Improving Public Debt Management

In the OIC Member Countries

133

The share of government debt denoted in domestic currency amounts to 51.4%. It decreased

by 5.5 percentage points during 2015. While domestic debt is mostly denoted in domestic

currency (97.2%), external debt is entirely denoted in foreign currencies. Among foreign

currencies, the Euro is dominant making up 70% of foreign currency debt. This concentration

on the Euro is motivated by the relative stable exchange rate between the Albanian Lek and

the Euro, the intensive trade links with the Euro area and Albania’s plan to become a member

of the EU.

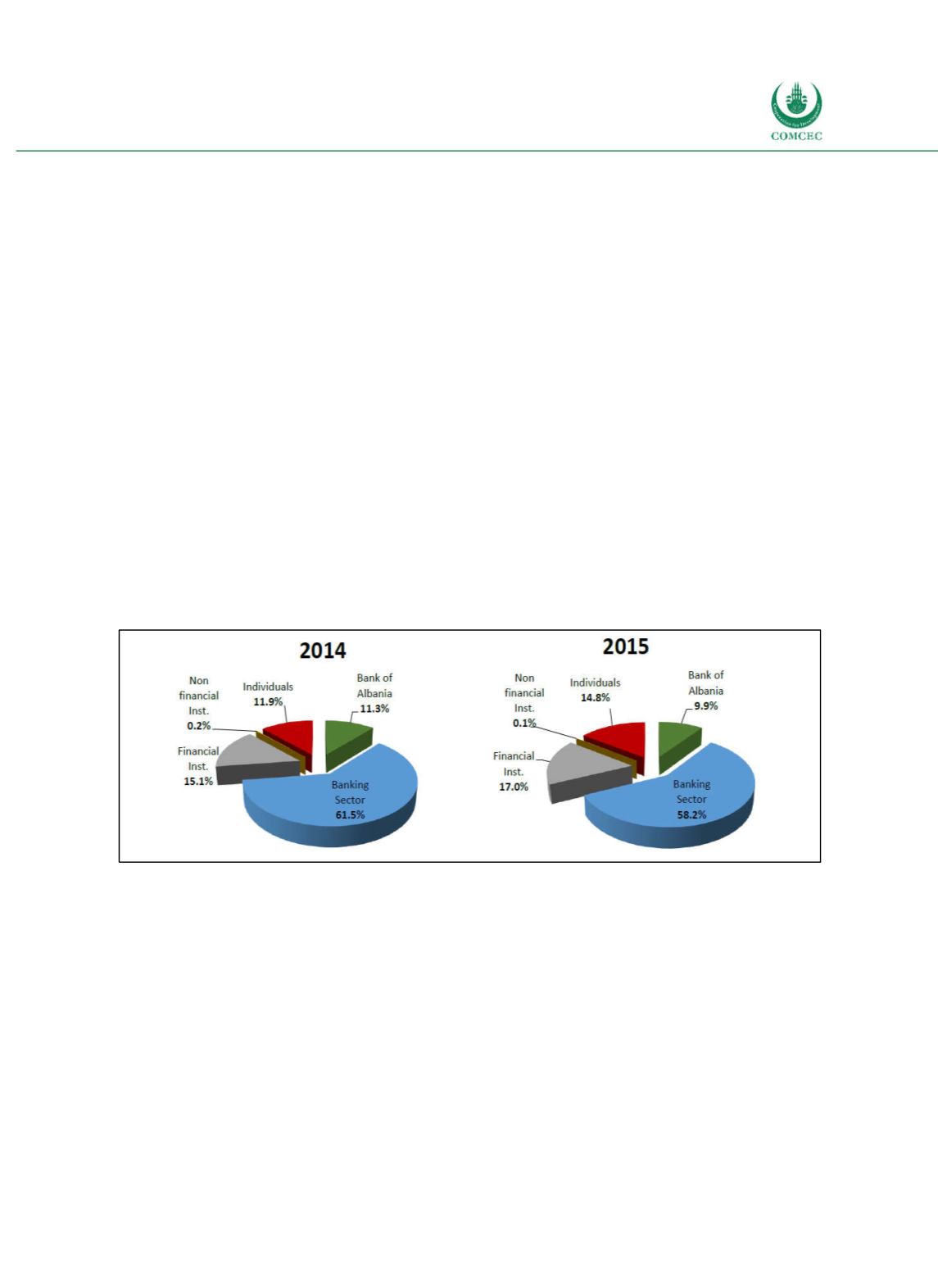

Albania has a functioning, albeit narrow domestic debt market. Government securities

auctioned in 2015 were bought by the banking sector (50.3%), the Bank of Albania (20.1%),

individuals (15.5%), financial institutions (13.5%) and nonfinancial institutions (0.7%). The

concentration of securities in the banking sector reflects the narrow investor base. Moreover, a

secondary market for government securities is missing. Compared to 2014 these numbers

show a tendency towards the intended diversification: While the share of the banking sector

has decreased, individuals and nonfinancial institutions have become more important players.

Figure 428 shows the breakdown of outstanding debt between types of holders. The figures of

outstanding debt and new purchases, show that the lower share of the banking sector in new

purchases is covered by a larger share of the Bank of Albania. This indicates that the Bank of

Albania has become a more important player on the market for government securities. An

important question is however whether these transactions are motivated by monetary policy

or by government financing needs.

Figure 4-28: Albania – Creditor Structure of Domestic Public Debt

Source: MoF (2016a).

Foreign borrowing

External public borrowing has consisted of multilateral and bilateral official credits, syndicated

bank borrowing and Eurobonds. Among the most important multilateral creditors have been

the World Bank, the European Bank for Reconstruction and Development, the European

Investment Bank, the Council of Europe Development Bank and the Islamic Development Bank.

Official credits have been the government’s preferred source of external financing because of

its concessional nature. These generally have been related to a reform programme. The most

important bilateral creditors have been Germany (through KfW Development Bank), Italy and

Austria. In 2010, Albania issued its maiden Eurobond amounting to €300 million. Before

entering the Eurobond market some prerequisites had to be fulfilled – including the existence

of a sovereign credit rating – such that the first Eurobond issuance was considered an

important step in accessing external financial markets.