The Role of Sukuk in Islamic Capital Markets

36

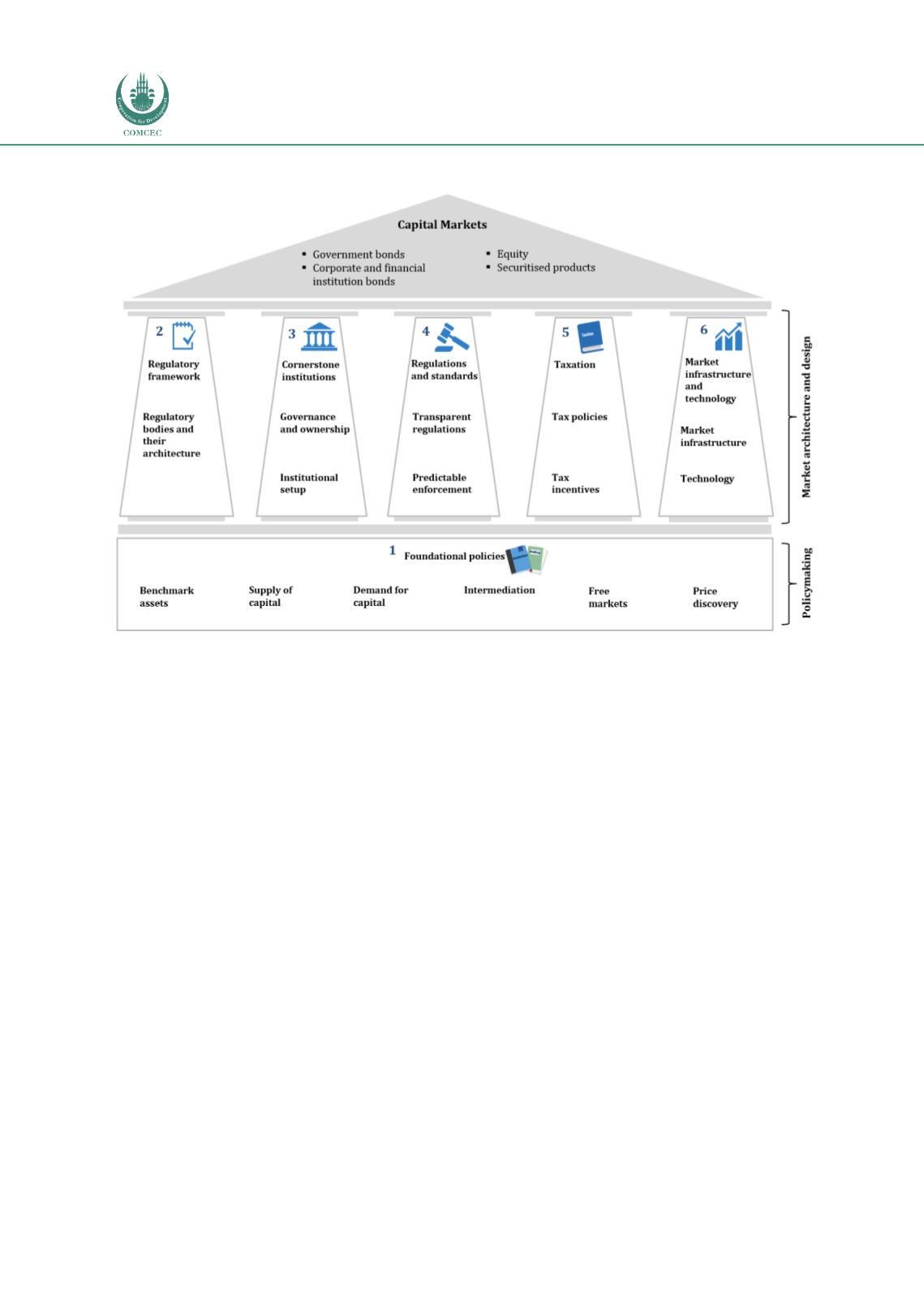

Figure 3.1: McKinsey’s Building Blocks to Sustain the Long-Term Growth of Capital Markets

Source: McKinsey & Company (2017)

3.1

CRITICAL SUCCESS FACTORS FOR A SUSTAINABLE SUKUK MARKET

Central to the development of a sustainable sukuk market is the provision of a level playing

field vis-a-vis conventional bonds. Commercial reasoning will always be the tipping point for

issuers, and creating a vibrant, thriving environment for sukuk is the key to success. Another

critical component is to have a “top down” approach to promoting the Islamic finance agenda.

The dynamic shift towards sukuk, instead of conventional bonds, is a balance driven by both

supply (sell side) and demand (buy side). This can only be achieved through the collective

efforts of governments and regulators, in collaboration with industry players.

Based on our analysis, each jurisdiction has evolved in its own way to overcome inherent

domestic risks. The concerted efforts of key market stakeholders listed in Table 3.1 can

facilitate a supportive ecosystem in which sukuk issuance can thrive: