Improving Public Debt Management

In the OIC Member Countries

103

(Alexbank 2015). Private banks and foreign bank branches hold about 29% of the TBills.

Regarding TBonds, 75.1% are held by banking institutions. High interest rates on government

debt and preferences for safe lending reduce the incentives of banks to provide credit to the

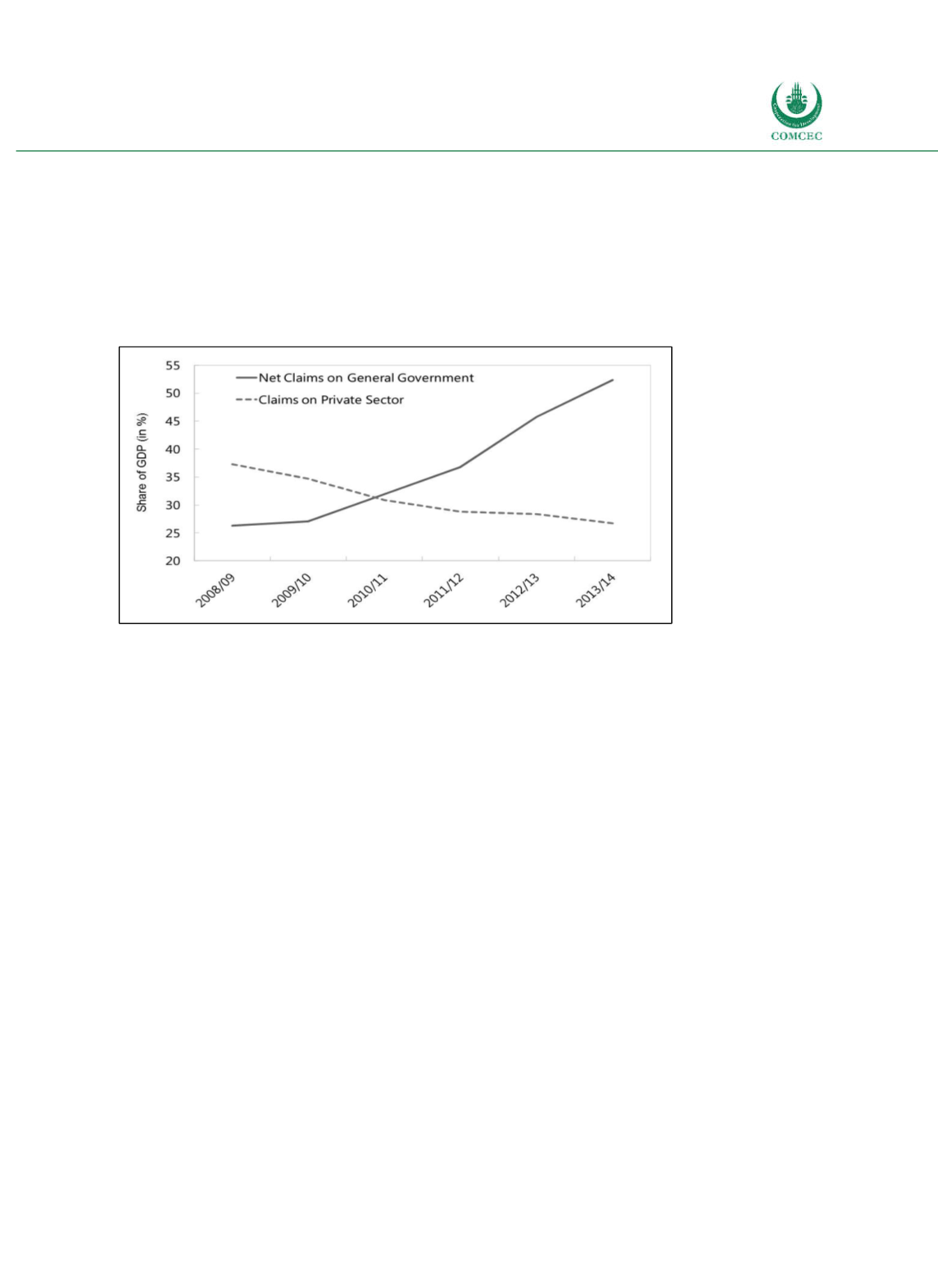

private sector, leading to a crowdingout of bank loans to the private sector. While net claims

on the general government have steadily increased since 2009, claims on the private sector

have declined (see Figure 415). Banks tend to invest in instruments with shorter maturities

to avoid asset and liability mismatches with shortterm bank deposits.

Figure 4-15: Egypt - Credit to the Economy

Source: IMF (2015, p. 10).

To improve the domestic debt market the government is carrying out several reforms. On the

primary market a new issuance strategy is being developed, Floating Rate Notes (FRNs) will be

reintroduced and investments banks will be included as primary dealers. On the secondary

market, the government is establishing new electronic trading and auction platforms,

constructing an official yield curve for government securities, using market mechanisms such

as Repos and ShortTerm Liquidity Facilities, and including market players such as nonprimary dealer banks and bond dealers. Furthermore, the Primary Dealers Decree reviews the

code of conduct (duties and incentives) and market making activities, and quotes obligations.

Foreign borrowing

External public debt amounted to about 7.9% of GDP in 2015. Creditors of external debt are

foreign governments (mainly Paris Club bilateral debt) and regional and international

organizations such as the IMF, the World Bank, the Islamic Development Bank and the African

Development Bank. These organizations provide loans with to finance specific investments

and development projects. External debt also includes deposits held by the Egyptian central

bank (Alexbank 2015). The MTDS envisages raising funds from the international capital

markets in the amount of $35 billion on a yearly basis over the period 20152018 (MoF 2015).

External debt is mainly denominated in U.S. Dollars (56.1%), Euro (21.4%) and Japanese Yen

(6.6%). The share of external debt in U.S. Dollars has increased over the last decade, while the

share denominated in Euro and Japanese Yen have decreased (see also Figure 413).