82

flourish, by cultivating a conducive environment for product innovation and flexibility while

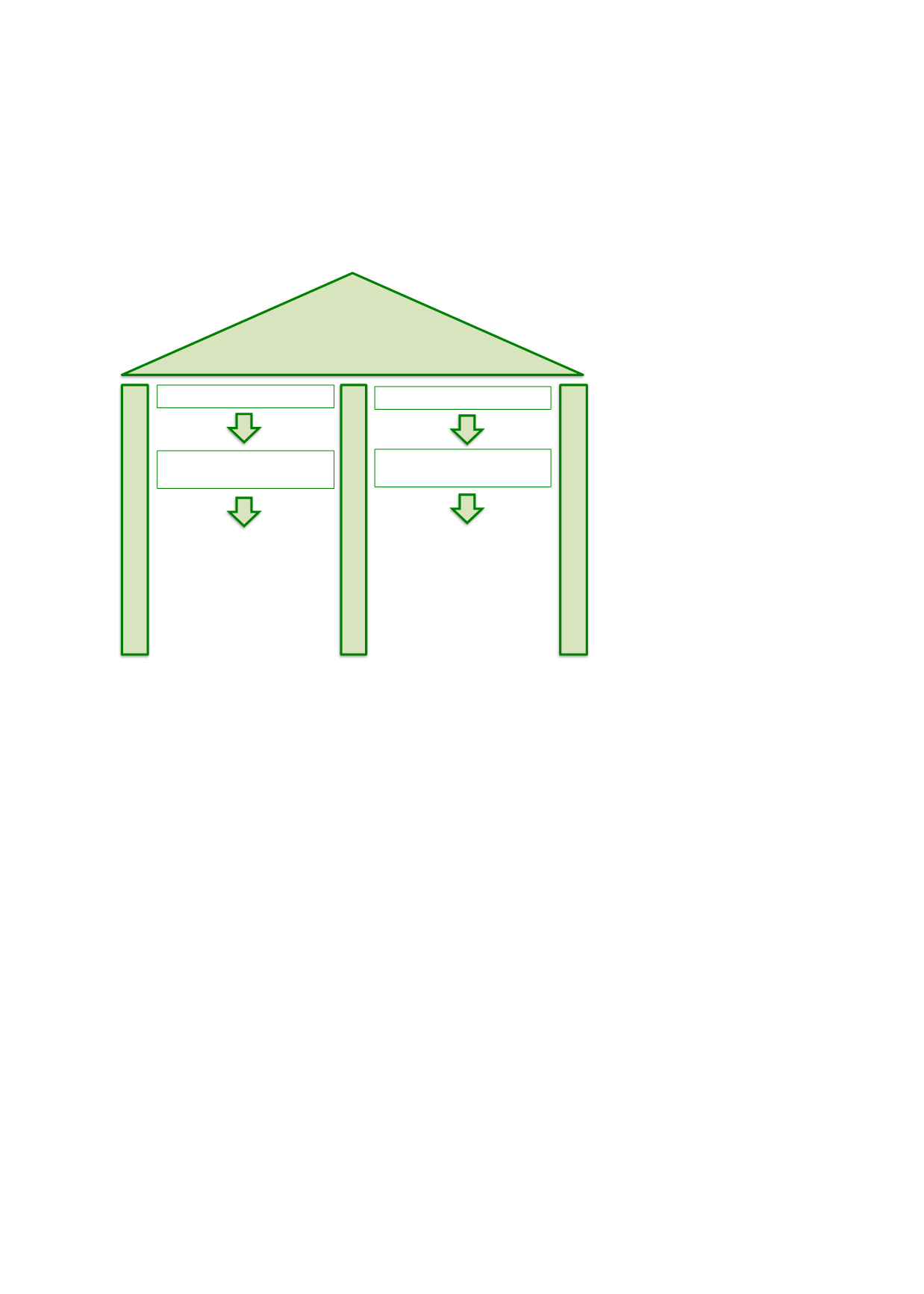

ensuring compliance with Shariah principles. Figure 4.1 summarizes the roles of these 2

Shariah authorities.

Figure 4.1: Malaysia’s Shariah Governing Bodies

MALAYSIA’S SHARIAH

REGULATORY BODIES

Islamic Banking and Takaful

Islamic Capital Market

Shariah Advisory Council of

BNM

Shariah Advisory Council of

SC

Objective: Established in May

1997, the committee is

responsible to advise on

matters relating to Islamic

banking and takaful business

or any other Islamic finance

area that is supervised and

regulated by BNM.

Objective: Established in May

1996, the committee is

responsible to advise on

matters pertaining to Islamic

capital market.

Sources: BNM, SC

Based on our observation, several SAC resolutions differ from the opinions of Shariah experts

in other countries. According to the

Resolutions of the Securities Commission Shariah Advisory

Council (Second Edition),

these variations exist due to differences in time and place, and the

divergence in the needs and background of a country. Regardless of the difference, each

jurisdiction (e.g. Malaysia and GCC countries) has evolved to accommodate the requirements

of its domicile country, with each having expanded rapidly over the years in the development

of its Islamic finance landscape.

2.

Requirement of Identified Assets, Ventures and/or Investments

The

Guidelines on Unlisted Capital Market Products under the Lodge and Launch Framework

(2015) set out the asset requirements ― whether tangible or intangible ― for sukuk issuance

related to the contracts of

bay’ bithaman ajil

(BBA),

murabahah

,

istisna’

and

ijarah

:

a)

The identified asset and its use must satisfy Shariah requirements.

b)

If the identified asset is subject to any encumbrance or is jointly owned with another party,

prior consent must be obtained from the charge or joint owner.

c)

Where the identified asset is in the form of a receivable, it must be

mustaqir

(established

and certain) and transacted on the spot, either in the form of cash or commodities.

In relation to sukuk issuances based on

musharakah

,

mudarabah

and

wakalah bil istithmar

, the

ventures and/or investments must also comply with the SC’s specific Shariah requirements.