Improving Public Debt Management

In the OIC Member Countries

108

Debt management strategy (incl. risk management)

Two documents lay out the debt management strategy: the MediumTerm Debt Management

Strategy document and Annual Debt Financing Strategy document. The MediumTerm Debt

Management Strategy for the period 20142017 was detailed in Ministry of Finance Decree no.

113/2014 dated 23. April 2014 and has been published as Directorate General of Debt

Management (2014). The annual debt management document is issued by a decree of the

Director General of Budget Financing and Risk Management and has been published since

2014.

Debt management has to make three fundamental choices, after the decision on budget size

and the financing of the budget through taxes, nontax revenue and debt has been made, i.e. the

size of the budget deficit has been determined. The first central choice pertains to the currency

denomination of the debt issued. Foreign currency debt (mostly global bonds) is less

expensive, the market is more liquid than the domestic market for government debt, and

foreign borrowing prevents a possible crowding out in the domestic bond market. Yet,

increased foreign currency exposure increases the exchange rate risk; in particular if the

exchange rate depreciates the domestic value of the debt is increased. The mediumterm debt

financing strategy targets for the issuance of new debt a foreign currency share of 25% for the

years 2015 to 2017 with a priority of dollar denominated loans and securities (Directorate

General of Debt Management 2014, p. 22).

The second central choice is what share of newly issued debt instruments should have fixed

interest. Obviously, the fixed interest rate debt makes calculation of future debt obligations

easier and thus reduces interest rate risk; yet this often comes at the cost of higher interest

rates. Variable interest rate debt is cheaper in times of declining interest rates; however the

demand for variable rate debt is lower and its secondary market is less liquid. At the end of

2015, the coupon on tradable (fixed interest) government securities was 8.69% while the

variable rate securities had an interest rate of 5.71% (Directorate General of Budget Financing

and Risk Management 2015, p. 47 and personal communication). The shares of new debt with

fixed interest targeted in the

State Debt Management Strategy 2014-2017

are 95.5% for 2015

and 94% for 201617.

The third central choice relates to the maturity structure of public debt. The maturity structure

indicates the refinancing requirement at any point in time and thus the need to issue new debt

beyond the current budget deficit. Alternatively, the maturity structure can be altered through

debt switching and buyback operations, both of which the Ministry of Finance undertakes.

The

State Debt Management Strategy 2014-2017

stipulates the share of new debt with tenors

up to three years not to exceed 15% for the period 201517.

While the above targets refer to the issuance of

new

debt, the mediumterm strategy document

also stipulates goals for the overall debt portfolio (Directorate General of Debt Management

2014, p. 22, Table 4.2). They are reported in Table 46 below:

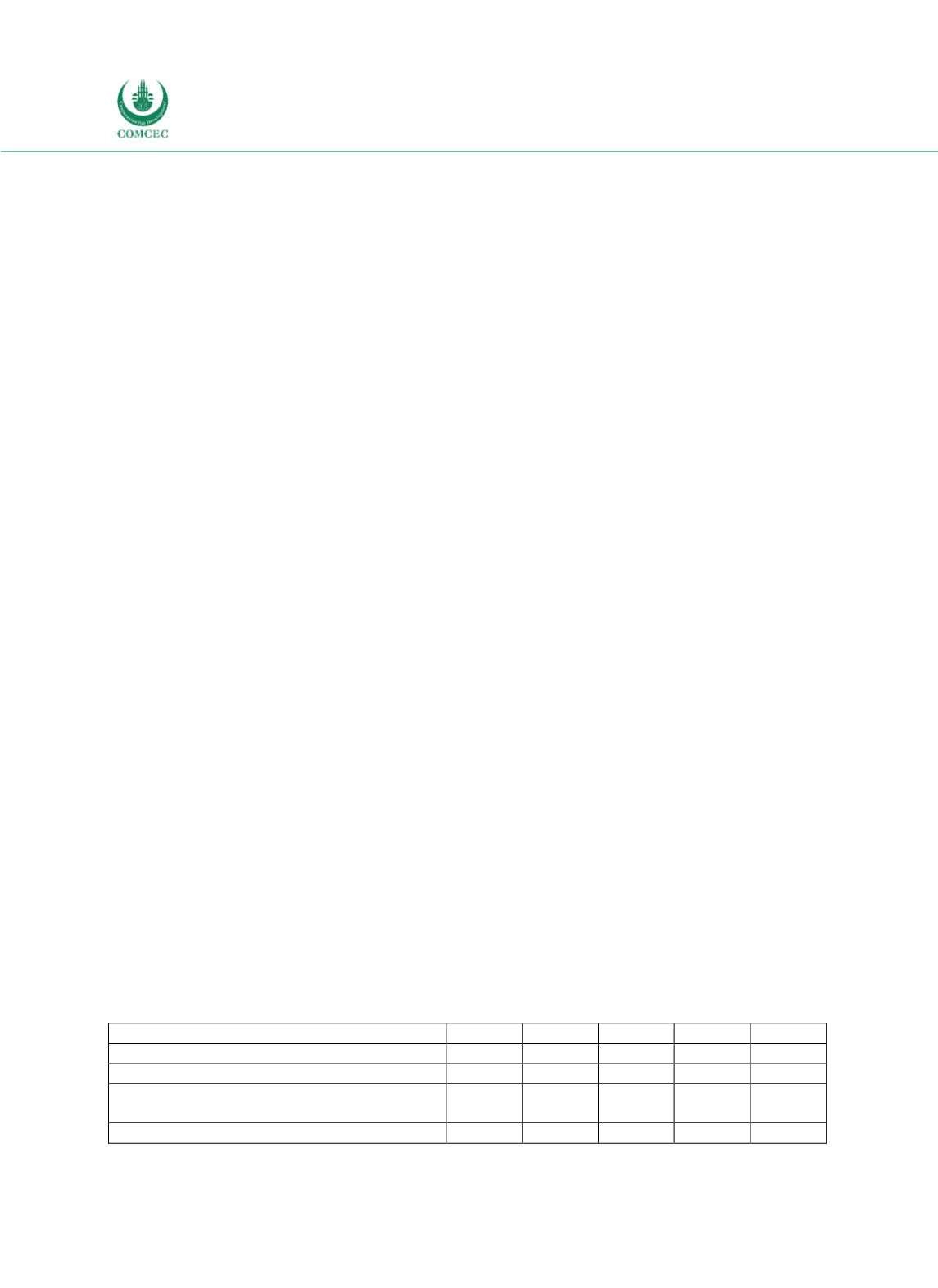

Table 4-6: Indonesia - Target indicators for debt portfolio risk

Target Indicator

2014

2015

2016

2017

Range

FX Debt to Total Debt Ratio (%)

42.0

41.0 40.0

39.0 ± 2.0

Fixed Rate Debt to Total Debt Ratio (%)

86.0

87.0 88.0

89.0 ± 2.0

Debt Mature in 3 Years to Total Debt Ratio

(%)

22.0

22.0 22.0

22.0 ± 2.0

Average Time to Maturity (ATM) (yr)

9.5

9.5

9.0

9.0

± 0.5

Source: Directorate General of Debt Management 2014, Table 4.2.