Increasing Broadband Internet Penetration

In the OIC Member Countries

124

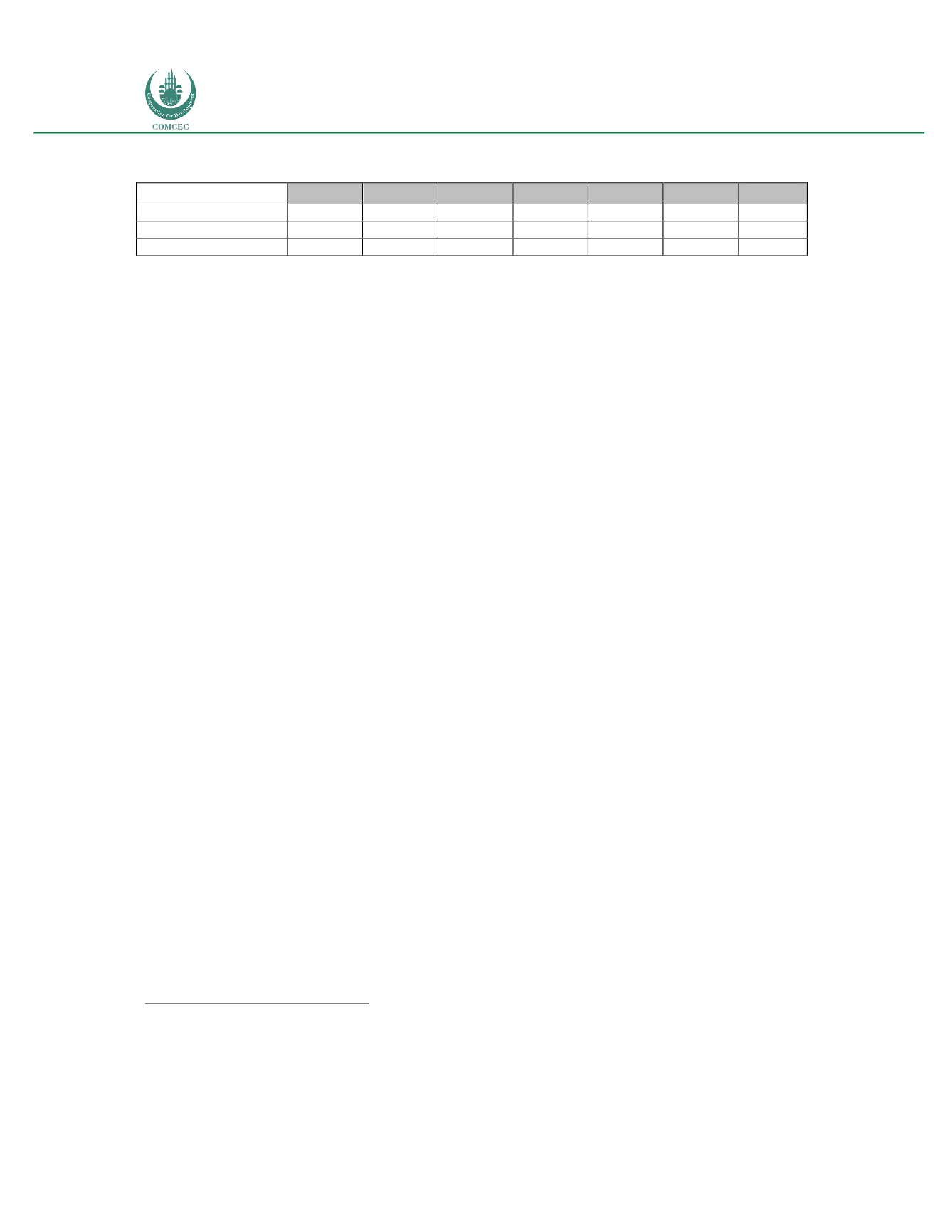

Table 61: Saudi Arabia: Mobile broadband demand gap (%)

2010

2011

2012

2013

2014

2015 2Q2016

Service coverage

90.00

93.80

95.08

97.00

97.00

97.00 97.00

Percent Population

9.7

39.6

42.1

47.6

94.5

105.9

83.5

Demand gap

80.3

54.2

52.98

49.4

2.5

0 (*)

13.5

(*) When the demand gap calculation is negative, it is assumed that there are no barriers to adoption.

Sources: GSMA Intelligence; Telecom Advisory Services analysis

Table 61 also illustrates the dynamics between mobile broadband coverage and adoption in a

country where adoption is not supply constrained. Saudi Arabia very rapidly achieved a high

level of population coverage, which enabled over time a diffusion process that was essentially

completed by 2014: a demand gap of 13.5% would indicate that barriers for mobile broadband

adoption are fairly low. This estimate is fairly close to the results of a survey conducted by the

Saudi regulator on ICT usage in the Kingdom

70

. According to that study, only 9% of all survey

respondents aged between 12 and 65 years old were found to be non-users of the Internet.

What are the reasons explaining non-adoption of broadband? First and foremost, the survey

data indicates that affordability does not appear to be a significant barrier. Based on the

calculation of the digitization index in 2014, Saudi Arabia scored in 2014 a

telecommunications affordability index of 94.83

71

. This index reflects in the aggregate the total

cost of ownership of telecommunications services (including taxes) as a function of income. In

fact, when compared with the rest of the OIC Member Countries, Saudi Arabia is at the top-end

of the affordability range (see figure 37).

70

Op.cit. p. 20.

71

The digital affordability index is a composite index calculated on the basis of six indicators: Residential fixed line tariff

adjusted for GDP per capita; Residential fixed line connection fee adjusted for GDP per capita; Mobile cellular prepaid tariff

adjusted for GDP/capita; Mobile cellular prepaid connection fee adjusted for GDP per capita; fixed broadband Internet

access cost adjusted for GDP per capita; mobile broadband Internet access cost adjusted for GDP per capita (see Katz and

Koutroumpis, 2014).