Improving Public Debt Management

In the OIC Member Countries

109

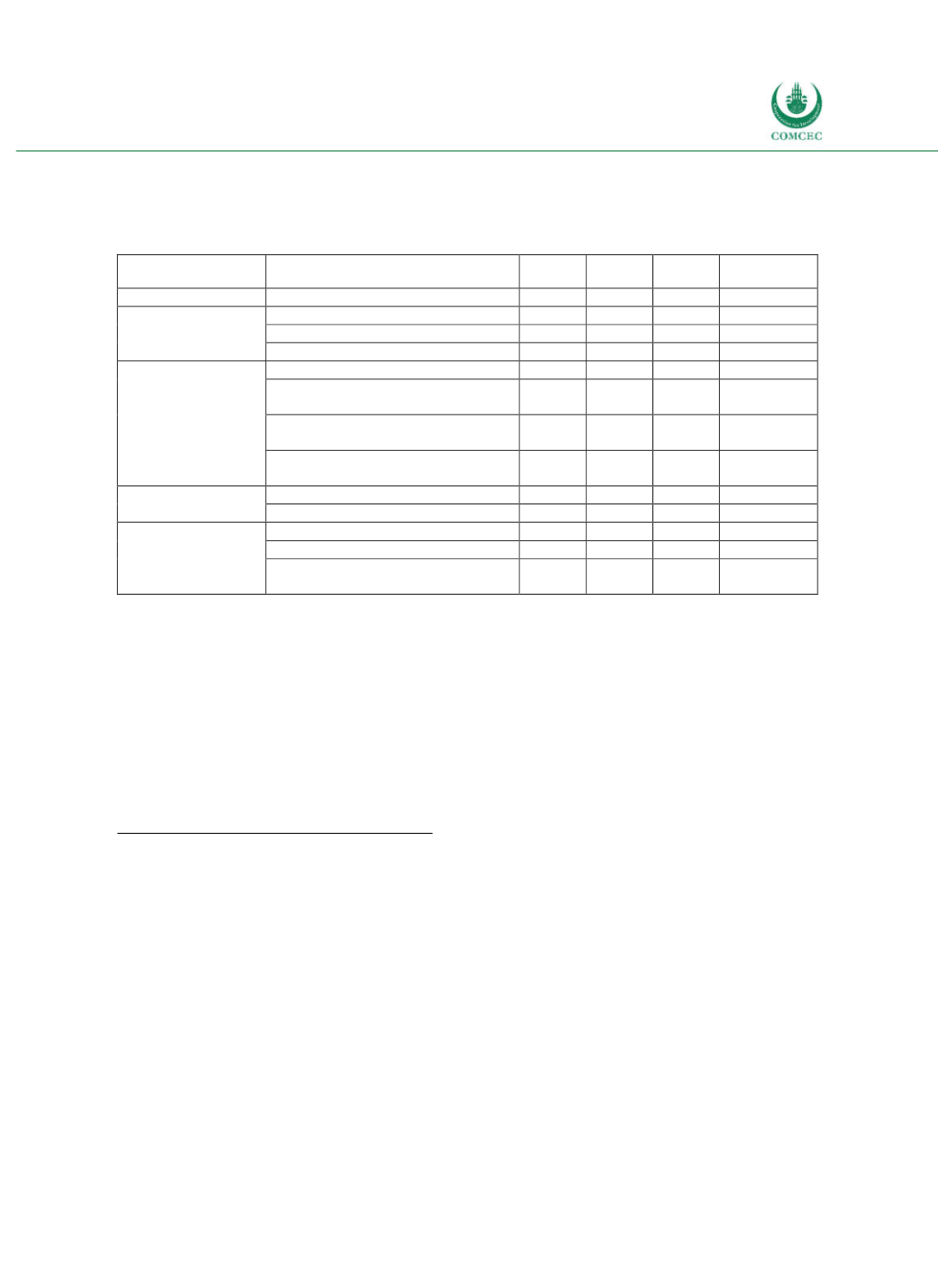

The actual values for these and related indicators for the three major risk types – exchange

rate risk, interest rate risk and refinancing risk – as well as the cost of debt are detailed in

Table 47 below.

Table 4-7: Indonesia - Cost and Risk Indicators of the Government’s Debt Portfolio

Type of risk

Risk indicator

2011

2014

2015

Nov 2016

(provisional)

Solvency

Debt (% of GDP)

23.1 24.7 27.4

27.7

c

Cost of debt

Interest payments (% revenues)

7.5

8.4

9.9

10.2

a

Interest payments (% total debt)

5.2

5.3

5.2

5.0

Interest payments (% of GDP)

1.2

1.3

1.4

b

1.5

c

Refinancing risk

ATM total debt (years)

9.32 9.73 9.40

9.02

d

Debt maturing in less than 1 year

(% of total)

8.2

7.7

8.4

6.6

d

Debt maturing in less than 3 years

(% of total)

22.7 20.1 21.4

23.0

x

Debt maturing in less than 5 years

(% of total)

34.6 33.9 34.7

36.5

d

Interest rate risk

Variable rate ratio

18.8 14.8 13.7

12.3

d

Refixing rate

25.9 21.0 20.7

17.5

d

Exchange rate risk

FX debt (% of total debt)

45.1 43.4 44.5

41.8

d

FX debt (% of GDP)

10.4 10.7 12.2

11.6

External debt interest (% total

interest payments)

29.2 11.2 9.4

b

9.8

c

Note: ATM = Average Time to Maturity; FX = Foreign exchange;

a

: third quarter 2016,

b

: provisional,

c

: based on

budget projections for 2016.

d

:

based on realization at 31 December 2016

Source: Directorate General of Budget Financing and Risk Management 2016b, pp. 33, 42, 46, 47.

Four shortterm trends are discernible. In the past five years, debt levels have increased in

overall values, but also significantly as a share of GDP (see above). In 2011 overall debt stood

at 23.1% of GDP and is now 27.7%. The cost of debt has thus risen in this period accordingly

from 1.2% of GDP to 1.5%. Refinancing risk has largely been unaltered; the term structure of

the debt seems solid. Interest rate risk has been reduced substantially, which may in part

explain the increase in the cost of debt. The share of external debt in total debt has decreased

while the amount of external debt as a share of GDP has slightly increased.

Borrowing and Related Financial Activities

Operations (incl. Islamic finance)

The government finances its debt through loans and securities. As of December 31

st

2016,

loans make up 21% of total government debt, while 79% are in securities. Basically all loans

are from foreign creditors, while around three quarters of the securities are sold domestically.

This is detailed in Figure 417. The structure of the debt has shifted substantially from loans to

securities in the past; in 2011 one third of the central government debt was still in loans.