The Role of Sukuk in Islamic Capital Markets

3

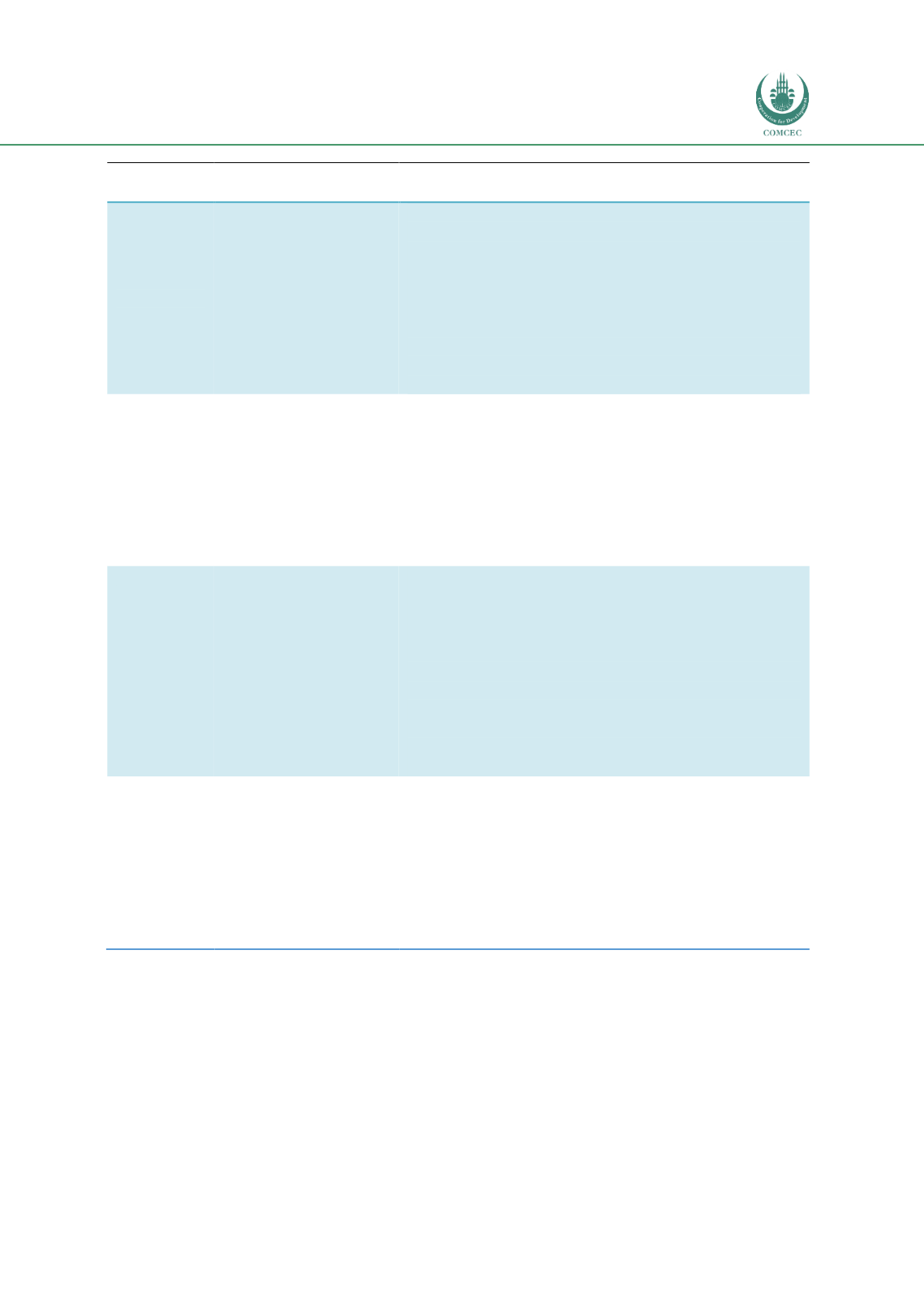

Country

Stage of sukuk market

development

Rationale

Indonesia

Developing

(Intermediate)

The Indonesian government’s keenness to grow its ICM

has been a boon to Indonesia’s sukuk market. As at end-

2016, the country recorded 16.3% (USD11.9 billion)

market share, supported by issuances from the public

sector (97.2%) and private sector (2.8%). By

comparison, the sukuk ecosystem favours the public

sector with no real value proposition created for

corporate issuers. Nevertheless, Indonesia is placed

under ‘developing’ due to its growing influence and

potential in capturing a slice of the global sukuk market.

Turkey

Developing

(Beginner)

The growth of Turkey’s sukuk market is driven by the

development of its participation banks and sovereign

issuances. From the release of regulator’s Communique

for sukuk, the number of issuance has rapidly grown to

garner more than 4.0% (USD3.0 billion) market share of

total global sukuk as at end-2016. The country’s status

under ‘developing’ evidenced key stakeholders’

supportive role to move the sukuk industry to its next

phase of growth.

Hong Kong

Developing

Hong Kong is reputed as an established international

financial centre. Its endeavour to include Islamic finance

into its financial system is to support a complementary

role to the Islamic finance community which it currently

serves. As a non-OIC nation that has returned to tap the

sukuk market three times, it underscores the

government’s interest to expand its sources of financing

and investor base. Its categorisation under ‘developing’

relate to this initiative by the government compared to

other global financial centres such as London, New York

and Singapore.

Nigeria

Infancy

Nigeria has proactively included Islamic finance into its

master plan to facilitate its ICM progression. However,

its

underdeveloped

financial

system,

currency

fluctuation, etc. pose certain challenges to grow its

domestic bond market. Hence, its placement under

‘infancy’ to depict the requirement to strengthen its

market

infrastructure

and

attainment

of

macroeconomic stability to facilitate the growth of its

domestic bond market.

Sources: RAM, ISRA