Infrastructure Financing through Islamic

Finance in the Islamic Countries

14

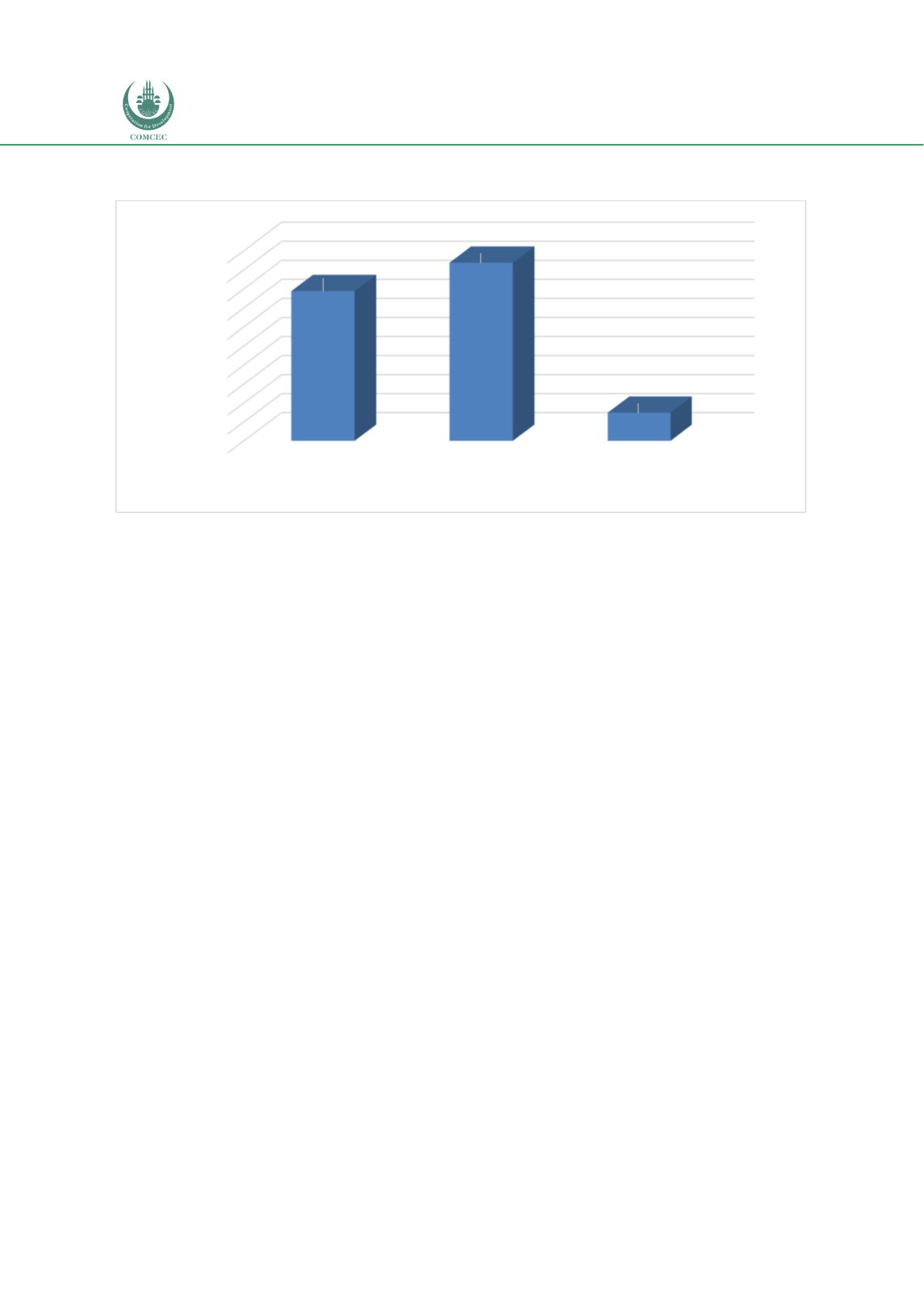

Chart 1.6: Global Cumulative Infrastructure Spending and Investment Needs 2016-2040

(USD trillion, 2015 prices & exchange rates)

Source: GIH and Oxford Economics (2018), Global Infrastructure Outlook, Infrastructure investment needs 50

countries, 7 sectors to 2040.

1.3.

Aim, Objectives and Research Methods

Given the features of infrastructure projects that are large with long gestation periods, the

sector has traditionally been financed by the public sector. The provision of infrastructure by

the government was justified because the services were considered essential, large amounts of

investments were required, and projects had features of natural monopolies (Chan et. al 2009).

However, increasing demands on public funds, budget deficits, and increasing public debt have

limited their role in financing the sector. Furthermore, there have been issues of efficiency of

provisions of infrastructure services by the government. As discussed above, the projections

show that the demand for infrastructure is expected to grow further in the future, in particular,

due to the implementation of SDGs. With limited resources available to the governments of

most countries, there is expected to be huge investment gaps. Given the need for funds, there

will be a need to seek resources from different sources to fill the funding gaps. In this regard,

domestically the private sector and the non-profit sector can be important sources of

financing, and, externally, funding could be secured from multilateral developmental financial

institutions and sources such as sovereign wealth funds. To enable these stakeholders to

contribute to infrastructure development, however, would require a well-functioning financial

sector that can facilitate the mobilization of resources to fill the gap.

The Islamic financial sector has grown significantly during its short history with the size of the

global assets exceeding USD 2 trillion in 2017 (IFSB 2018). The sector has become large in

many OIC MCs and has become systematically important in several countries. Based on the

overall broader objective of the Shariah in enhancing benefit (maslahah) and avoiding harm

(mafsada), the key features of the Islamic financial system include risk-sharing, direct linkages

with the real economy, low leverage and not dealing with toxic instruments and derivatives

(Ahmed 2009, El-Hawary et al. 2004). In line with the ideological standing and its ethical,

social and legal ethos, the Islamic finance industry can potentially play an important role in

providing financing to infrastructure projects since they provide essential services and also

promote growth and alleviate poverty.

0

10

20

30

40

50

60

70

80

90

100

Current trends

Investment needs

Infrastructure spending

gap

78.8

93.7

14.9

USD trillion