Financial Outlook of the OIC Member Countries 2017

25

As shown in the above figure, all OIC group data recording higher ROA ratio compared to the

world average. Although this could be interpreted as the efficiency of these economies, this

situation could also be explained by weak asset base of financial intermediaries, lack of

competition and shallow structure of the market. The World average which was realized as

1.2 percent in 2012 decreased continuously over the selected period and reached to 1 percent

in 2015. During the same period, OIC average decreased from 1.6 to 1.3 percent. ROA for OIC-

HIG group performed better than all other countries and hovered around 1.7 percent during

the selected period.

Bank Return on Equity (ROE)

is another ratio used to measure efficiency of financial

intermediaries. The ROE measures a corporation's profitability by revealing how much profit a

company generates with the money shareholders have invested. It is calculated as a ratio of

commercial banks’ after-tax net income to yearly averaged equity.

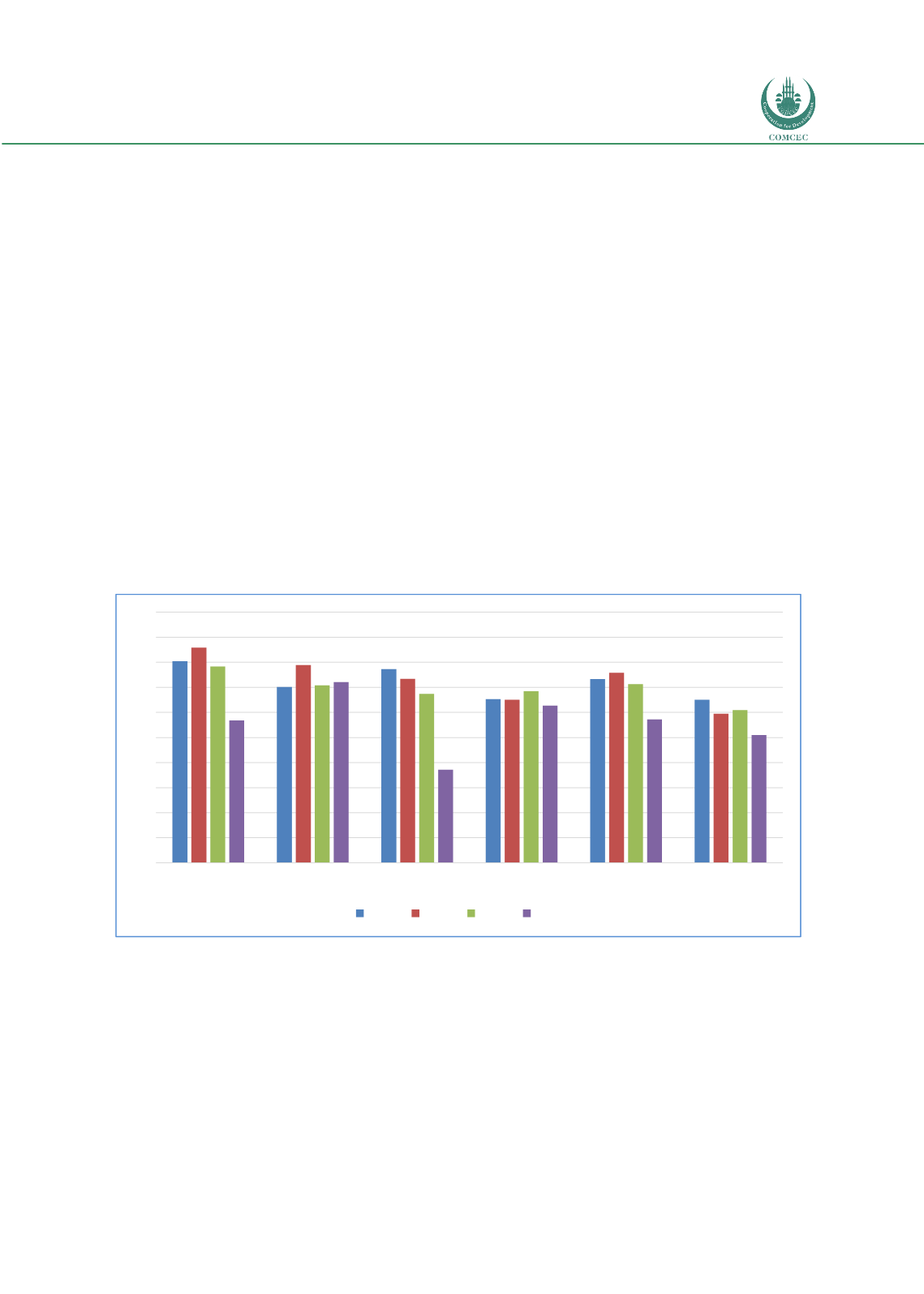

The figure below shows the ROE data for OIC income groups and the World average

performance during 2012-2015. OIC group average performed better than the world average

while it has been declined since 2013 up to 2015. The same trend has been also recorded for

the world average which declined to 10 percent in 2015 after realized as 13 percent in 2012.

The highest rates have been recorded for OIC-LIG countries while there was a significant drop

in the last year.

Figure 22: Bank Return on Equity (%, after tax)

Source: Authors’ calculation from the World Bank Database

As a result, in terms of the efficiency characteristic, the OIC average has performed slightly

better than the world average for the selected indicators over the period between 2012 and

2015. It has been noted that the averages of the high and upper middle income group countries

performed better than the world average which highlights the level of development of the

financial markets and institutions in these countries. As for this characteristic, the low income

segments of the countries should be targeted to increase financial efficiency in order to

support further economic development.

0

2

4

6

8

10

12

14

16

18

20

OIC-LIG

OIC-LMIG OIC-UMIG

OIC-HIG OIC-Average World Average

2012 2013 2014 2015