Islamic Fund Management

148

4.5.3

Investment and Commercial Considerations

Different countries have different methodologies or process flows on how a fund may be

developed.

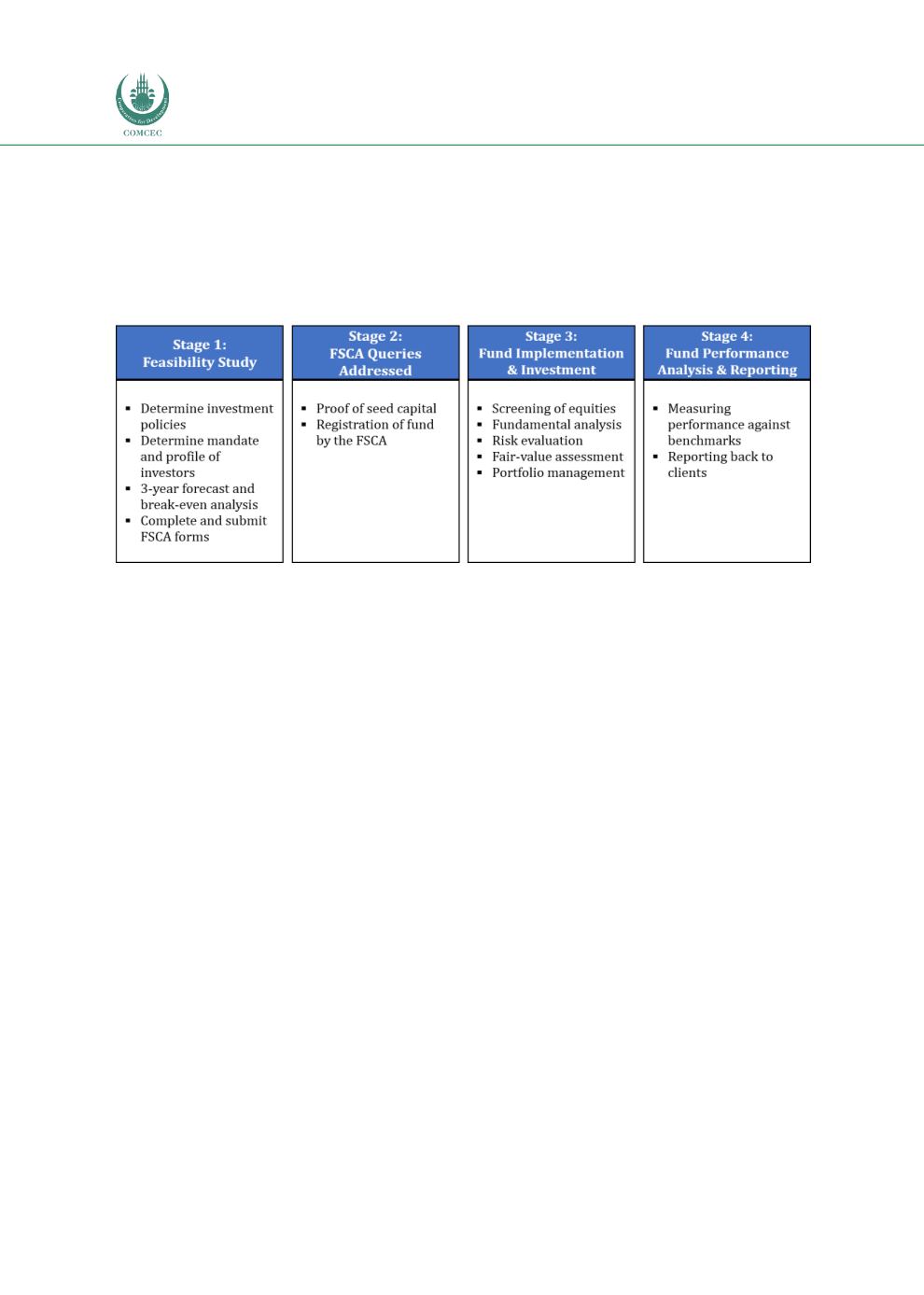

Figure 4.20illustrates the processes of fund development from conceptualisation,

planning, regulatory approval and implementation to monitoring of funds in South Africa.

Figure 4.20: Process Flow of Fund Development in South Africa

Source: Kagiso Asset Management

Value Propositions of Islamic Funds

It is fairly challenging in South Africa to construct balanced fund solutions for investors which

comply with the prudential guidelines of Regulation 28 and Shariah parameters yet still offer

good returns. Islamic funds tend to differ from conventional funds in terms of their underlying

sector risk, stock risk and asset allocation.

1.

Shariah Compliance and Shariah Screening

Demand for Islamic funds has been largely fuelled by increasing awareness, rising trade with

the Middle East, growing demand by local Muslim populations for Shariah-compliant products,

and an ever-increasing demand for more ethical risk sharing-based products given the recent

global financial crisis.

The JSE collaborated with FTSE to come up with a Shariah screening methodology while FTSE

formed a joint venture with Yasaar to create Shariah-compliant indices. The FTSE/JSE Shariah

All Share, the FTSE/JSE Shariah Top 40 and the FTSE/JSE Capped Shariah Top 40 indices were

launched in 2007, 2008 and 2011, respectively. Under these indices, Shariah credibility is

determined through company screening at both the financial and business levels.

Based on the FTSE/JSE Shariah screening methodology, companies involved in any of the

activities listed i

n Table 4.24will be filtered out as Shariah non-compliant. The remainder are

then screened further from a financial perspective.