Risk Management in

Islamic Financial Instruments

93

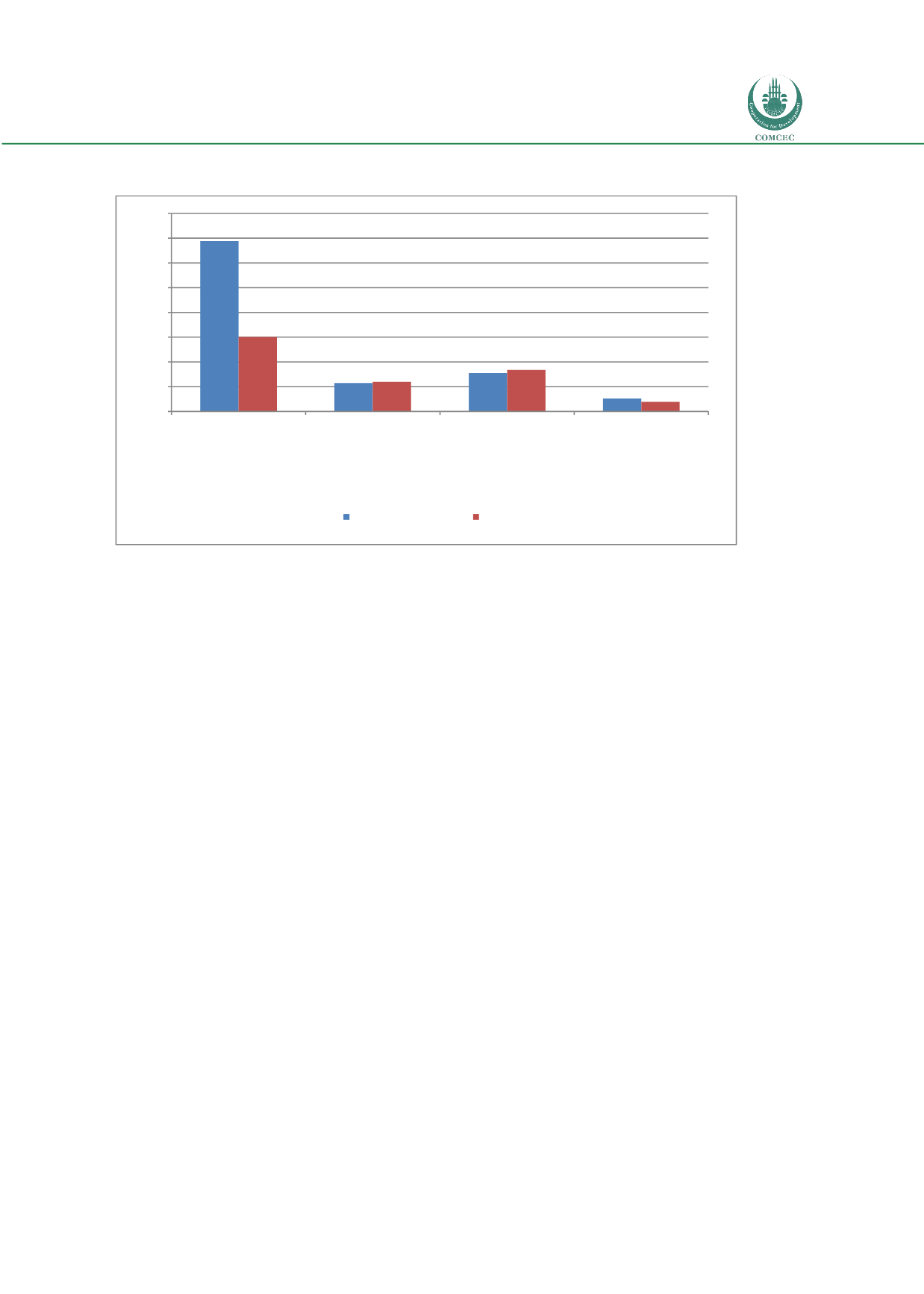

Chart 4.42: Liquidity Ratio for United Arab Emirates (UAE) Banks

Source: BankScope Database 2013

4.4.5 Bangladesh

Bangladesh represents a vibrant market for Islamic banking over the last couple of decades. At

present, seven (7) full-fledged Islamic banks are operating with a total of 615 branches and

maintaining a growth rate of around 10.0%-12.0% per year. In addition, sixteen (16) other

scheduled commercial banks, including two foreign banks with 22 branches and seven other

Islamic insurance companies are also providing Islamic banking and insurance services.

Islamic banks operate in the same legal environment as their competing conventional

commercial banks. In addition, Islamic banks are also required to abide by the guidelines for

conducting Islamic banking issued by the Central Bank of the country.

4.4.5.1 Bangladesh Banking Sector

The following analysis consists of data from 6 Islamic banks of Bangladesh for which data is

available on the BankScope database. The banks are: (6) Islamic Banks: ICB Islamic Bank

Limited, Social Islami Bank Ltd, First Security Islami Bank Limited, Al-Arafah Islami Bank Ltd.,

Shahjalal Islami Bank Ltd., and Islami Bank Bangladesh Limited.

The average total asset of the Bangladesh Islamic bank is 1,584 million USD, with average

deposits of 1,398 million USD. On average, Islamic banks in Bangladesh employs 639 workers

across 28.67 branches.

344,15

57,14

77,45

25,88

150,38

59,58

83,84

19,12

0

50

100

150

200

250

300

350

400

Interbank Ratio

%

2011

Net Loans / Tot Assets

%

2011

Net Loans / Dep & ST

Funding

%

2011

Liquid Assets / Dep & ST

Funding

%

2011

U.A.E. Conventional

U.A.E. Islamic