Infrastructure Financing through Islamic

Finance in the Islamic Countries

16

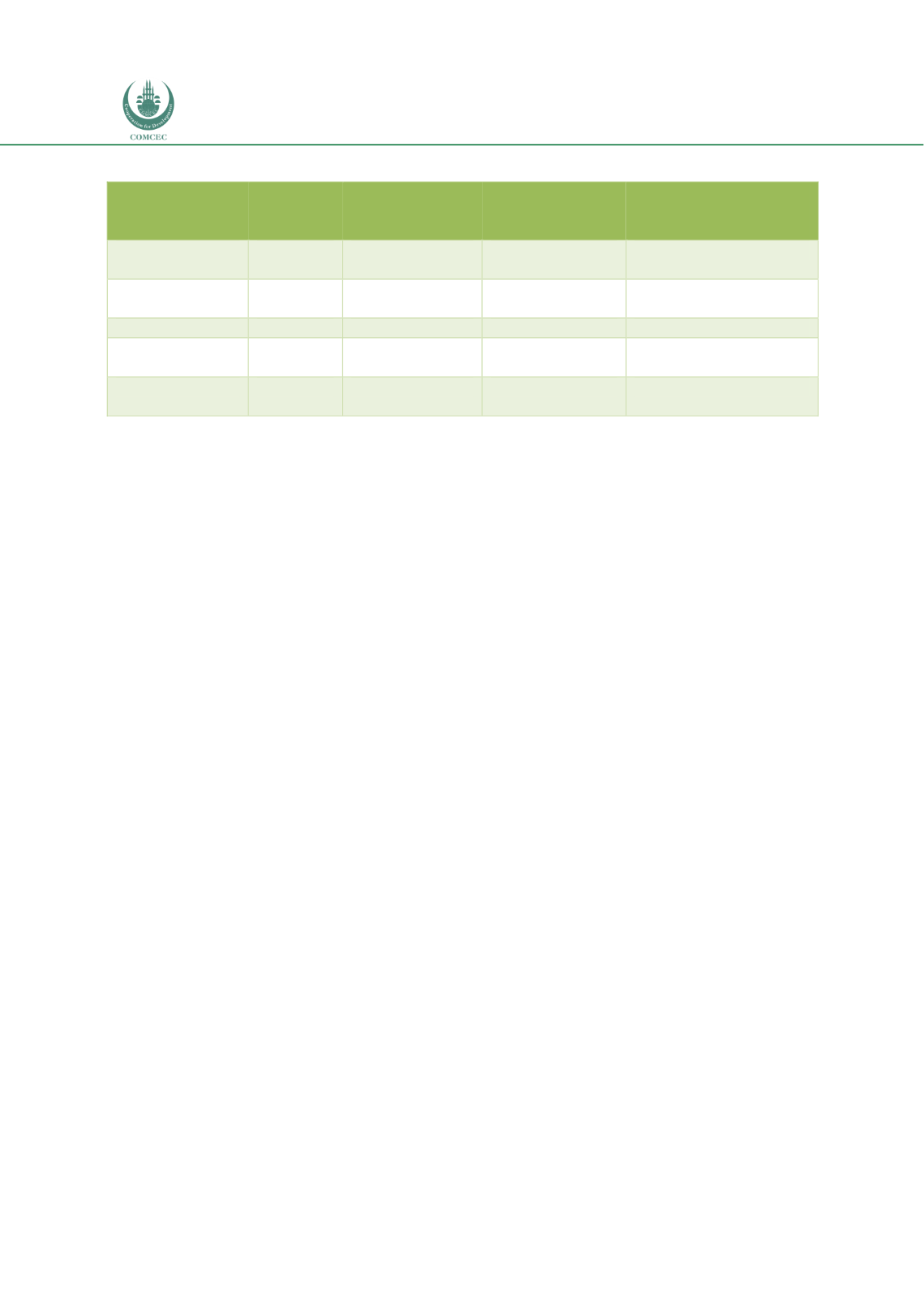

Table 1.3: List of OIC Countries to be Used for Case Studies

Country

Region

Legal

System

Family

e

Income

Grouping

Size of IF sector:

% of National Banking

Assets

a

1.

Indonesia

Asia

Civil Law

Lower Middle

Income

5.6

b

2.

Malaysia

Asia

Common Law

Upper Middle

Income

30.0

c

3.

Nigeria

Africa

Common Law

0.28

d

4.

Saudi Arabia

Arab

Islamic/

Civil Law

High Income

51.1

5.

Sudan

Africa

Islamic/

Common Law

Lower Middle

Income

100

a-Data for 2017H1 (source IFSB 2017) except otherwise indicated; b-Data for 2017 (source OJK 2017); c-

BNM (2017); d-Central Bank Nigeria; World Bank (2004). Note that the countries are classified according to

legal origins such as English, French, etc. While the English are considered to be common law, the latter

belongs to civil law regimes.

While most of the information/data is collected from secondary sources, useful information is

also gathered for country case studies through interaction with relevant personnel and

officials in their respective countries. Information and data will also be gathered through

interviews and discussions with relevant officials and stakeholders to further understand the

country specific issues related to the use of Islamic finance in infrastructure development.

The research is descriptive and evaluative and attempts to arrange, summarize and present

data/information to enable meaningful interpretation. Other than analyzing quantitative data

on the size and status of the infrastructure financing needs and the Islamic financial sector in

different jurisdictions, some of the analyses will be qualitative and conceptual in nature. The

analyses will produce material that can identify deficits in the infrastructure investment needs,

identify the role of Islamic finance in filling these gaps, and come up with appropriate policy

recommendations.

1.4.

Overview of the Study

Other than this introduction chapter, the research report has five additional chapters. A brief

overview of the contents of these chapters is given below.

Chapter 2: Infrastructure Financing

Chapter 2 discusses various issues related to infrastructure financing. The chapter starts by

identifying the special features of infrastructure financing and then covers issues related to

infrastructure planning. After discussing the sources of infrastructure financing, the products

and approaches for infrastructure financing are presented. The chapter ends by examining the

factors affecting financing long-term infrastructure projects and then identifying infrastructure

needs and financing gaps in OIC MCs.