Improving Public Debt Management

In the OIC Member Countries

102

CBE, pension fund notes, facilities from banking system accounts and Treasury Single Account,

actuarial deficit notes, Barwah company notes, pension funds time deposits and housing

notes).

TBills have maturities of 91, 182, 273 and 364 days. TBonds have an average maturity of 3.48

years (as of May 2016). The average time to maturity of domestic debt was 2.20 years in 2015

(compared to 0.34 years in 2004) and is on an increasing path. The average time to maturity of

external debt is slightly higher at 2.50 years. The share of debt maturing in less than one year

is high at 55% of total public debt (see also Table 45).

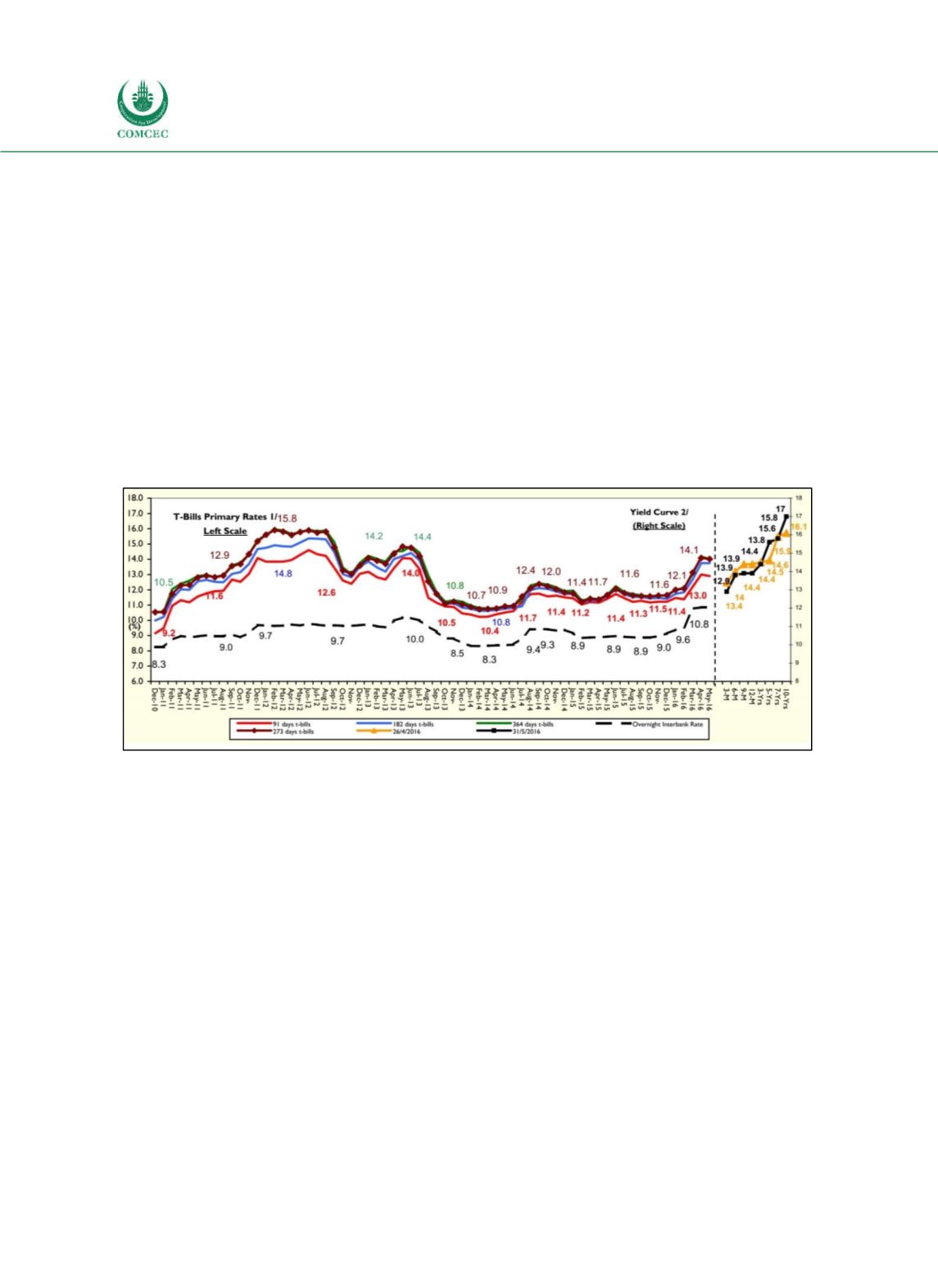

Interest rates on TBills started to increase in 2011 because of political and economic risks

(see Figure 414). In 2013 interest rates declined because of inflows of aid from Gulf countries.

In 2014, however, interest rates started to increase again because of the government’s high

borrowing needs and the devaluation of the Egyptian Pound (Alexbank 2015). In April 2016,

interest rates on TBills were between 13.0% and 14.1%, depending on the maturity structure.

Figure 4-14: Egypt - Interest Rates on Government Securities

Note: 1/ Monthly average in Primary Markets, 2/ Secondary market rates.

Source: MoF (2016a, p.42).

Egypt has not issued

sukuk

so far. However, the MoF plans to diversify “the sources of

financing through the issuance of new instruments such as

sukuk

to finance development and

infrastructure projects as well as enlarging the investor base by attracting retail investors and

incorporating more nonbanking financial institutions” (MoF 2015).

Sukuk

issuance by both

the government and the private sector is regulated in a law from 2012. Egypt plans to issue

sovereign

sukuk

with

ijara

contracts in 2016.

Sukuk ijara

are leasebased financial instruments,

i.e. bondholders are owners of the asset and are entitled to receive revenues from leasing

(Abaza 2015). The government is currently working on amending the

sukuk

law in order to

attract new investors domestically and internationally. Moreover, the government plans to tap

new sources of financing (particularly from the informal sector) by issuing other new

instruments such as project bonds and

sukuk

to finance development and large infrastructure

projects (Egypt Economic Development Conference 2015).

Domestic debt market

The major part of Egypt‘s public debt is held by domestic creditors (about 90%). Tradable

domestic debt is financed through TBills (54%) and TBonds (46%). The largest domestic

creditors of the government are Egypt’s three state banks, holding about 50% of the TBills