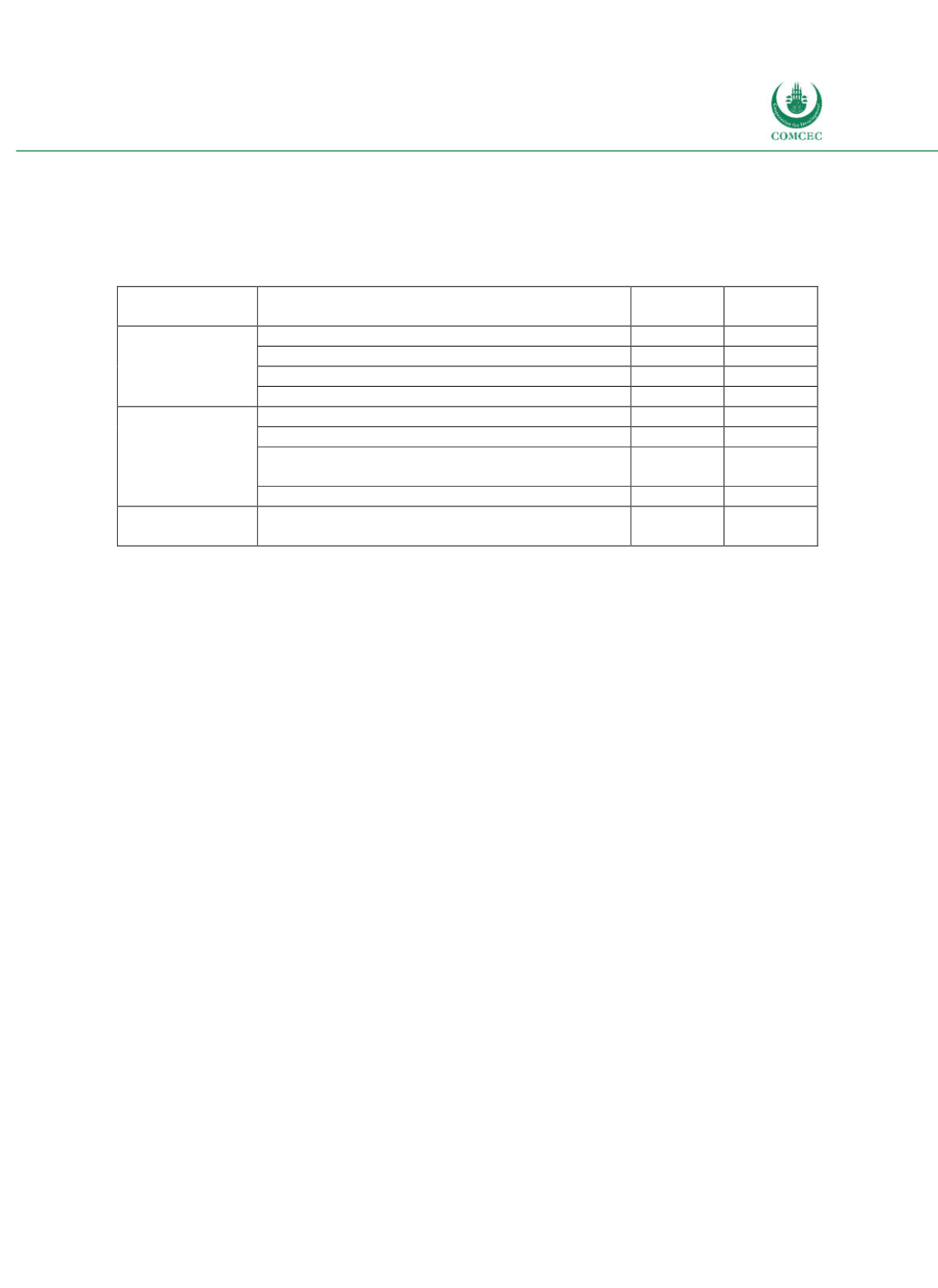

Table 4-10: Albania – Cost and Risk Indicators for the Government’s Debt Portfolio (2015)

Risk type

Risk indicator

Indicator

2015

Objective

(2018)

Refinancing

risk

ATM of domestic debt (in years)

2.0

Min. 2.2

ATM of total debt (in years)

4.9

Min. 4.7

Domestic debt matured in 1 year (% of total)

55.9 Max. 46.0

Total debt matured in 1 year (% of total)

31.6 Max. 26.0

Interest rate

risk

ATR of domestic debt

1.8

Min. 2.0

ATR of total debt

3.2

Min 3.0

Domestic debt reevaluated within 1 year (% of

total)

67.7 Max. 60.0

Total debt reevaluated within 1 year (% of total)

58.1 Max. 55.0

Exchange rate

risk

FX debt (% of total)

48.5 50.055.0

Note: ATM = Average Time to Maturity; ATR = Average Time to Refixing; FX = Foreign exchange; ST = Short-term.

Source: MoF (2016b).

During 2015, debt management successfully engaged in operations to increase the maturity of

public debt (MoF 2016b): first, it focused on the issuance of longterm bonds (7year and 10year bonds). Second, it actively repurchased bonds of low remaining maturities. Concerning

foreign debt, the issuance of a €450 million fiveyear Eurobond in November 2015 and donor

financing with the IMF and the World Bank have lowered rollover risk in the near future.

Debt management, however, missed its target for the currency composition of debt according

to which debt denoted in domestic currency should make up at least 55% of total debt.

However, the reliance on foreign debt enabled Albania to further decrease refinancing and

interest rate risks because foreign markets provide financial resources at longer maturities

than domestic markets. This highlights the tradeoff between the different risk categories.

Moreover, given the narrow domestic investor base, refinancing on international markets

might be favourable for the domestic economy. It prevents that government drains domestic

financial resources and makes it easier for private domestic investors to get their projects

financed locally.

While the average maturity of outstanding debt amounts to 4.9 years, there is an important

difference between domestic and foreign debt: the average maturity of domestic debt equals

two years, while foreign debt has an average maturity of 8.1 years. The share of longterm debt

(debt with a maturity exceeding two years) has increased steadily in recent years (see Figure

427). During 2015, the average maturity of domestic debt increased by 0.2 years and that of

foreign debt by 0.5 years.

During 2015, the share of debt with fixed interest rates has slightly decreased to 68.2%. The

entire domestic debt is contracted at market interest rates, whereas foreign debt is equally

divided between debt at market rates and debt at concessional terms.