The Role of Sukuk in Islamic Capital Markets

33

2.7

NEW FRONTIERS FOR THE DEVELOPMENT OF SUKUK IN THE ICM

As mentioned earlier, the growth of the sukuk market has been stimulated by a number of new

entrants as well as innovative structures. A specific area that is gaining increasing interest

relates to SRI and green sukuk.

2.7.1

CONVERGENCE OF SUKUK WITH SRI

There is an inevitable overlap of the rationale behind SRI and Islamic finance; both are trying

to achieve a balance between ESG issues. Both sectors are now worth millions of dollars, with

the SRI industry being at least 10 times larger than its Islamic counterpart. The SRI industry

boasted USD21 trillion of assets under management as of 2016 (Responsible Finance Summit,

2016).

1

The growing importance of ESG issues, particularly environmental concerns, has led to more

concerted efforts in the Islamic finance industry to come up with more sustainable and greener

initiatives. One such development is the issuance of SRI sukuk, which mobilises funds for

sustainable development objectives. Malaysia, in particular, is a leader in this sphere; the

framework for SRI sukuk was introduced by the SC in August 2014, to facilitate the financing of

SRI initiatives. This framework has been integrated with the LOLA framework (June 2015).

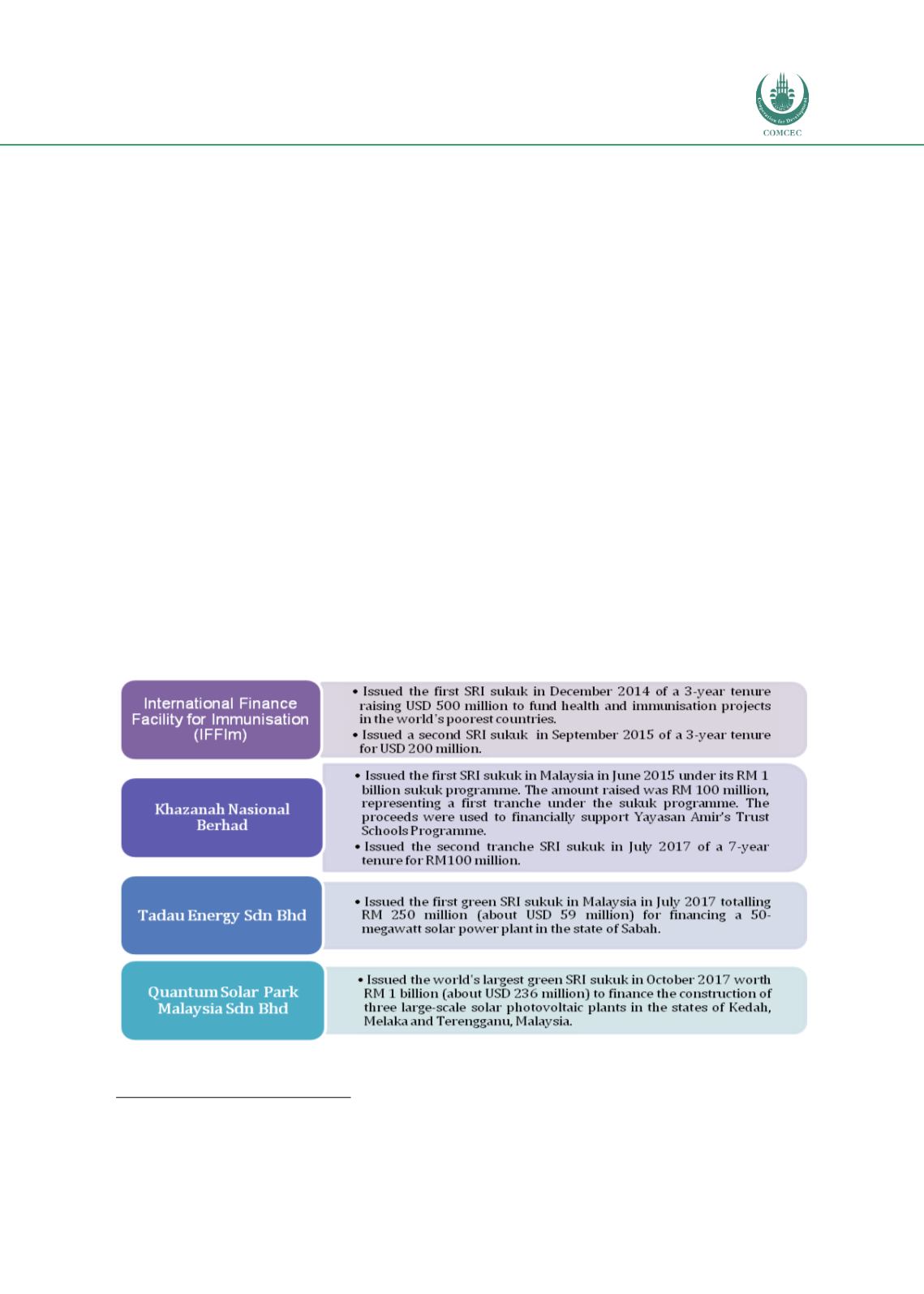

Figure 2.11 provides details on prominent SRI sukuk issued in the market up to November

2017.

Figure 2.11: SRI Sukuk Issued in the Islamic Finance Industry

Source: ISRA

1

Responsible Finance Summit - Unlocking Finance, Expanding Impact (2016), RFS Concept Note, 30-31 March 2016, Kuala

Lumpur: Bank Negara Malaysia.