85

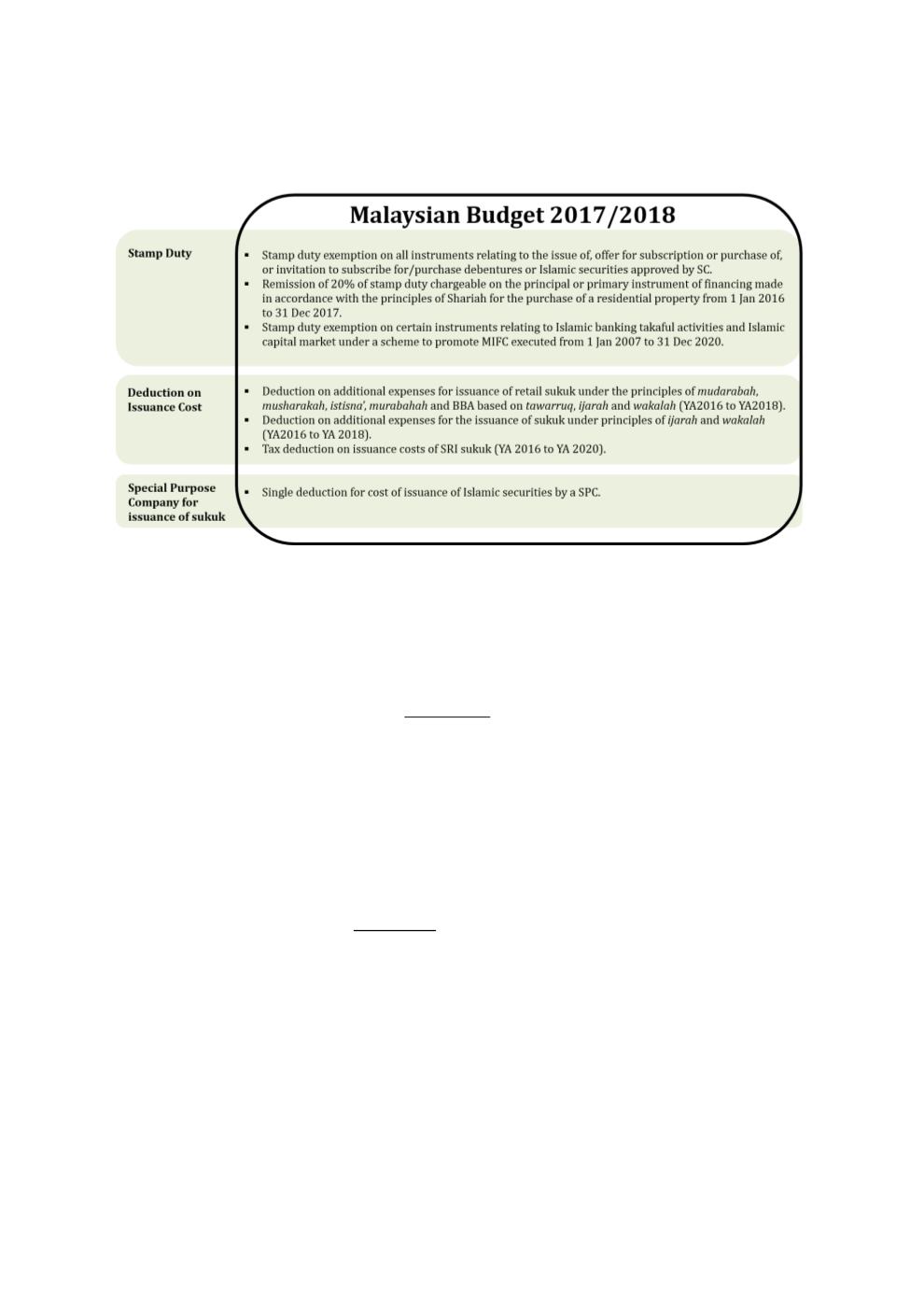

Figure 4.3: Tax Incentives Accorded to Islamic Finance Based on Budget 2018

Source: PwC 2017/2018 Malaysian Tax and Business Booklet

Other supporting tax-related initiatives that have facilitated the country’s transformation into

a vibrant sukuk hub that has attracted not only domestic but also global issuers and investors

are listed below. These fiscal measures have been introduced in line with Malaysia’s aspiration

of becoming an international Islamic hub, known as the Malaysia International Islamic

Financial Centre (MIFC):

1.

Promoting Malaysia as a point of origination:

SPVs for the issuance of sukuk are not subject to the administrative tax procedures

under the Income Tax Act 1967.

Companies that establish SPVs are given tax deductions on the cost incurred by the

SPV for the issuance of sukuk.

The issuance cost for all Islamic securities approved by the SC is eligible for tax

deductions.

Stamp duty is exempted for instruments relating to Islamic securities issued under

the MIFC until 2020.

2.

Promoting Malaysia as an investment destination:

No withholding tax is imposed on non-resident investors vis-à-vis the profit or

income received from FCY sukuk originated in Malaysia and approved by the SC.

Foreign investors in Malaysia are allowed to hedge their positions with onshore

banks in relation to committed flows of funds, such as the repatriation of

investment proceeds, dividends and profits from Malaysia, and the purchase of

ringgit assets in Malaysia.

Free inward and outward movement of funds relating to both foreign direct

investments and portfolio capital investments.