83

3.

Asset-Pricing Guidelines on Sale and Purchase Sukuk Structures

The assets (tangible or intangible) used in a sukuk structure must also satisfy the asset-pricing

guidelines. The purchase price for the sale and purchase of an identified asset under the sukuk

structures of BBA,

murabahah

,

istisna’

and

ijarah

must adhere to the following requirements:

3

a)

The purchase price must not exceed 1.51 times the market value of the asset.

b)

In cases where the market value of a particular asset cannot be ascertained, a fair value or

any other value must be applied.

The rationale for the asset-pricing guidelines is to protect investors’ interests so that the

market value of the underlying assets commensurate with the investors’ principal/investment

value. Where there is an unavailability of assets (e.g. unencumbered, insufficient assets to meet

the asset-pricing guidelines, commercial reasons), issuers have the option of utilising any of

the approved platforms to purchase Shariah-compliant assets to facilitate the sale and

purchase requirements under a

murabahah

(via a

tawarruq

arrangement) structure.

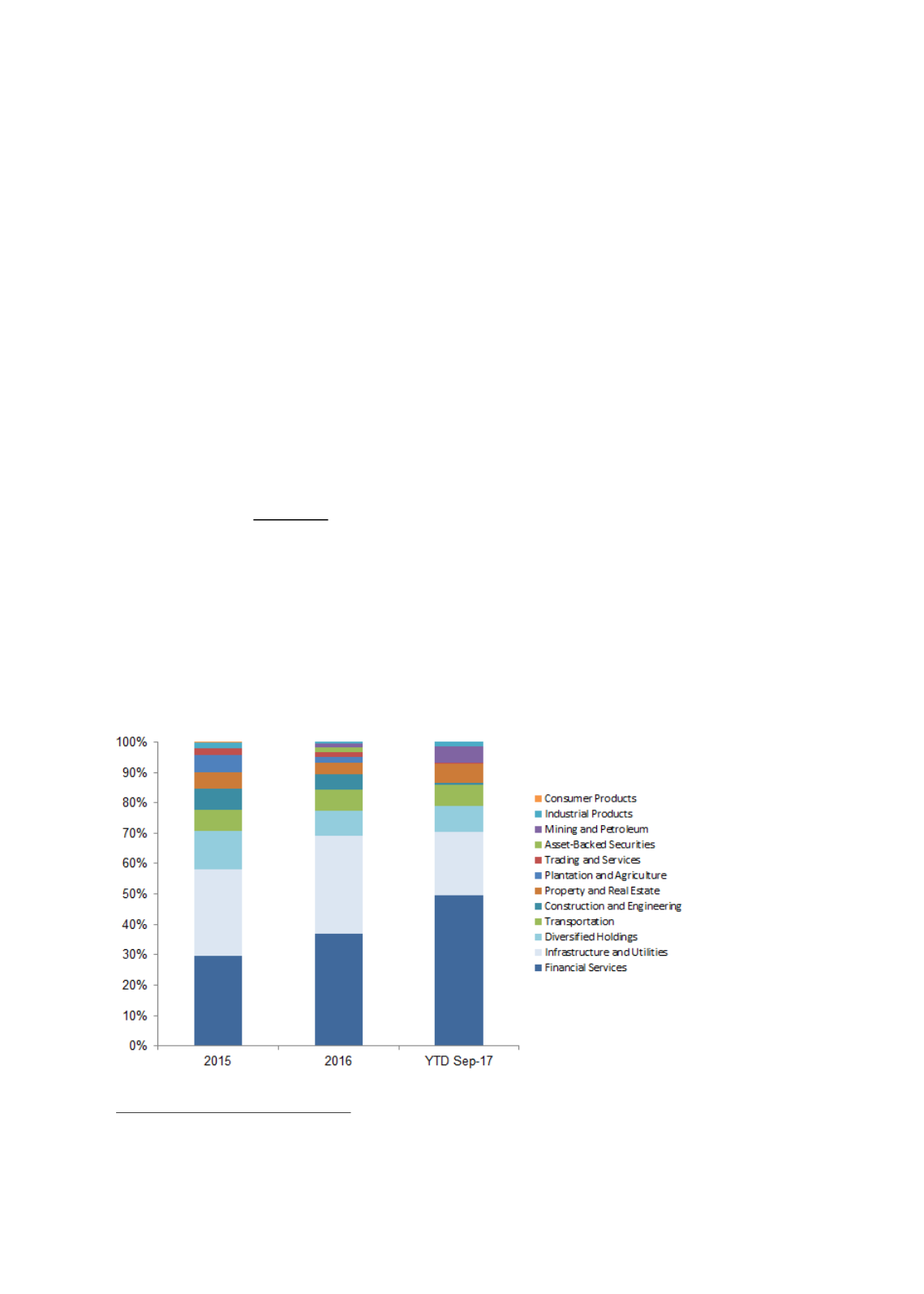

Analysis of Sukuk Issuances – Supply (Sell Side)

Since the early 2000s, the private sector has been identified as the country’s economic growth

driver. The privatization of the country’s infrastructure has taken centre stage in building the

base of the country’s capital markets. In 2003, fiscal stimuli were introduced via the annual

budgets for Islamic finance. These have proven successful in incentivising the private sector to

opt for sukuk instead of conventional bonds. As shown in Figure 4.2, the ICM has played host

too many sectors, with financial institutions and infrastructure & utilities claiming a large slice

of the pie due to their sizeable financing amounts.

Figure 4.2: Malaysia’s Corporate Sukuk Issuance by Sector (2015-Sep 2017)

Sources: BPAM, RAM

3

The guideline is not applicable to

ijarah

sukuk that does not involve the sale and purchase of identified assets.