Increasing Broadband Internet Penetration

In the OIC Member Countries

55

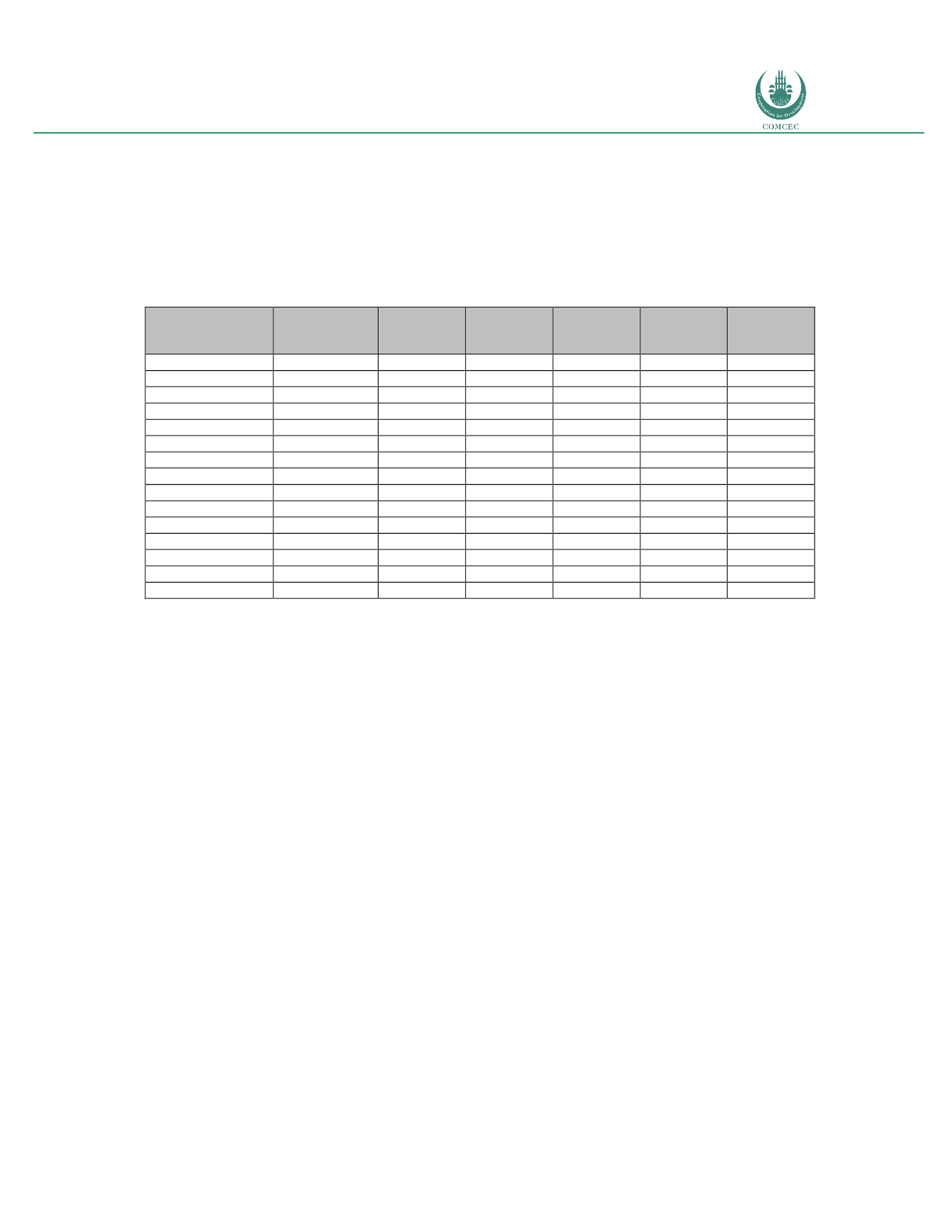

Thus, the relationship between both variables indicates that a change in the price level would

have a positive impact in the level of penetration of fixed broadband. By relying on the

estimates depicted in figure 17, the effect of a price reduction between 5% and 25% was

estimated for different regions of the world (see table 19).

Table 19: Impact on penetrati n level (percentage of households) of fixed broadband (FBB)

of a price reduction

Region

2015

Household

Penetration

5%

Price

Reduction

10%

Price

Reduction

15%

Price

Reduction

20%

Price

Reduction

25%

Price

Reduction

Australasia

75.16

77.26

79.35

81.45

83.55

85.65

Central Asia

22.87

25.36

27.84

30.33

32.81

35.30

Eastern Asia

67.80

70.09

72.38

74.67

76.96

79.26

South Asia

8.39

9.72

11.05

12.38

13.70

15.03

South-Eastern Asia

17.35

19.53

21.70

23.88

26.06

28.23

Northern Africa

17.16

19.32

21.49

23.65

25.81

27.98

Eastern Africa

2.22

2.63

3.05

3.46

3.87

4.28

Midde Africa

0.74

0.88

1.03

1.17

1.31

1.45

Southern Africa

19.61

21.93

24.25

26.57

28.89

31.21

North America

84.44

86.29

88.14

89.99

91.85

93.70

South America

41.77

44.55

47.32

50.10

52.88

55.66

Eastern Europe

51.82

54.47

57.13

59.78

62.43

65.09

Northern Europe

86.24

88.04

89.85

91.65

93.46

95.26

Southern Europe

69.48

71.73

73.98

76.22

78.47

80.72

Western Europe

89.11

90.84

92.57

94.30

96.03

97.76

Source: Estimates by Telecom Advisory Services based on ITU 2015 data

As indicated in table 19, the price elasticity is higher for the regions with lower levels of

penetration. As a result, in regions like Middle Africa or South Asia, a 25% price decline could

yield an approximate doubling of current penetration levels. The increase in fixed broadband

penetration is substantial in other emerging countries as well.

Broadband pricing needs to be decomposed among its different elements because they affect

broadband initial adoption and usage in different manners. Initial adoption is constrained by

device acquisition, its corresponding tax burden, service activation cost, and expected

recurring costs derived from subscription retail fees and taxes.

Device retail prices and their corresponding taxes vary between fixed and mobile broadband.

Fixed broadband requires the acquisition of a personal computer, while mobile broadband

could be supported through either a personal computer or a smartphone. Retail acquisition

prices of this type of equipment are driven by supply and demand conditions, in particular

manufacturing economies of scale and component costs. While device retail pricing is typically

out the realm of policy control, taxation is not. Final price of devices is affected by a set of

different taxes, which vary by country and year. Taxes can, in some cases, add a significant

burden to the retail price.

As an example of initiatives aimed at lowering broadband prices, in September 2011, Comcast,

the cable TV operator in the United States launched its “Internet Essentials” plan to offer

broadband to as many as 2.5 million low-income families for a monthly rate of US$ 9.99. The