Improving Public Debt Management

In the OIC Member Countries

110

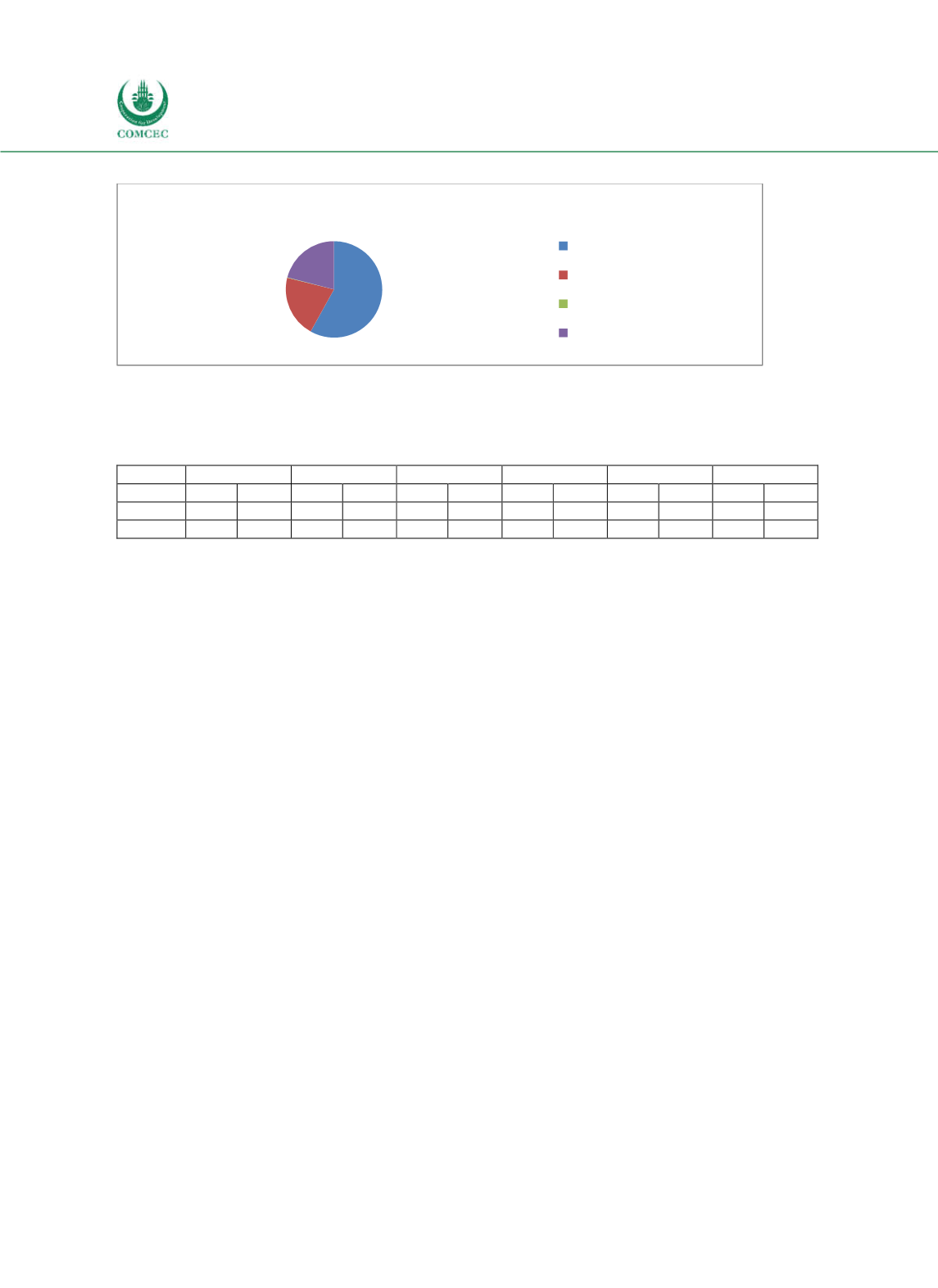

Figure 4-17: Indonesia - Structure of Central Government Debt by Instrument

Source: MoF (2017b)

The change in structure is detailed in Table 48 below.

Table 4-8: Indonesia - Outstanding Central Government Debt 2011-2016 (in billion USD)

2011

2012

2013

2014

2015

2016

a

Loans

68.5 34% 63.0 31% 58.7 30% 54.5 26% 54.6 24% 54.2 21%

Securities

131.0 66% 138.9 69% 136.5 70% 155.2 74% 174.2 76% 202.2 79%

Total

199.5 100% 201.9 100% 195.2 100% 209.7 100% 228.8 100% 256.4 100%

Source: Directorate General of Budget Financing and Risk Management (2016b, p. 20)

a

: provisional figures, refer

to 31 December 2016.

Table 48

shows that while loans have only slightly increased in nominal terms, the

accumulating debt has been financed largely by an increase in securities. The structure of the

loans explains why: out of the 733 trillion IDR ($54.2 billion) loans outstanding at the end of

2016, 728 trillion IDR ($53.8 billion) were external; of that amount 313 trillion IDR ($23.1

billion) were bilateral loans with Japan accounting for almost two thirds thereof. 370 trillion

IDR ($27.4 billion) were multilateral loans, of which the World Bank held 63%, the Asian

Development Bank 34%, and the Islamic Development Bank 1.3%. Only 45.6 trillion IDR ($3.4

billion) were held by commercial banks, and 5 trillion IDR ($0.4 billion) by suppliers

(Directorate General of Budget Financing and Risk Management 2016b, p. 24 and personal

communication). In other words, the bulk of loans consist of bilateral or multilateral

intergovernmental loans, partly under concessionary terms, which cannot accommodate the

growing needs to finance rising budget deficits.

65% of all securities are IDR denominated and tradable, 9% are nontradable, and 26% are

foreign currency denominated and tradable. In the latter category, 88% are dollar

denominated, the rest is split between Yen and Euro. The increasing use of securities has made

Indonesia less reliant on a few international institutions and governments as multilateral and

bilateral creditors and thus has reduced political risk; at the same time it has made debt

financing more responsive to market forces and international sovereign credit ratings.

Sharia government securities have been issued since 2008 on the basis of Law No. 19/2008.

Following the Ministry of Finance Regulation 206/PMK.01/2014, the Directorate of Shariah

Financing has been established within the DGBFRM. Sharia bonds are issued in the domestic

market including the retail market, but also as

Global Sukuk

denominated in foreign currency.

Since May 2015 the

Global Sukuk

has been listed at the Dubai NASDAQ exchange (Directorate

General of Budget Financing and Risk Management 2015). The Islamic Government Bonds

(

Surat Berharga Syariah Negara, SBSN

), including a number of subgroups such as the

Indonesian Haj Funds Sukuk (

Sukuk Dana Haji Indonesia, SDHI

) or Islamic Treasury Bills (

Surat

Perbendaharaan Negara-Syariah

), account for % of all government securities or almost 12% of

149.9

53.57 0.38 54.19

in billion US $ equiv. , as of 31.12.2016

Gov. Securities, domestic

Gov. Securities, external

Loans, domestic

Loans, external