Improving Public Debt Management

In the OIC Member Countries

101

domestic securities market. One of the key objectives is reducing the refinancing risks by

lengthening the maturity structure of the domestic tradable debt and consolidating a domestic

yield curve.

Regarding market developments, the following challenges are described (MoF 2015, p. 8):

Focusing on a limited number of benchmark maturities, namely three, five, seven and ten

years, possibly issuing longer maturity as new benchmark;

Increasing the number of reopenings of each security in order to raise the target amount

outstanding to approximately EGP 1215 billion per TBond life time. This may increase

liquidity enhancing activity in the secondary market;

Organizing the issuance schedule to avoid the crowding out of securities through

alternating the issuance weeks for TBills and TBonds with different maturities.

Regarding sources of financing, the following challenges are described (MoF 2015, p. 11):

Diversifying the investor base and adding nonbanking financial institutions;

Developing the secondary market, increasing the issuance of longerterm bonds and

adding new instruments to deepen the market;

Paying more attention to the effects of government borrowing on the private sector in

order to limit the crowding out effect, within the context of the government’s need to raise

funds from the domestic market.

Based on a macroeconomic baseline scenario, various risk assumptions on different shock

scenarios are considered in the MTDS and multiple financing options are presented and

evaluated using a costrisk analysis framework.

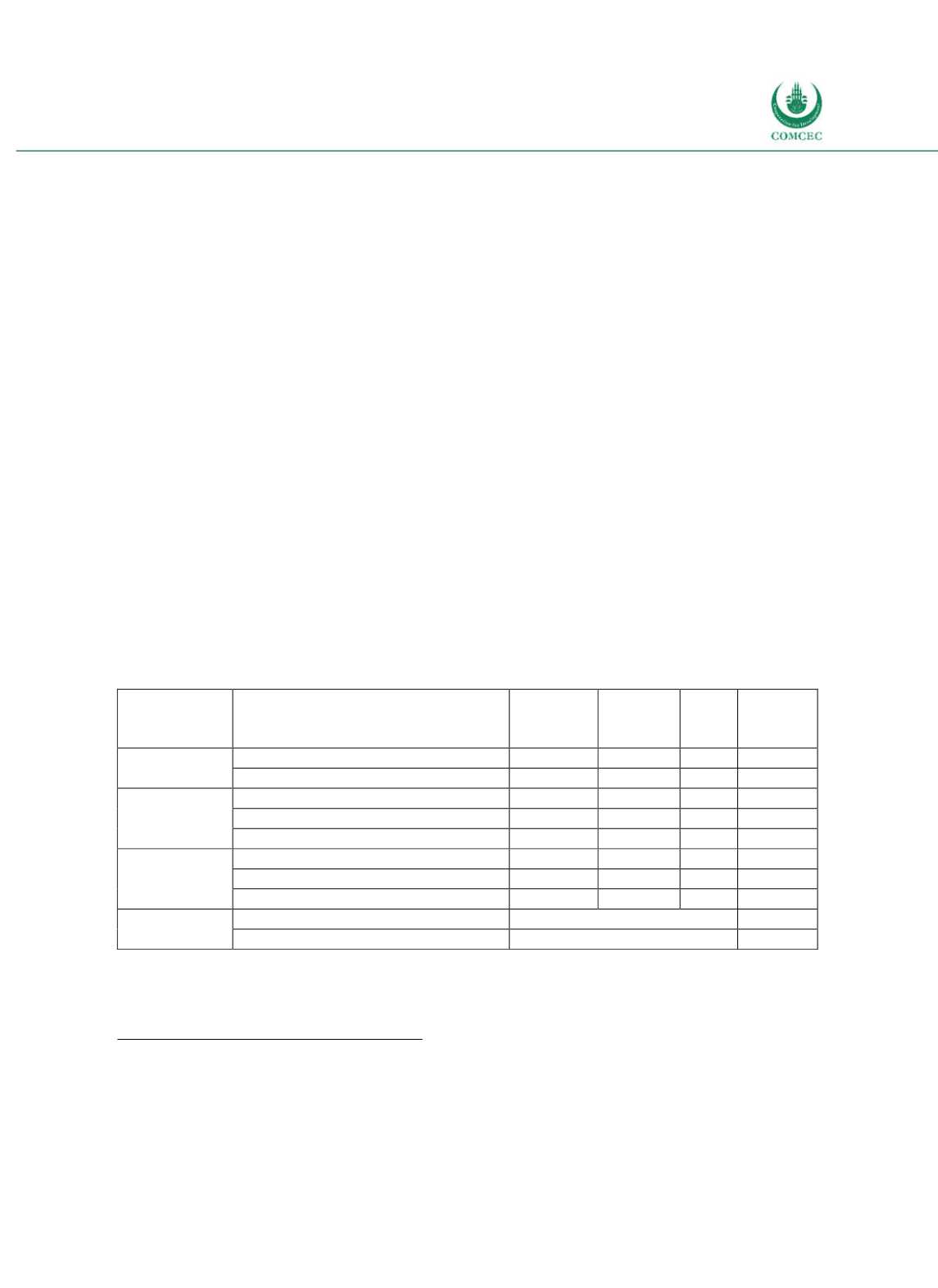

Table 4-5: Egypt – Cost and Risk Indicators for the Government's Debt Portfolio (Mid 2015)

Type of risk

Risk indicator

Domestic

debt

External

debt

Total

debt

Targets

(tot.

debt)

Cost of debt

Interest payments as % of GDP

5.4

0.2 5.6

Weighted avg. interest rate (in %)

12.3

3.3 11.3

Refinancing

risk

ATM (years)

2.2

2.5 2.2

2.5

Debt maturing in 1 year (% of total)

55.1

56.3 55.2

50.0

Debt maturing in 1 year (% of GDP)

24.1

3.2 27.3

Interest rate

risk

ATR (years)

2.2

2.5 2.2

Debt refixing in 1 year (% of total)

55.1

56.3 55.2

Fixed rate debt (% of total)

100.

100.0 100.0

Exchange

rate risk

FX debt (% of total)

11.3

15.0

ST FX debt (% of reserves)

56.7

Note: Classification of domestic and ex ernal debt based on currency denomination. Note: ATM = Average Time to

Maturity; ATR = Average Time to Refixing; FX = Foreign exchange; ST = Short-term.

Source: MoF (2015, p. 10).

Borrowing and related financial activities

Operations (incl. Islamic finance)

In 2015, 28.5% of outstanding government debt consisted of TBills denominated mainly in

Egyptian Pound (25.4%) and to some extent in Euro and U.S. Dollars (3%). TBonds

denominated in Egyptian Pound accounted for 28.5% and Eurobonds for 1.4% of outstanding

debt. The remainder (41.7% of outstanding debt) is nontradable debt (notes issued for the