Increasing Broadband Internet Penetration

In the OIC Member Countries

6

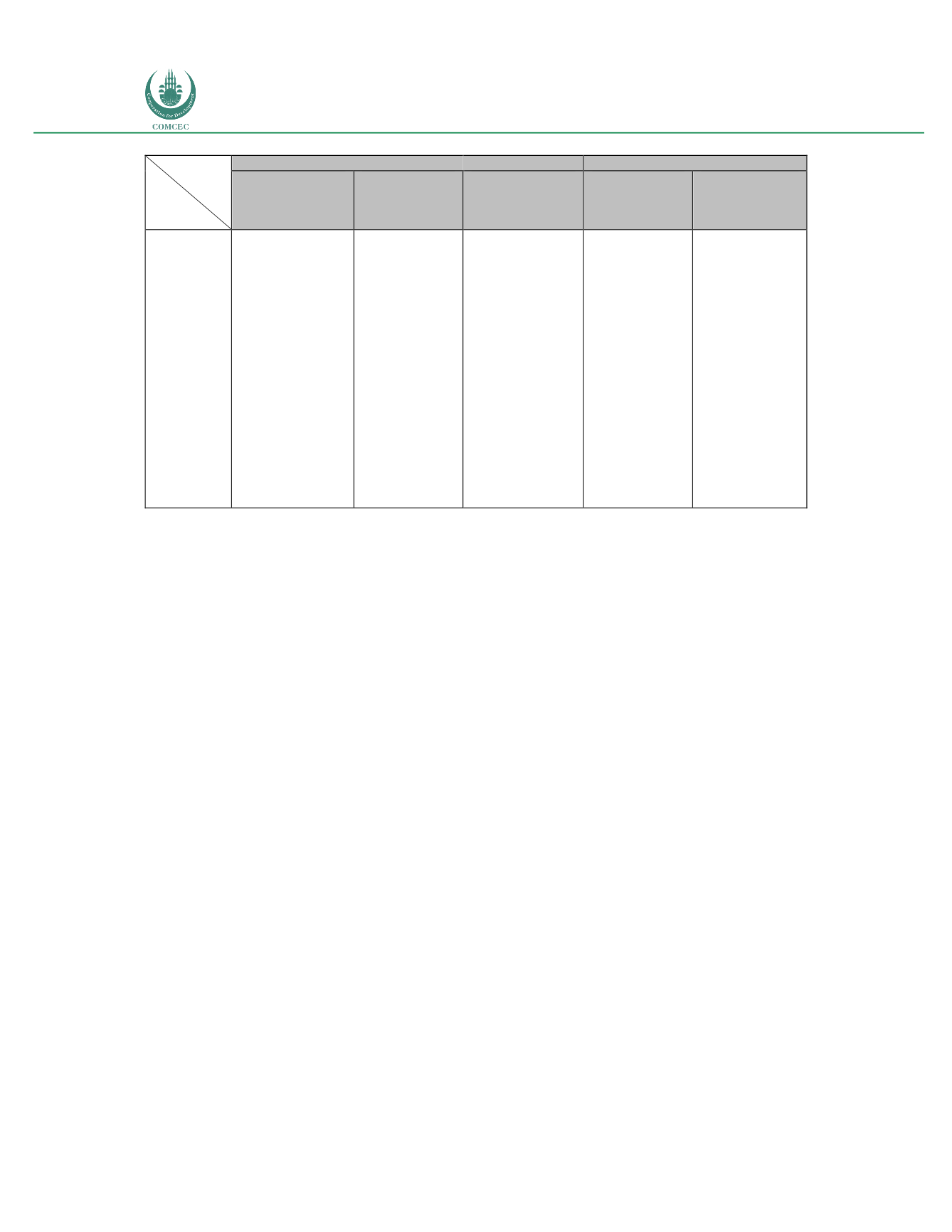

Supply

Demand

Fixed Broadband

Coverage (ADSL)

Mobile

Broadband

Coverage (3G)

Mobile

Broadband

Coverage (4G)

Fixed

Broadband

Penetration

(households)

Mobile

Broadband

Penetration

(population)

Iran, Iraq,

Kyrgyzstan, Mali,

Mauritania,

Morocco,

Mozambique,

Niger, Nigeria,

Sierra Leone,

Somalia, Syria,

Sudan, Tajikistan,

Togo, Tunisia,

Turkmenistan,

Uganda,

Uzbekistan, Yemen

Iran, Iraq,

Kyrgyzstan, Mali,

Mauritania,

Mozambique,

Niger, Nigeria,

Sierra Leone,

Somalia, Syria,

Sudan, Tajikistan,

Togo, Tunisia,

Turkmenistan,

Uganda,

Uzbekistan, Yemen

Indonesia, Iran,

Iraq, Jordan,

Kuwait,

Kyrgyzstan,

Libya, Mali,

Mauritania,

Morocco,

Mozambique,

Niger, Nigeria,

Pakistan,

Senegal, Sierra

Leone, Somalia,

Sudan, Syria,

Tajikistan, Togo,

Tunisia,

Turkmenistan,

Uganda,

Uzbekistan,

Yemen

Mauritania,

Morocco,

Mozambique,

Niger, Nigeria,

Pakistan, Senegal,

Sierra Leone,

Somalia, Sudan,

Syria, Tajikistan,

Togo,

Turkmenistan,

Uganda,

Uzbekistan,

Yemen

Source: International Telecommunications Union; GSMA Intelligence; Regulatory authorities; Telecom Advisory Services

analysis

In general terms, some OIC Member Countries in the Middle East (Bahrain, Oman, Qatar, Saudi

Arabia, UAE) and Central Asia (Azerbaijan, Kazakhstan) tend to be fairly advanced in terms of

supply and penetration of broadband services. On the other hand, a large group of African

countries (Benin, Burkina Faso, Cameroon, Chad, Guinea, Senegal, Sierra Leone, Sudan, Togo)

are still at a limited stage of broadband development both in terms of supply and demand.

Finally, a number of countries in North Africa (Egypt, Tunisia, Morocco), Sub-Saharan Africa

(Cote d’Ivoire), Middle East (Kuwait) and Asia (Brunei, Kyrgyzstan, Turkey, Uzbekistan)

exhibit advanced service coverage of the population combined with low penetration.

Advanced OIC Member Countries exhibiting high broadband service coverage and adoption are

facing the challenge of building a forward-looking world-class infrastructure that will position

them in a leading position in terms of digitization. This entails deploying fiber optics in their

last mile, completing their 4G wireless coverage and preparing to deploy 5G. Supply related

policies for these countries need to recognize that few broadband providers (typically the

incumbent telecommunications operators) are capable of tackling these challenges. Along

these lines, governments need to consider policies that entail appropriate incentives to

warrant next generation infrastructure deployment. They typically include a range of tax

benefits and regulatory holidays.

Countries with advanced coverage but limited penetration face classical demand gap reduction

challenges. First and foremost, governments have to recognize that increased service adoption

is dependent on lowering the total operating cost incurred by consumers for purchasing the

technology. This can be achieved through service subsidies or modification of tax regimes, like

exempting low-income population from paying import duties on terminals or VAT on service.

Moving to the digital literacy domain, governments need to put in place a series of training