Improving Public Debt Management

In the OIC Member Countries

132

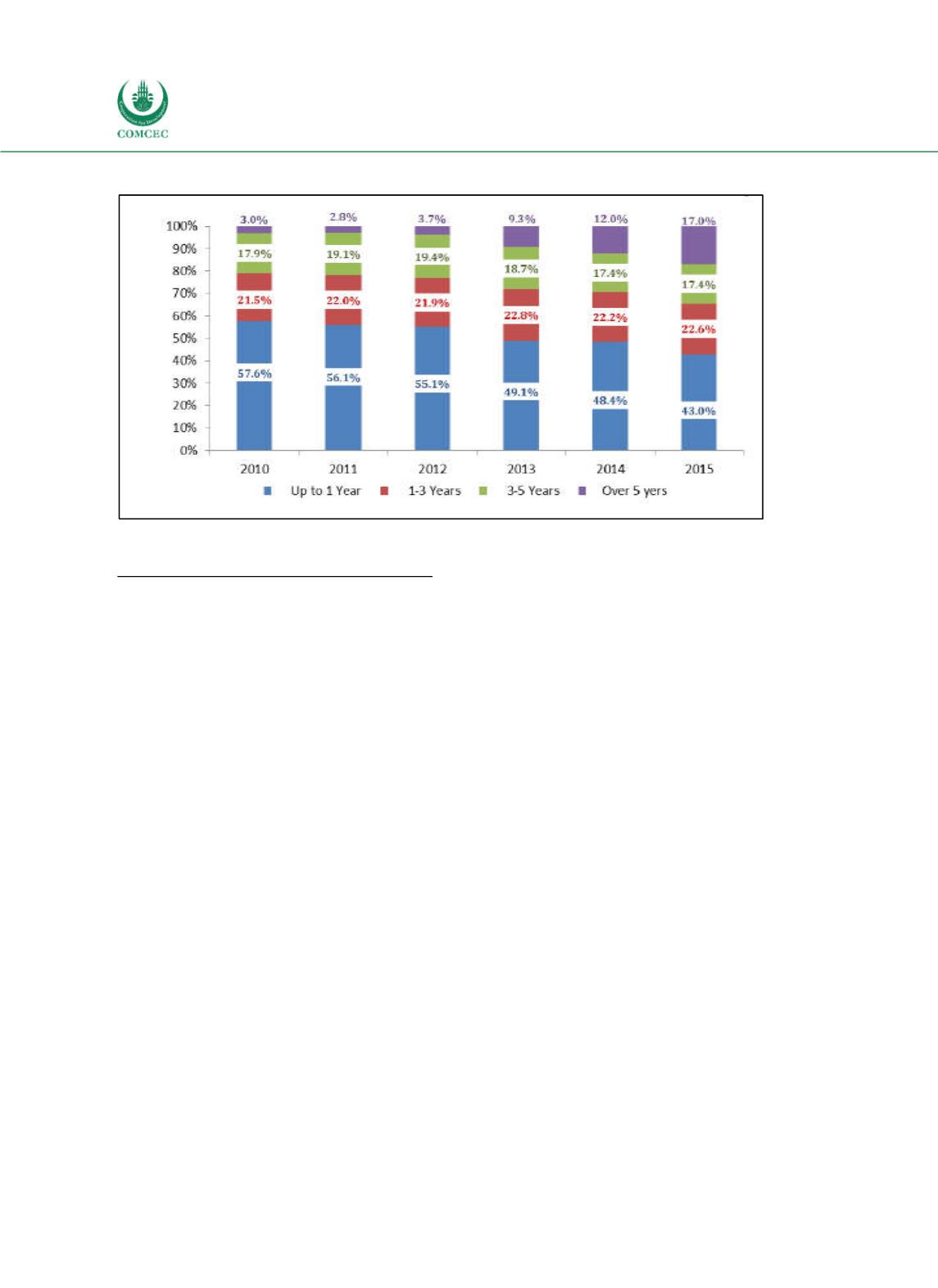

Figure 4-27: Albania – Public Debt Composition by Instrument Maturity

Source: MoF (2016a).

Borrowing and Related Financial Activities

Operations (incl. Islamic finance)

Borrowing in the domestic market is undertaken by issuance of sovereign bonds in domestic

currency through an auction process managed by the Bank of Albania, which acts as an agent

for the MoF. The government issues bonds with a variety of maturities: TBills with zero

coupons are issued for three, six, nine and twelve months. Couponbearing TBonds exist for

maturities of two, three, five, seven and ten years. Only 5year bonds have a floating interest

rate, which is annually reset depending on market conditions.

The Albanian banking system is characterised by the dominance of subsidiaries of EUbased

banking groups: in 2015, of a total of 16 commercial banks nine were linked to EUbased

banks. According to the World Bank (2014b) only one bank is classified as an Islamic bank: the

United Bank of Albania is owned by a SaudiArabian financial institution.

For public finances sovereign

sukuk

seem to play no role so far. Official documents like the

current MTDMS (MoF 2016a) do not mention

sukuk

financing as an option. In its Stability

Report, loan agreements with other Islamic countries did not meet the conditions for Islamic

banking and were not

sharia

compliant. An example is a loan contract with the Saudi Arabian

fund for development, which in 2011 agreed to lend $25 million to the Albanian government

for the construction of a highway. Interest payments were part of the contract.

Domestic debt market

At the end of 2015, general government debt had the following characteristics: 52.8% was

domestic liabilities, whereas 47.2% was external debt (see Figure 426). While domestic debt

was held entirely in tradeable instruments, only 13.4% of external debt was tradeable in

international markets. The major part of external debt consists of loans for development

projects, budget support by the IMF and the World Bank as well as liabilities guaranteed by the

World Bank, which are not traded on financial markets.