Islamic Fund Management

149

Table 4.24: FTSE/JSE Shariah Screening Methodology

Business Activity Screening

Financial Ratio Screening

Conventional finance (e.g. non-Islamic

banking, finance and insurance)

Alcohol

Pork-related products and non-

halal

food

production, packaging and processing or any

other activity related to pork and non-

halal

food

Entertainment (casinos, gambling and

pornography)

Tobacco

Weapons, arms and defence manufacturing

Debt is less than 33% of total assets

Cash and interest-bearing items are less than

33% of total assets

Accounts receivable and cash are less than

50% of total assets

Total interest and non-compliant income

should not exceed 5% of total revenue

Source: Market Data FTSE/JSE Shariah Indices

2.

Islamic ETF

Absa Capital launched South Africa’s first Shariah-compliant, equity-linked ETF, i.e. New Funds

Shariah Top 40 Index ETF, on 11 March 2009. The IPO for this new ETF opened on 23

February and it was listed on the JSE on 6 April 2009. The Shariah Top 40 Index ETF provides

investors with a diversified exposure to the broad market by investing in one Shariah-

compliant ETF and earning a market-related performance. The New Funds Shari’ah Top 40

Index ETF tracks the price performance of the FTSE/JSE Shari’ah Top 40 Index, which is jointly

established by FTSE and the JSE.

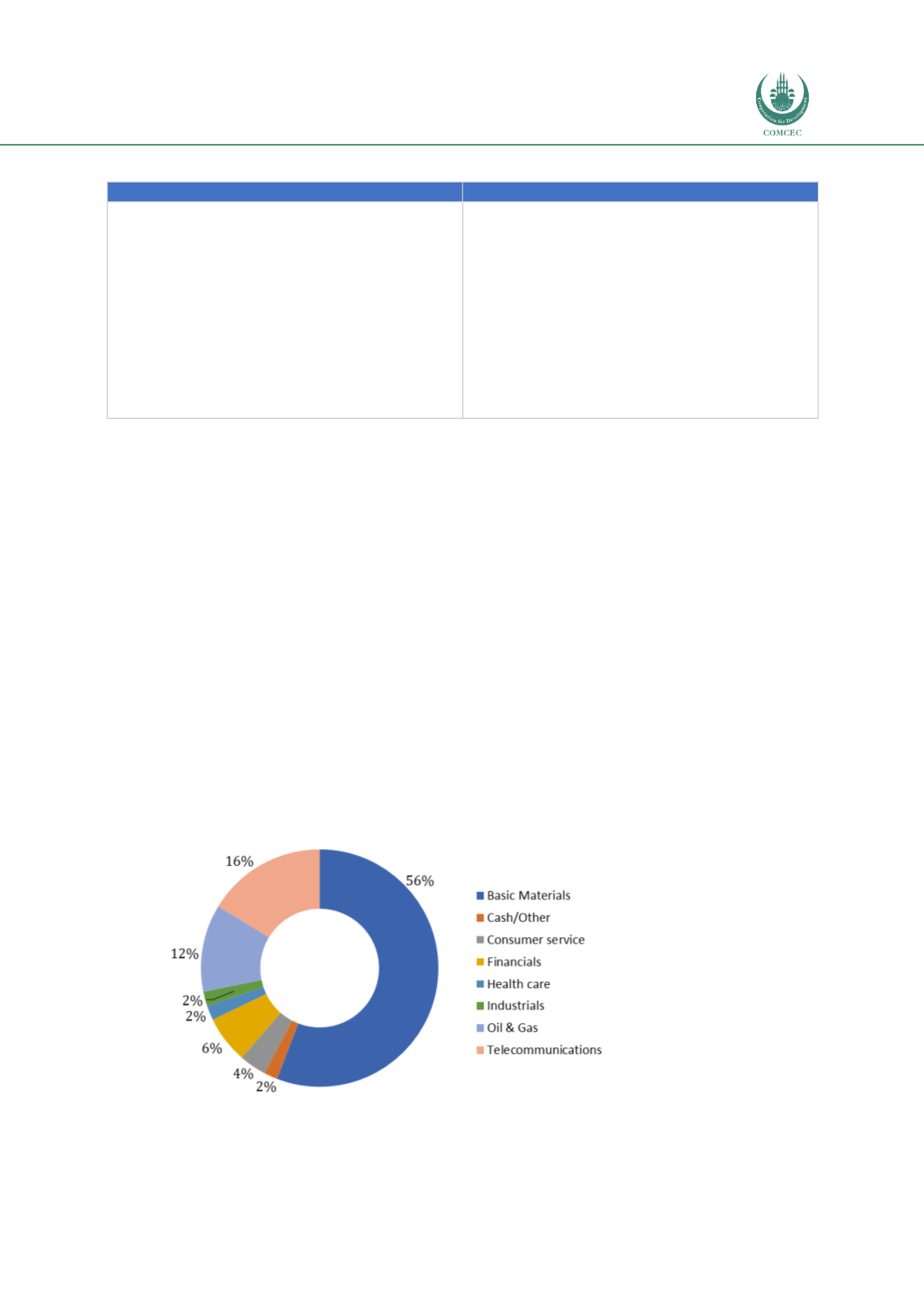

The FTSE/JSE Shariah Top 40 Index comprises securities that represent the performance of

the 40 largest and most liquid JSE-listed companies, the activities and financial ratios of which

are Shariah-compliant. The index is rebalanced quarterly and all dividends will be paid out to

the investors on a quarterly basis whenever declared. As shown i

n Chart 4.26 ,the sector that

dominates the asset mix of the New Funds Shariah Top 40 Index ETF is basic materials

(55.86%).

Chart 4.26: Sector Allocation of New Funds Shariah Top 40 Index ETF

Source: ABSA CIB